In 1980, COMEX silver futures reached a record $50.36 per ounce high, and it took four and one-half decades to eclipse that price. In October 2025, the price of the continuous silver futures contract reached $53.765. The following month, the price rose to $57.245, and in December it exploded to $82.67 per ounce. In January 2026, the price has been as high as $95.78, and silver’s ascent has not slowed, but picked up steam since breaking above the high from 1980.

In a December 11, 2025, Barchart article that asked if silver could trade at $100 per ounce or higher, I concluded with the following:

Trading silver could be optimal after the recent rise to record highs. However, leveraged futures and ETF products require careful attention to risk-reward dynamics. Price and time stops will protect capital when approaching the market with leveraged ETFs that can suffer from time decay if silver’s price moves contrary to expectations or remains stable.

I am bullish on silver as the current trend is our friend. However, silver will likely enter a choppy period, during which price swings could favor trading over investing.

Silver was trading just over $60 per ounce on December 9, 2025, and by January 21, 2026, the price was over $32 per ounce higher.

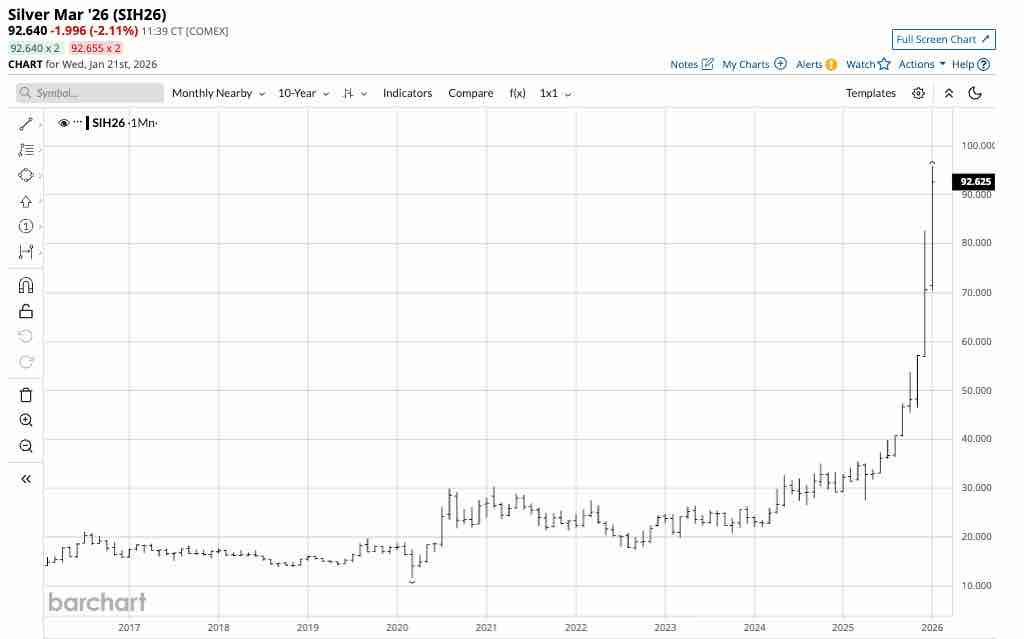

A parabolic silver rally continues

Silver’s parabolic rally has continued into 2026, with the price reaching over $95 per ounce on the nearby March COMEX silver futures contract.

The monthly continuous COMEX chart highlights that COMEX silver futures reached $95.78 per ounce on January 20 as silver futures continue to make higher highs and were close to a challenge of the psychological $100 level.

Markets can rise to illogical prices

Silver futures remained below the 1980 record high of $50.36 per ounce for four and a half decades before the previous high gave way as a hot knife goes through butter.

Gold had surpassed its 1980 high of $875 per ounce in 2008, and it took silver another 17 years to achieve the same feat.

Parabolic rallies, as we have witnessed in silver and gold, can take prices to illogical, irrational, and unreasonable levels that defy technical and fundamental analysis.

The reasons why silver’s rise is not illogical

At the most recent high of $4,891.10 per ounce on January 20, 2026, gold was over 5.59 times the 1980 high. At $95.78 on January 20, silver was nearly twice its 1980 peak. If gold is the model, silver could have considerably more upside. The following factors support even higher silver prices in early 2026:

- In a November 2025 release, The Silver Institute reported the fifth consecutive year of a structural market deficit, with the demand exceeding supplies.

- Gold continues to reach higher highs, with many conservative analysts projecting prices at or above $5,000 per ounce in 2026.

- While silver’s trend remains parabolic in early 2026, it is virtually impossible to pick tops in markets during bullish trends.

- The U.S. dollar and all fiat currencies continue to lose value and purchasing power in early 2026. Gold and silver have long been hard currencies, dating back thousands of years, with many Biblical references. Limited supplies of the rare, precious metals support higher prices as fiat currencies and foreign exchange instruments lose value.

- Gold and silver are global currencies. The cross-border nature supports higher prices during times of geopolitical tensions. The bifurcation of the world’s nuclear powers, along with ongoing and potential conflicts in Ukraine, the Middle East, and Taiwan, is boosting gold and silver’s role as a means of exchange. Moreover, tariffs and sanctions only increase the precious metal’s role in the global financial system.

- Meanwhile, trends are a trader’s or investor’s best friend, and the path of least resistance for gold and silver prices remains higher in early 2026.

Risk rises with price

While there are many factors supporting gold and silver prices in early 2026, the higher the prices rise, the greater the odds of substantial corrections. Since 1999, when gold and silver reached respective lows of $252.50 and below $5 per ounce, prices have powered higher. However, periodic corrections have been the most attractive buying opportunities. I expect that trend to continue in 2026. Buying gold and silver during corrections on a scale-down basis has been optimal during selloffs. However, the corrections can turn ugly and can last for extended periods. In 2011, silver reached $49.82 per ounce before trading in a bearish trend, bottoming at $11.74 in 2020. Since then, every price decline has been a golden, no pun intended, buying opportunity.

I expect that gravity will once again cause silver prices to correct. However, it is impossible to pick the top that will trigger the downside price action. Therefore, the best approach is likely trading silver with the trend, which remains bullish in late January 2026. When the trend bends, look to take profits and consider a short position with a defined risk-reward profile.

Watch for sudden periodic corrections

The daily trading range in silver futures from 1982 through 2005 was typically around 10-15 cents, with a volatile day reaching 50 cents. Silver was mostly trading between $5 and $7 per ounce during this period. Using $6 as a midpoint, the daily range was 2% with a volatile day at 8.3%. At $90 per ounce, this translated to a daily trading range of $1.80 during a typical session and $7.50 during a volatile one. Expect more extreme price ranges over the coming days, weeks, and months as silver prices continue on a parabolic path.

Silver’s price has moved into uncharted territory in 2026, following the explosive rally in 2025 and early 2026. Therefore, technical analysis becomes challenging. While a sudden correction can appear for no other reason than selling dominating buying, any risk positions on the long or short side require a plan, including acceptable risk levels and profit horizons.

Based on the price action over the past five decades, silver is expensive at nearly $100 per ounce, but that does not mean it will not become even more expensive. Gravity has a way of hitting a parabolic market when no one is expecting it, so approach silver with extreme caution in the current environment. I remain bullish on silver in January 2026, but the odds of a severe, and perhaps ugly, correction are rising as the price rises.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)