The U.S. 30-year Treasury Bond futures edged 1.18% higher in 2025, while the iShares 20+ Year Treasury Bond ETF (TLT) posted a marginal 0.19% decline. I asked where U.S. government bonds were heading in 2026 in a November 27, 2025, Barchart article, where I concluded with the following:

I favor lower interest rates in 2026, but in late 2025, the path of least resistance remains a coin flip that could land on its side, suggesting another year of sideways trading.

The long bond futures were at 118-09 on November 25, with the TLT ETF at $90.50 per share. The bonds and TLT were lower in late January 2025, but both remained within the narrow trading range since October 2023.

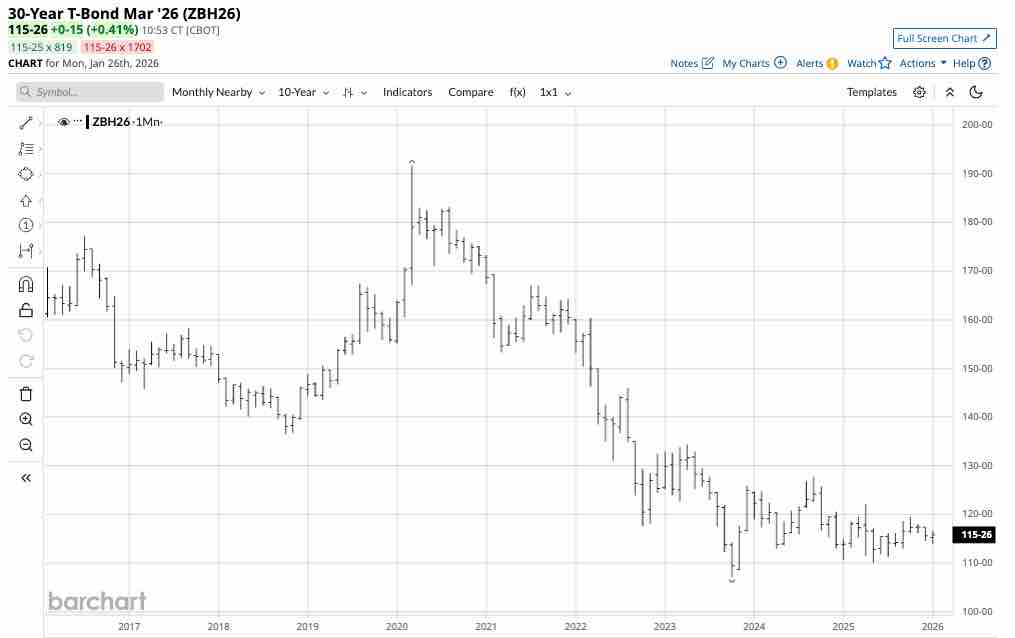

Sideways trading in the long-bond futures

Since 2024, the U.S. long bond futures have consolidated between 110-01 and 127-22.

The monthly chart highlights that in 2025, the range was from 110-01 to 122-05. The U.S. government 30-year Treasury Bond Futures trading range narrowed in 2025, and at the 115-26 level in late January, the bonds were within the consolidation range.

