/An%20image%20of%20a%20hand%20holding%20a%20smartphone%20with%20the%20Pinterest%20logo%20and%20app%20background_%20Image%20by%20FellowNeko%20%20via%20Shutterstock_.jpg)

Pinterest (PINS) shares are slipping this morning after the forum social media platform confirmed plans of laying off nearly 15% of its workforce and right-sizing office space to free up resources.

According to the company’s management, it will reallocate these resources to artificial intelligence (AI)-focused products, making the selloff essentially a buying opportunity for long-term investors.

At the time of writing, Pinterest stock is down more than 90% versus its 52-week high.

Here’s Why You Should Buy Pinterest Stock on the Pullback

Long-term investors should consider loading up on PINS today as its announced cuts signal a pivot to efficiency and higher-margin growth.

By reallocating resources to AI-enabled products, the company is positioning itself to improve ad targeting, shoppable content, and conversion rates for advertisers. This will help directly lift its average revenue per user (ARPU) in 2026.

In short, lowering headcount and downsizing office space to reinvest in AI mean leaner operations and stronger monetization potential, which makes PINS stock an exciting long-term pick at current levels.

Valuations and Technicals Favor Investing in PINS Shares

Pinterest shares appear strongly positioned to witness multiple expansion on the back of AI pivot also because they’re currently valued more attractively than peers, including Reddit (RDDT).

While the forum social media platform is trading at a forward price-to-earnings (P/E) ratio of 57x at the time of writing, PINS is going for a significantly more compelling 34x only. It’s partly why options traders believe Pinterest will push meaningfully higher over the next four months.

According to Barchart, derivatives contracts expiring May 15 have the upper price set at nearly $29 currently, indicating potential upside of more than 23% from here.

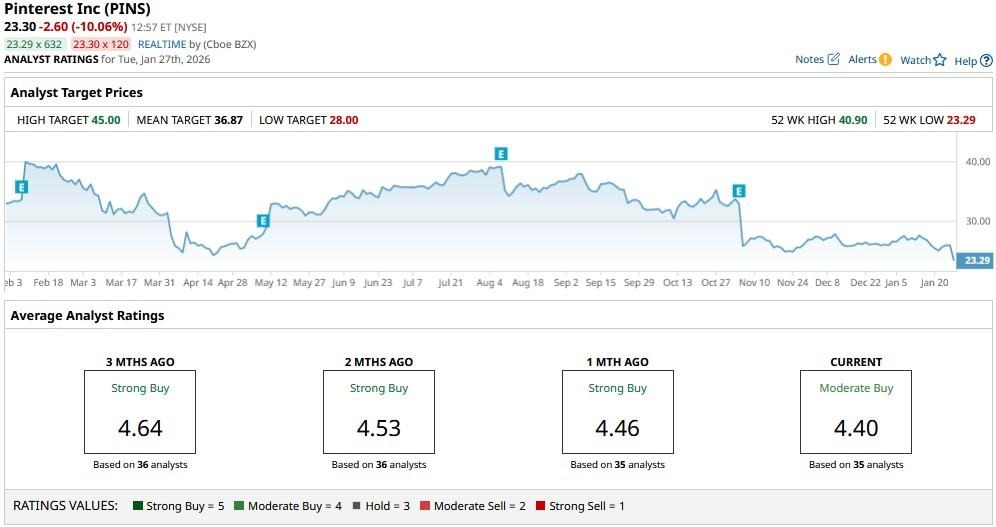

Wall Street Remains Bullish as Ever on Pinterest Inc

Wall Street analysts also recommend buying PINS shares on the pullback given the visual search engine is seen improving its earnings per share (EPS) by more than 20% in its current fiscal quarter.

The consensus rating on Pinterest remains a “Moderate Buy,” with price targets as high as $45 indicating the social media company could nearly double from here over the next 12 months.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)