Financial services giant Charles Schwab (NYSE:SCHW) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 18.9% year on year to $6.34 billion. Its non-GAAP profit of $1.39 per share was in line with analysts’ consensus estimates.

Is now the time to buy Charles Schwab? Find out by accessing our full research report, it’s free.

Charles Schwab (SCHW) Q4 CY2025 Highlights:

- Revenue: $6.34 billion vs analyst estimates of $6.38 billion (18.9% year-on-year growth, 0.6% miss)

- Pre-tax Profit: $3.18 billion (50.2% margin)

- Adjusted EPS: $1.39 vs analyst estimates of $1.39 (in line)

- Market Capitalization: $179.5 billion

Company Overview

Founded in 1971 as a disruptive force challenging Wall Street's high fees and limited access, Charles Schwab (NYSE:SCHW) is a wealth management and brokerage firm that provides investment services, banking, and financial advice to individual investors and independent advisors.

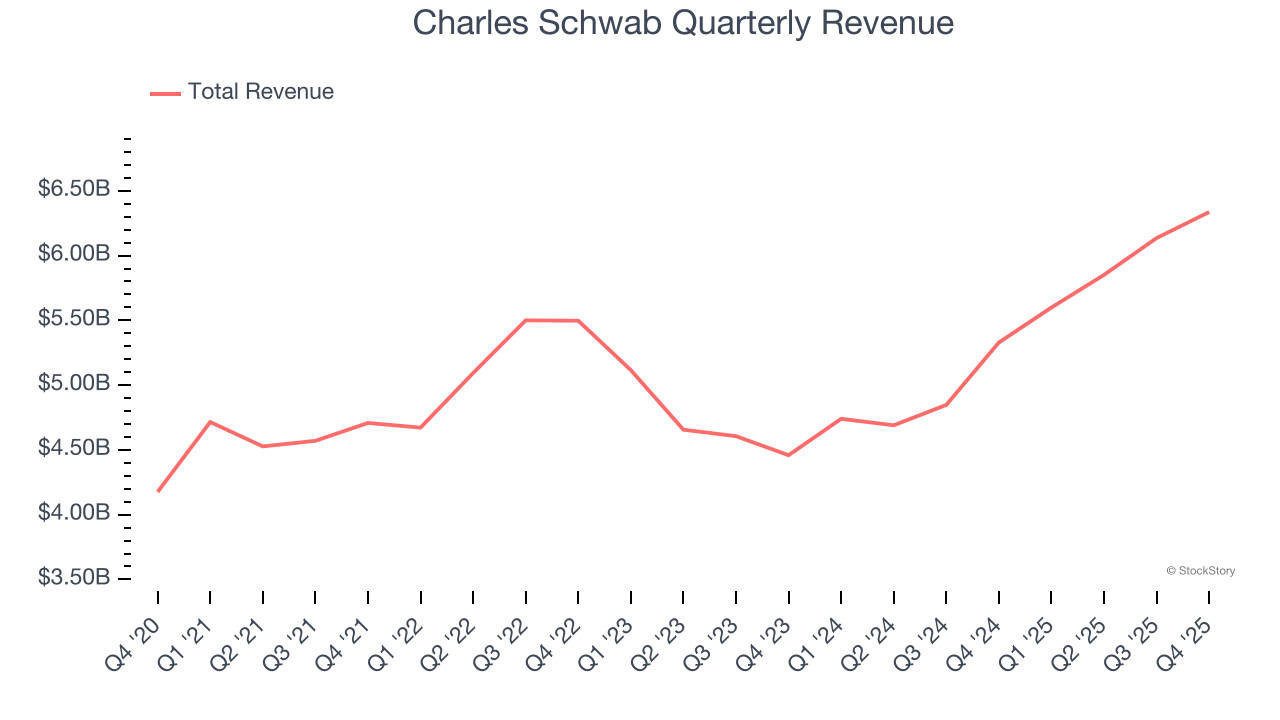

Revenue Growth

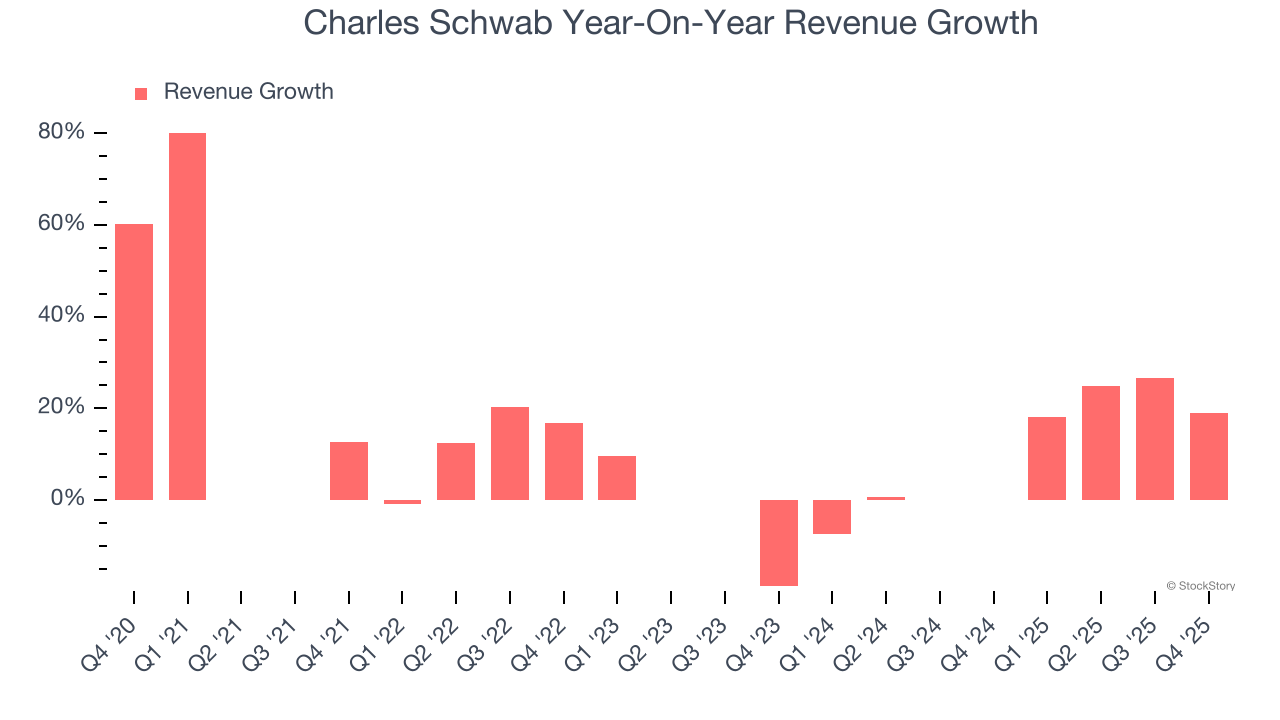

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Charles Schwab grew its revenue at an impressive 15.4% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Charles Schwab’s annualized revenue growth of 12.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Charles Schwab’s revenue grew by 18.9% year on year to $6.34 billion but fell short of Wall Street’s estimates.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Charles Schwab’s Q4 Results

We struggled to find many positives in these results. Revenue missed slightly, and EPS didn't make up for the topline shortfall, as it just met expectations. The stock traded down 1.2% to $98.77 immediately after reporting.

Is Charles Schwab an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)