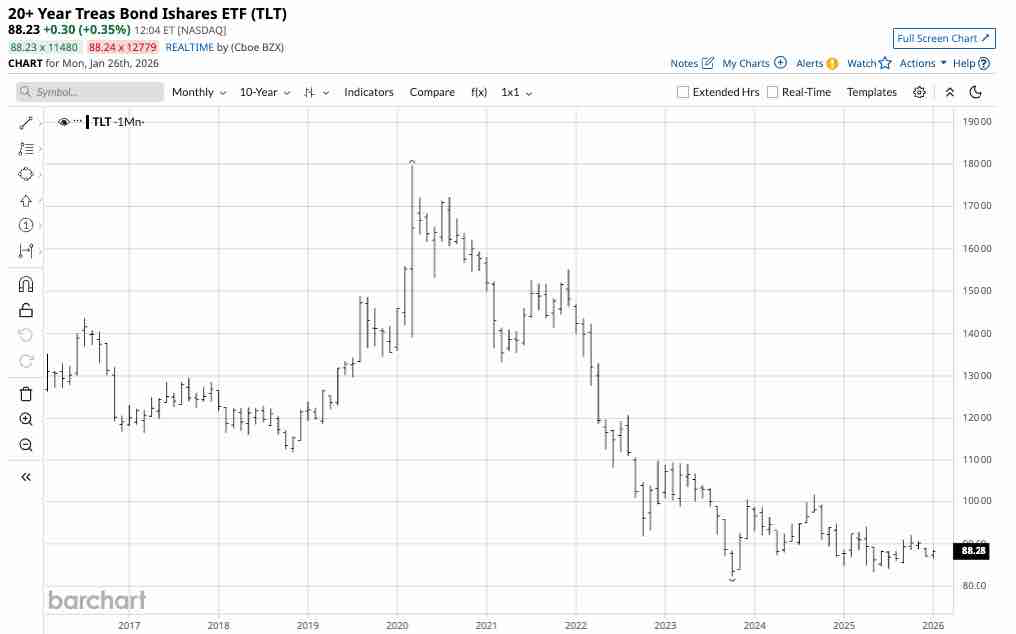

A narrow range in TLT

Since 2024, the iShares 20+ year Treasury Bond ETF has followed the long bond futures, consolidating between $83.30 and $101.64 per share.

The monthly chart highlights that in 2025, the range was from $83.30 to $94.09 per share. TLT’s trading range narrowed in 2025, mirroring that of long bond futures. At the $88.23 per share in late January, TLT was within the consolidation range.

Changes on the horizon at the U.S. Federal Reserve

Over the coming months, the complexion at the U.S. Federal Reserve will change as President Trump replaces Chairman Powell with a more dovish appointee. The President originally appointed Chairman Powell during his first term, but has grown increasingly critical of the Fed’s monetary policy approach, insisting that the central bank has moved too slowly in reducing the short-term Federal Funds Rate as inflation has fallen below the 3% level, according to the most recent data. The Fed Funds Rate currently stands at a midpoint 3.625% after declines in 2024 and 2025. Meanwhile, the central bank has cautiously reduced the rate, which remains elevated, due to its concerns that the Trump administration’s tariffs and trade policies will increase inflationary pressures.

The bottom line is that short-term interest rates are likely to fall further in 2026 as the administration appoints a new Fed Chairman who supports the President’s monetary policy demands.

Lower short-term rates do not guarantee lower long-term rates

While the U.S. central bank has other options in its monetary policy toolbox, short-term interest rates and the Fed Funds Rate is its primary monetary policy tool. While the Fed’s FOMC has total control of the short-term Fed Funds Rate, market forces determine interest rates further out on the yield curve. Therefore, there is no guarantee that falling short-term rates will filter through and lower long-term interest rates.

The Fed cut the Fed Funds Rate by 100 basis points in 2024 and another 75 basis points in 2025. The long bond futures remained in their consolidation range, meaning the Fed’s rate reductions did not filter through to longer-term interest rates. Time will tell if further reductions in 2026 will impact longer-term interest rates this year.

The reasons why bonds and TLT are in neutral territory at the current levels

While long-term interest rates remain elevated despite the 175 basis point reduction in short-term rates over the past two years, the following factors support higher long-term bonds and lower long-term interest rates over the coming months:

- New appointments to the Fed and a new Chairman over the coming months will likely lower the short-term Fed Funds rate. A more dovish Fed Chairman will have additional monetary policy tools that could help lower long-term rates.

- While the long bond futures and TLT ETF remain within their narrowing trends, they have not challenged the October 2023 low, which is the critical technical support level.

- Volatility in the U.S. stock market or unforeseen events that heighten economic or geopolitical fears could trigger a wave of U.S. government bond buying, as the U.S. remains the leading economic power. The 2020 highs occurred as market participants reacted to the global pandemic.

Meanwhile, other factors that could keep pressure on long-term bonds and the TLT are as follows:

- Inflation remains above the Fed’s 2% target, which increases downside pressure on long-term U.S. interest rates.

- U.S. debt, at over $38.64 trillion and rising, is bearish for bonds, as it lowers the United States’ credit rating and the demand for its sovereign debt.

- The long-term trend since the 2020 high remains bearish, despite the sideways trading action in 2024 and 2025. Technical resistance for the long bond and TLT is at the September 2024 highs of 127-22 and $101.64 per share, respectively. A move above those levels is necessary to negate the bearish trends since the 2020 highs.

- Gold and silver prices have exploded higher, signaling inflationary pressures that could continue to support elevated long-term interest rates.

The path of least resistance of long-term U.S. interest rates remains sideways in late January 2026. Bullish and bearish factors are pulling bonds and the TLT ETF in opposite directions, and we could be in for a third consecutive year of sideways trading in long-term interest rates in 2026.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)