Please join me every Thursday at 3pm Central for a free grain webinar. We discuss supply, demand, weather, and charts. Sign Up Now

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Grain Spreads: Who is Unknown in Corn?

Consolidation and a choppy trade were the key features in corn this week until the market received this week’s export sales report for corn in my opinion. Buyers remained mostly idle amid a flurry of fundamental and technical challenges, stemming from the January 12th crop report. Managed funds in my view have pushed out to a sizable short from neutral post report in the last two weeks. Ending stocks swelled on increased acres as yield and production were record large. In another black eye for corn, legislation to allow year-round sales of higher ethanol blends in the U.S. was left out of a suite of 2026 spending bills, as lawmakers sought to avoid another government shutdown. Futures reacted minimally, though producers and the National Corn Growers Association were quick to show disapproval. USDA’s Prospective Plantings Report at the end of March could be the next major market mover, unless weather in South America shows lower corn production potential in Argentina, amid corn planting just getting underway in Brazil. There is increased talk by some crop scouts that current Argentine production estimates are tedious given that Argentine soybean crop ratings have declined for two consecutive weeks, dropping 30 points in the good to excellent category. Extended forecasts showing weather conditions are not improving into February while reports Argentina’s corn crop has seen production loss as well as good to excellent ratings have dropped 23 percentage points in the last two weeks.

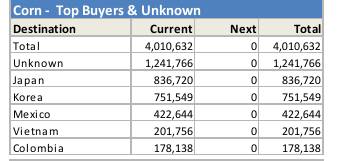

The big news on the week in my view, was on the demand side of the ledger. Who is Unknown in corn buying 1.241 million metric tons on the week. The remainder of sales destinations for future shipment are all disclosed except for Unknown. We have continued to see this in corn going back months when the gov't was shutdown. We have seen a plethora of sales to unknown in corn, whether it was a flash sale or weekly announcement. I have a hard time believing it isn't China despite the fact they just harvested a crop. I could definitely be wrong though, it could be the EU, or some other country who would like to remain anonymous. We see this designation used for buying Soybeans every year as Unknown Destinations for Soybeans is spelled C-H-I-N-A. Eventually the corn destination will be disclosed, but until then it's all a guess. This much is certain, in the Unknown Destination category, there is approximately 260 million bushels unshipped for the 25/26 marketing year. If not China, who are these masked buyers for that many bushels?

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)