EURUSD Stalls at Range Extremes as Macro Forces Drive Two Way Risk

The EURUSD remains one of the most actively traded currency pairs globally, acting as a real time barometer for relative growth, inflation, and monetary policy expectations between the United States and the Eurozone. As we move along in 2026, the market finds itself at an important inflection point, with price still operating inside a well defined higher time frame distribution range. Understanding the macro backdrop alongside current market structure is essential for framing expectations in the weeks ahead.

Macro Factors Influencing EURUSD

Recent sentiment in EURUSD has been shaped primarily by diverging economic narratives between the Federal Reserve and the European Central Bank. In the United States, economic data has remained resilient, particularly in the labor market and consumer spending. This has kept the Fed cautious about signaling aggressive rate cuts, even as inflation shows signs of gradual moderation. Higher for longer rate expectations continue to underpin the US dollar, especially during periods of global risk aversion.

In contrast, the Eurozone faces slower growth dynamics, with manufacturing activity and business confidence remaining fragile in several core economies. While inflation has cooled meaningfully, the ECB has been more vocal about the need to support growth, leaving markets sensitive to any hint of accelerated easing. Headline risk remains elevated around ECB policy meetings, US CPI and employment releases, geopolitical developments, and energy related shocks that disproportionately impact Europe. Any surprise in relative rate expectations or risk sentiment can quickly translate into directional movement for EURUSD.

