The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how apparel and accessories stocks fared in Q3, starting with Movado (NYSE:MOV).

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 16 apparel and accessories stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was 0.9% below.

In light of this news, share prices of the companies have held steady as they are up 4.8% on average since the latest earnings results.

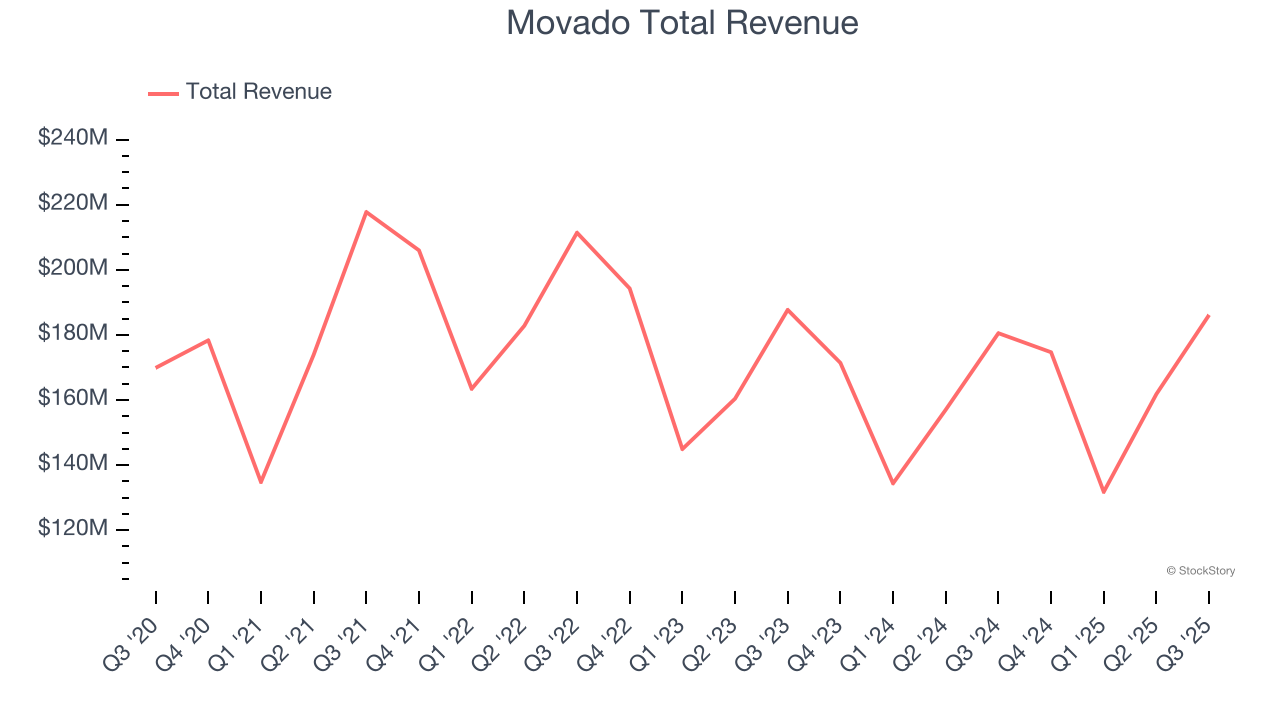

Movado (NYSE:MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $186.1 million, up 3.1% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates.

Efraim Grinberg, Chairman and Chief Executive Officer, stated, “We are pleased with our third quarter results, delivering a 3% increase in net sales, 80 basis points of expansion in gross margin and a doubling in diluted earnings per share versus the third quarter last year, even as we absorbed material tariff cost increases in the period. We capitalized on the accelerating interest in the fashion watch category among younger consumers, delivering innovative watch and jewelry assortments that were strongly received across our iconic brands, especially in Europe and the United States. We achieved double-digit growth for the Movado brand in our direct-to-consumer channels, while continuing to optimize the brand's wholesale business, which we expect to return to growth in the fourth quarter.

Interestingly, the stock is up 17.3% since reporting and currently trades at $22.79.

Read our full report on Movado here, it’s free.

