/Solar%20Panels%20City%20by%20Fuyu%20Liu%20via%20Shuttershock.jpg)

Solar power is becoming one of the most critical pillars of the modern economy. As everything from cloud computing to artificial intelligence (AI) grows more power-hungry, electricity demand is rising fast, and clean, scalable energy sources are no longer optional. Yet even as solar’s importance deepens, the industry is running into headwinds. The U.S. solar manufacturing and supply chain posted strong gains in 2025, with the country now able to produce every major component of the solar and storage value chain. Solar cell production surged 300%, while module capacity climbed 37%, pushing total capacity beyond 60 gigawatts by late 2025.

Still, supply remains short of domestic needs, and uncertainty looms heading into 2026. The expiration of residential tax credits, tighter eligibility thresholds, and new tariffs have complicated business planning. President Donald Trump’s One Big Beautiful Bill Act accelerates the phase-out of the Investment Tax Credit after 2027 and raises domestic content requirements, even as tariffs offer some protection from foreign competition.

Against this uncertain backdrop, Enphase Energy (ENPH) is making sharper, cost-focused moves. The solar technology leader announced plans to cut roughly 160 jobs, or under 6% of its workforce, shift roles to lower-cost regions, and rein in operating expenses to protect margins. The restructuring, expected to cost about $4.6 million, with $4.2 million estimated to be incurred in Q1, also leans on distributors, automation, and AI to boost efficiency.

Still, Enphase’s shares slipped on the headlines, leaving investors at a crossroads. Is this the kind of belt-tightening that sets up the next growth cycle, a signal to stay patient on the sidelines, or a cue to step away before bigger cracks emerge?

About Enphase Energy Stock

Founded in 2006, Fremont, California-based Enphase Energy is a global energy tech company focused on simplifying how homes generate, store, and manage power. Best known for its semiconductor-based microinverter technology, Enphase converts energy at the individual solar panel level, pairing hardware with proprietary software and networking for real-time monitoring and control.

Its ecosystem spans IQ microinverters, IQ Batteries, energy routers, gateways, EV chargers, and the cloud-based Enlighten platform, alongside design and installer services. Serving the rooftop solar market worldwide, Enphase sells through distributors, installers, partners, and directly to homeowners. With most revenue coming from the U.S., Enphase operates at the intersection of clean energy and semiconductors, carrying a market capitalization of about $5.23 billion.

Over the past decade, the home energy tech name has rewarded long-term believers with a staggering 1,543% return, a reminder of what happens when innovation meets a powerful secular trend. But the last year tested that conviction. ENPH slid almost 35% over the past 52 weeks and now trades more than 43% below its $70.78 peak, as policy uncertainty and softer demand weighed heavily on sentiment.

Still, the more recent chapter reads differently. After bottoming near $25.77 in November, the stock has staged a sharp comeback, rallying nearly 57% from its lows. Year-to-date (YTD), shares are up 26.27%, with a brisk 12.5% gain in just the past five sessions, suggesting momentum is rebuilding rather than fading.

Technically, Enphase is showing clear signs of revival. Volume has expanded alongside the rally, signaling conviction rather than a thin bounce. The 14-day RSI of 71.62 has pushed into overbought territory, reflecting strong momentum even as near-term consolidation would be healthy.

Meanwhile, the MACD oscillator reinforces the improving setup. The MACD line remains above its signal line and continues to trend higher, while the histogram has decisively flipped positive after January’s lows. This shift points to improving momentum and suggests the rally is being supported by strengthening underlying price action.

Valuation-wise, ENPH is trading at a discount. It trades at about 14.4 times forward adjusted earnings and 3.56 times sales, both below sector averages and its own historical median. For a company tied to a long-term solar growth runway, the market is pricing in caution – if not outright skepticism – leaving room for upside if industry demand steadies and execution holds.

A Closer Look at Enphase’s Q3 Earnings Report

When Enphase dropped its third-quarter numbers on Oct. 28, the tone felt noticeably different from earlier in the year. The company posted $410.4 million in revenue – its strongest quarter in two years and a clean step up from $363.2 million in Q2 2025. The top line has surged 7.8% year-over-year (YOY), beating estimates. Profitability followed suit. Non-GAAP EPS jumped nearly 38.5% annually to $0.90, comfortably clearing expectations and reminding the market that Enphase can still execute when demand lines up.

A big driver was safe harbor activity, which climbed to $70.9 million from $40.4 million the prior quarter, helping push U.S. revenue up roughly 29% sequentially. Europe, however, told the other side of the story. Revenue there fell about 38% quarter-over-quarter (QOQ) as demand continued to soften, underscoring how uneven the global solar recovery remains.

Margins held up well. Non-GAAP gross margin landed at a solid 49.2%, while operating expenses ticked only slightly higher to $78.5 million. That discipline translated into non-GAAP operating income of $123.4 million, up again from Q2. The balance sheet stayed sturdy, too. Enphase ended the quarter with $1.48 billion in cash and marketable securities, generated $13.9 million in operating cash flow, and kept capital spending modest at $8 million.

On the capital allocation front, the company focused more on limiting dilution than buying back stock. It withheld about $1.7 million in shares to cover employee tax obligations, trimming diluted shares by just over 49,000. No repurchases were made in Q3, though nearly $269 million remains authorized.

Operationally, Enphase kept its domestic manufacturing engine humming. It shipped around 1.53 million microinverters from U.S. facilities eligible for Section 45X credits, alongside strong volumes of IQ Batteries. Battery shipments hit a record 195 MWh, and the installer base expanded sharply to more than 19,500 globally. Add in the ramp of its fourth-generation energy system – earning positive early feedback and broader utility approvals – and Q3 looked less like a one-off and more like a reminder that Enphase still has momentum when the pieces fall into place.