What the Market Has Done

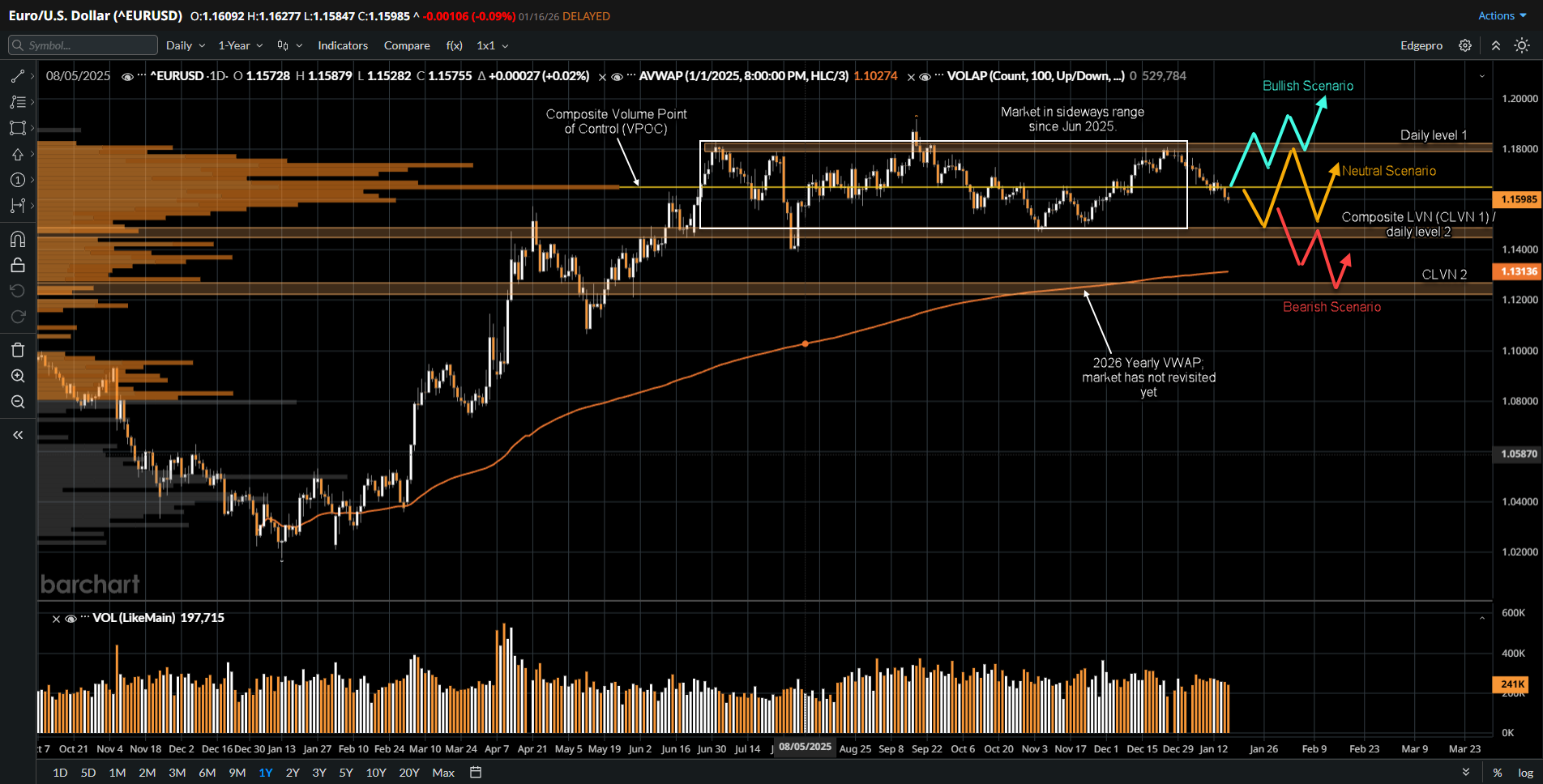

- The market has been in a distribution range between 1.18 and 1.148 since June 2025, signaling balance at the higher time frame rather than sustained trend continuation.

- Since the start of 2026, sellers have consistently responded from the 1.18 area, reinforcing it as a key supply zone within the broader range.

- In the past month, price has developed a downtrend structure on the lower timeframe, with lower highs and lower lows.

- EURUSD is currently trading below the Composite Volume Point of Control (CVPOC).

- Rotations have remained rotational rather than impulsive, reinforcing the idea of auction behavior rather than trend expansion.

What to Expect in the Coming Weeks

Key levels to watch remain 1.18 and 1.148, which define the upper and lower boundaries of the broader distribution range.

Neutral Scenario

- Expect price to remain contained within the 1.18 and 1.148 range as the market continues to digest macro uncertainty.

- In the near term, the market may auction lower toward the 1.148 CLVN 1 area.

- Responsive buyers are expected to defend this zone and attempt to rotate price back up through the range, keeping conditions balanced.

Bearish Scenario

- If buyers are unable to defend the 1.148 area, the auction is likely to extend lower.

- In this case, price may rotate down toward the 2026 yearly VWAP, where an initial buying response can be expected.

- Failure to attract meaningful demand at VWAP would open the door for continuation toward 1.122, identified as CLVN 2.

Bullish Scenario

- If buyers respond aggressively and are able to bid price back above 1.165, which aligns with the CVPOC, upside momentum could rebuild.

- A sustained acceptance above this level would increase the probability of a move back toward 1.18.

- If sellers fail to defend the upper boundary, the market could print an imbalance above the consolidation range and extend higher toward the 1.200 area.

Conclusion

EURUSD remains a market defined by balance at the higher time frame, even as near term price action reflects persistent pressure from macro forces favoring the US dollar. Ongoing resilience in US economic data, cautious Federal Reserve communication, and periodic risk off responses to geopolitical and trade related headlines continue to limit upside follow through for the euro. At the same time, slower Eurozone growth and sensitivity around ECB policy expectations keep sellers engaged near the upper end of the distribution range.

With macro headlines driving sharp but often short lived rotations, technical reference levels such as 1.18, 1.165, and 1.148 take on added importance. Until a clear shift occurs in relative policy expectations or growth outlooks, EURUSD is likely to continue auctioning between established value areas rather than transitioning into a sustained trend. Traders should remain attentive to upcoming US inflation and employment data, ECB communication, and any developments that alter global risk sentiment, as these catalysts are most likely to determine whether balance persists or gives way to expansion.

For traders focused on the currency markets such as the EURUSD, trading futures offers transparency, centralized pricing, and regulated execution that CFDs simply cannot match. "Edge Clear LLC" provides direct access to global futures markets with reliable execution and trader focused platforms built for serious market participation and traders who want to take their trading to the next level. Check out "Edge Clear LLC" at edgeclear.com

Disclaimer:

This article is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The analysis presented reflects the author’s market observations and opinions at the time of writing and is not a recommendation to buy or sell any futures contract, security, or financial instrument. Futures trading involves significant risk and is not suitable for all market participants. Losses may exceed initial margin deposits, and market conditions can change rapidly.

Any scenarios, levels, or market expectations discussed are hypothetical in nature and are intended solely to illustrate potential market behavior. They do not represent actual trading results and should not be interpreted as guarantees of future performance. Past performance, market behavior, or historical price action are not indicative of future outcomes.

Readers are solely responsible for their own trading decisions and risk management. Always conduct independent research, consider your financial situation and risk tolerance, and consult with a qualified financial professional if necessary before engaging in futures or derivatives trading.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)