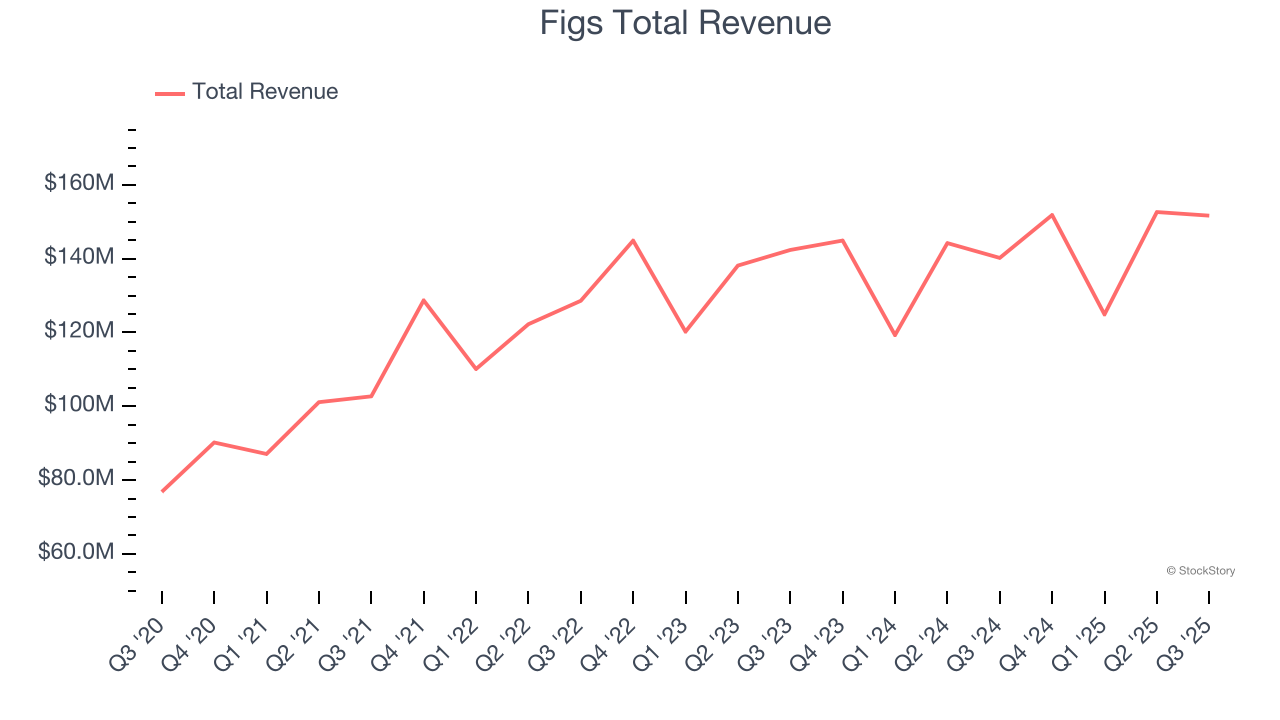

Best Q3: Figs (NYSE:FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $151.7 million, up 8.2% year on year, outperforming analysts’ expectations by 6.4%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 54.7% since reporting. It currently trades at $11.64.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it’s free.

Columbia Sportswear (NASDAQ:COLM)

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ:COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Columbia Sportswear reported revenues of $943.4 million, up 1.3% year on year, exceeding analysts’ expectations by 2.7%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 4.7% since the results and currently trades at $53.92.

Read our full analysis of Columbia Sportswear’s results here.

Under Armour (NYSE:UAA)

Founded in 1996 by a former University of Maryland football player, Under Armour (NYSE:UAA) is an apparel brand specializing in sportswear designed to improve athletic performance.

Under Armour reported revenues of $1.33 billion, down 4.7% year on year. This number topped analysts’ expectations by 1.9%. Overall, it was a strong quarter as it also recorded a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 24.8% since reporting and currently trades at $5.76.

Read our full, actionable report on Under Armour here, it’s free.

Levi's (NYSE:LEVI)

Credited for inventing the first pair of blue jeans in 1873, Levi's (NYSE:LEVI) is an apparel company renowned for its iconic denim products and classic American style.

Levi's reported revenues of $1.54 billion, up 7% year on year. This print beat analysts’ expectations by 2.9%. It was a strong quarter as it also logged a solid beat of analysts’ constant currency revenue estimates and a beat of analysts’ EPS estimates.

The stock is down 11.9% since reporting and currently trades at $21.68.

Read our full, actionable report on Levi's here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)