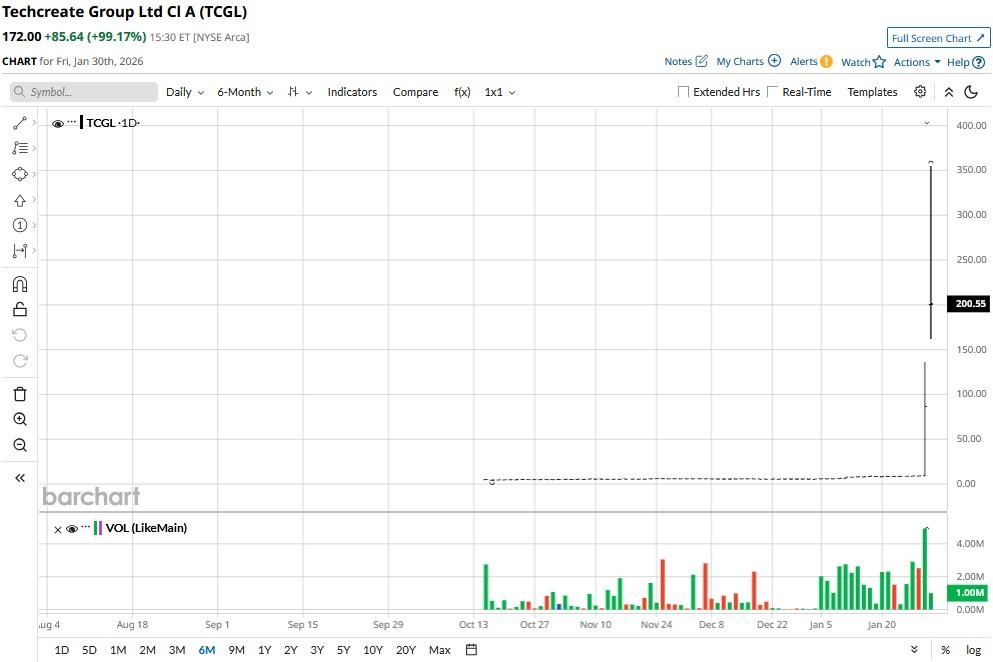

The tech sector has a new lightning rod: TechCreate Group (TCGL). After a quiet initial public offering (IPO) at $4, the stock ignited a monster rally this week, momentarily hitting an eye-watering $350. Driven by mysterious volume spikes rather than fundamental breakthroughs, TCGL shares are now up a mind-bending 3,765% versus the start of 2026.

But for those eyeing the buy button this late in the rally, the question remains: is this a moonshot or a mirage?

TCGL Stock Could Prove a House of Cards

Chasing TechCreate’s stock price rally is a high-stakes gamble given that it lacks the financial bedrock to support its multibillion-dollar valuation.

In fact, TCGL has itself admitted to the NYSE recently that it has no material news to explain the monster rally. This lack of a catalyst, paired with a price-to-sales (P/S) multiple that has soared past 650x, signals a classic pump-and-dump or meme-stock phenomenon rather than organic growth.

TechCreate’s latest financials show a net loss and staggering price-to-book (P/B) value exceeding 2,500x.

For a business that specializes in payment software, but “struggles with profitability” and high director turnover, the current market capitalization is an astronomical outlier that defies traditional logic.

Wall Street Remains Uninterested in TCGL Shares

The loudest warning bell for those eyeing an investment in TechCreate shares at current levels is the total absence of Wall Street coverage.

When no major brokerage provides research or price targets, retail investors are essentially flying blind, deprived of the institutional due diligence required to vet small-cap technology firms.

This information vacuum is often a hallmark of over-the-counter style volatility, leaving the stock susceptible to extreme manipulation and technical exhaustion.

Importantly, technical indicators are already screaming: TCGL stock’s relative strength index (14-day) has rallied past 99, indicating alarmingly overbought conditions, while repeated volatility halts signal a dangerous lack of liquidity.

In short, without professional oversight or clear earnings guidance, this rally could vanish just as quickly as it appeared, leaving latecomers holding the bag.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)