Fintech firm Affirm Holdings (AFRM) announced that it has submitted an application to the Nevada Financial Institutions Division and the Federal Deposit Insurance Corporation (FDIC) to establish the Affirm Bank. The proposed Nevada-chartered industrial loan company would enable the Buy Now, Pay Later (BNPL) provider to have an FDIC-insured institution while scaling its business.

This proposal has caught the attention of Needham analyst Kyle Peterson, who upgraded AFRM stock from “Hold” to “Buy” and set a $100 price target, implying 60% potential upside from current levels. Peterson believes that Affirm Bank would be a “game-changer” for the company, providing access to deposit funding for loans while reducing third-party risk.

Peterson also believes that approval is likely, given the government’s push for deregulation and the company’s track record of risk management. The analyst also expects lower funding costs for Affirm if the deal falls through, as well as the in-house movement of some of its products, which would reduce friction.

Should you buy Affirm stock now?

About Affirm Stock

Affirm is a prominent fintech firm that offers BNPL solutions that let customers split purchases into flexible installments at checkout. Based in San Francisco, California, the company orchestrates core activities by partnering with retailers to embed seamless payment options across online platforms, kiosks, apps, and cards.

Affirm extends unsecured loans, assessed through credit evaluations and AI-driven models, while prioritizing transparent terms without hidden fees or compounding interest, serving customers across multiple countries. The company has a market capitalization of $21.6 billion.

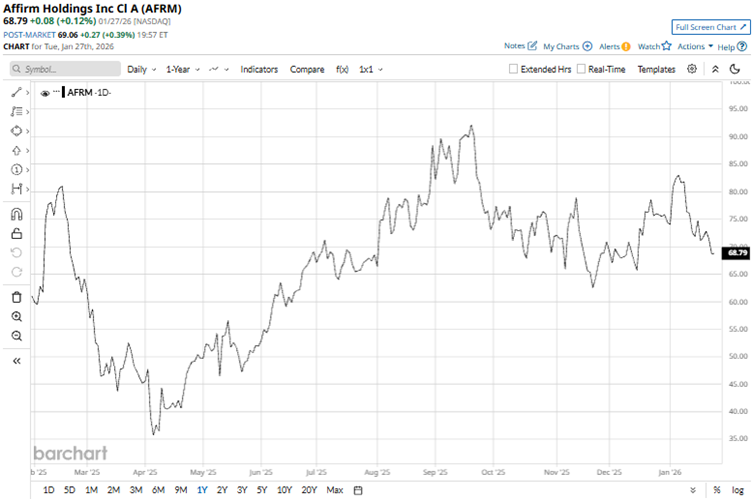

AFRM stock has gained 6% over the past 52 weeks but has declined 8% over the past six months. Affirm had reached a 52-week high of $100 in August 2025, but is down 38% from that level. However, its gains have been somewhat capped by volatility. The stock has also dropped 17% over the past month.

Affirm stock is trading at a stretched valuation. Its price-to-earnings ratio of 102.6 times is significantly higher than the sector median.

Affirm Reported Solid Q1 Fiscal 2026 Earnings

Affirm reported a record quarterly gross merchandise value (GMV) of $10.8 billion, up 42% year-over-year (YOY), for the first quarter of fiscal 2026 (the quarter ended Sept. 30). According to the report, about half of the growth came from direct merchant point-of-sale integrations, a third from the direct-to-consumer (DTC) business led by Affirm Card, and the rest from wallet partnerships.

Affirm’s net revenue increased 34% YOY from the prior-year period to $933 million, which was higher than the $885 million that Wall Street analysts had expected. Its total network revenue increased 38% YOY to $320.5 million, while its interest income grew 20% annually to $454.12 million. The company’s gains on loan sales also grew by 87% YOY. Affirm’s EPS for the quarter climbed significantly to $0.23, surpassing the $0.11 that Street analysts had expected.

Wall Street analysts are optimistic about Affirm’s future earnings. They expect EPS to increase 22% YOY to $0.28 in Q2 fiscal 2026 (to be reported on Feb. 5 after the market closes). For the current fiscal year, EPS is projected to surge 560% annually to $0.99, followed by 59% growth to $1.57 in the next fiscal year.

What Do Analysts Think About Affirm Stock?

Recently, analysts at Cantor Fitzgerald initiated coverage of AFRM stock with a bullish “Overweight” rating and an $85 price target. Cantor Fitzgerald analysts highlighted the company's new BNPL payment modality and durable funding model.

This month, TD Cowen analyst Moshe Orenbuch maintained a “Buy” rating on shares. However, the analyst also took a cautious step by lowering the price target from $115 to $110. This was done while accounting for macro factors affecting the specialty finance sector, as a secular growth trend is evident in areas like credit cards, BNPL, and auto lending.

On the other hand, last month, analysts at Wolfe Research initiated coverage of Affirm with a cautious “Peer Perform” rating, noting that the valuation doesn’t leave much room for near-term gains despite the company's growth drivers. While acknowledging solid fundamentals, analysts argued for a more favorable entry point for AFRM stock.

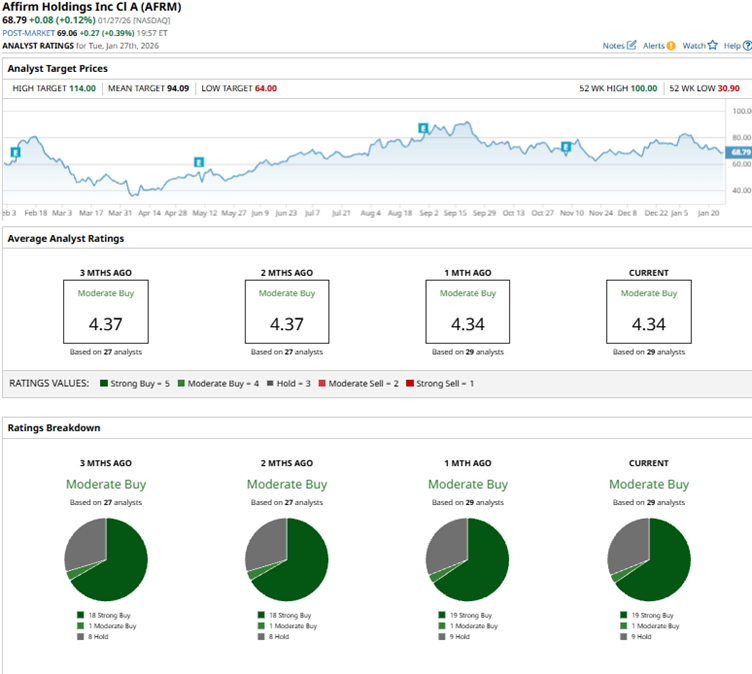

Wall Street analysts have a favorable view of AFRM stock, awarding it with a “Moderate Buy” rating overall. Of the 30 analysts rating the stock, 20 analysts have a “Strong Buy,” two offer a “Moderate Buy” rating, and eight analysts give a “Hold” rating. The consensus price target of $93.96 represents 51% potential upside from current levels, while the Street-high price target of $114 indicates 84% potential upside.

Key Takeaways

While the long-term potential of Affirm remains intact and Wall Street is bullish on its prospects, AFRM stock carries a significant price tag. However, analysts are still projecting upsides. Therefore, the stock might be a buy now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)