With Enphase set to report Q4 and full-year 2025 earnings after the bell on Tuesday, Feb. 3, management is guiding for revenue between $310 million and $350 million. That range includes shipments of roughly 140 to 160 MWh of IQ Batteries, but excludes any safe-harbor activity. Non-GAAP gross margins are expected to land between a healthy 42% and 45%.

Wall Street’s take on Enphase is a bit of a mixed bag right now. Analysts are feeling reasonably optimistic about the near term, with revenue expected to land around $338.8 million in Q4 and quarterly EPS pegged at about $0.20. For full-year 2025, profits are projected to grow 46.5% YOY to $1.48. But the tone shifts when we look further ahead. In fiscal 2026, profit is expected to cool off meaningfully, with EPS forecast to slide nearly 48% annually to around $0.77, highlighting how uneven the road ahead could be.

What Do Analysts Expect for ENPH Stock?

Sentiment around Enphase Energy may be shifting. Citi analyst Vikram Bagri recently upgraded the ENPH to “Neutral” from “Sell,” setting a $37 price target as risks appear increasingly skewed to the upside. With Q1 expectations now de-risked and full-year targets still achievable, Citi points to stabilizing market share in California and potential gains from a competitively priced storage launch versus Tesla’s Powerwall.

Demand response in Europe following price cuts adds another layer of support, especially for a stock viewed as deeply unloved and heavily shorted. Goldman Sachs’ analyst Brian Lee recently upgraded ENPH to a “Buy” with a $45 target. He cites growing confidence in 2026 momentum, stronger-than-expected late-2025 volumes, and valuation levels near historic lows – conditions that could amplify any positive surprise.

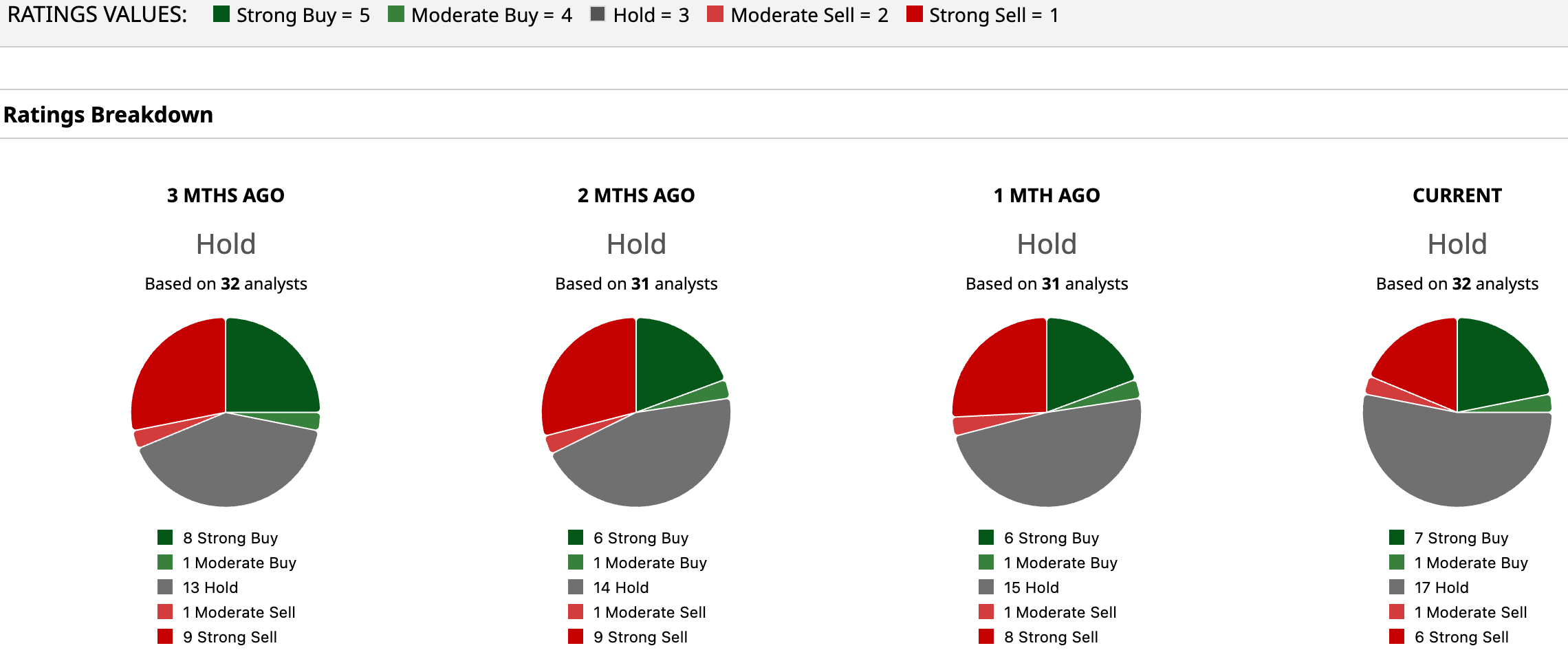

Overall, analysts are cautious on ENPH stock, giving a consensus “Hold” rating. Of the 32 analysts rating the stock, seven analysts rate it a “Strong Buy,” one suggests a “Moderate Buy,” a majority of 17 analysts are playing it safe with a “Hold” rating, one has a “Moderate Sell," and the remaining six are outright skeptical with a “Strong Sell” rating.

This solar stock is currently trading above its consensus price target of $38.15. But the Street-high target of $67 suggests the stock could rally as much as 65.6%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)