WALSH PURE SPREADER

Pure Hedge Division

RICH MORAN 1/16/2025

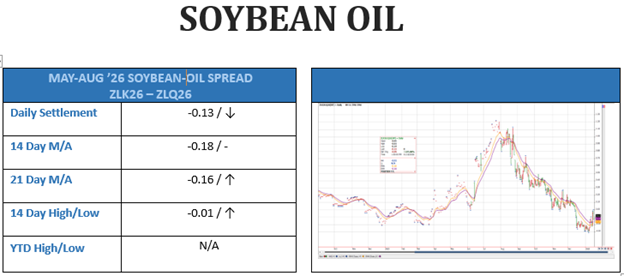

MAY-AUG ’26 SOYBEAN-OIL SPREAD (ZLK26-ZLQ26)

We are already long (on paper) the MARCH-JULY ’26 SOYBEAN-OIL SPREAD (ZLH26-ZLN26) at -0.79 cents. With the Soybean-Oil yield continuing to run below average, I still think it might be a good play to be long Soybean-Oil spreads, especially as they continue to float around not too far above their 52-week lows.

With March Soybean-Oil (ZLH26) only five or six weeks away from its First Notice Day, I think we should now take a look at getting long the MAY-AUG ’26 SOYBEAN-OIL SPREAD (ZLK26-ZLQ26). This spread is also not too far above its 52-week low. In addition to that, it is holding on slightly above both the 14-day and 21-day moving averages. We can risk a small loss with a short stop just below its 52-week low.

I am suggesting that when the market opens on Monday evening, we could try to buy ZLK26-ZLQ26 at -0.13 cents (today’s settlement) or better. If we open higher than that, just leave a -0.13 resting bid in. We are already long (on paper) ZLH26-ZLN26 so we can be a little patient with this this one. We can pick our exact exit points if and when we are able to put this trade on. In any case, if you do get long this spread, I would stop yourself out at -0.36 cents.

If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link Sign Up Now

Following up on still active past trade suggestions:

- 1/14/2026 ZWK26-ZWN26 (MAY-JULY ’26 Wheat Spread)

Today’s Settlement: -11¾, 14-Day Moving Average: -12, 21-Day Moving Average: -11½

With March Wheat (ZWH26) settling 512¾ today, only 11¼ cents above its 52-week low of 501½, we have the MAY-JULY ’26 Wheat Spread (ZWK26-ZWN26) settling at -12½, just above its 52-week low of -13¼. This spread has been floating near there for the last few weeks. At the same time, it has been hovering not too far below both the 14-day and 21-day moving averages.

According to the CFTC’s most recent release (1/9/26) of managed money’s net position in wheat, they are short 107,165.00 contracts. That is more than any other grain. There are also some winterkill risk possibilities next week according to forecasts in the upper Plains. ZWK26-ZWN26 is currently at 58% of full carry.

If we can get this spread to trade and settle above both of these moving averages, I think we might want to get long the spread. I feel the risk/reward of being long this spread at these levels could be worth making the trade. We can use a relatively short stop just below a new 52-week low. I would not want to be short wheat if the managed money shorts start to exit these positions and any winterkill can possibly bring a bid to the market as well.

I am suggesting that if we can trade above and settle above both the 14-day and the 21-day moving averages, we should try to get long this spread. We can pick our exact exit points when and if we are able to put this trade on.

- 12/17/2025 ZLH26-ZLN26 (MAR-JULY ’26 SOYBEAN-OIL SPREAD)

Today’s Settlement: -0.86, Long at -0.79

****Thursday (12/18/25): Shortly after the market opened Thursday (12/18/25) morning, we would have been able to buy -0.79’s in ZLH26-ZLN26 (MAR-JULY SOYBEAN-OIL SPREAD). It did trade -0.80. When that happened, it was -0.53 bid in ZLH26 (JAN-MAR ’26 SOYBEAN-OIL SPREAD), so we were able (on paper) to sell out and get flat that spread at -0.53. This was for a 1 tick or $6.00 loss, plus fees and commissions.

Risking 22 ticks (price of -1.01) or $132 to make 66 ticks (price of -0.13) or $396 Per Spread, plus fees and commissions.

- 11/14/2025: ZCH26-ZCZ26 (MAR-DEC’26 Corn Spread)

**** On Monday, 1/12/26, ZCH26-ZCZ26 traded down to -25½ cents, then traded -25 cents, and then continued down, so we were stopped out at -25½ cents (on paper) for a 2 Cent or $100 loss per spread, plus fees and commissions.

Long at -23½

On 11/14/25 I had suggested trying to buy this spread when the corn market opens on Sunday night at -23½ or better. If you do not get filled on the opening, continue to work a -23½ bid.

On 11/17/25 MAR-DEC’26 Corn Spread opened at -23 and traded down to -23¾, so we are long (on paper) at -23/½.

**** 12/9/2025 – We now have nice lead on this spread, so I am suggesting we lower our stop (on paper) to 25½.

New Parameters: Risking 2 cents (price of -25½) or $100 to make 23½ cents (price of -½) = $1,175 Per Spread, plus fees and commissions.

- 11/12/2025: KEH26-ZWH26 (March’26 Kansas City-Chicago Wheat Spread)

**** On Monday, 12/23/25, KEH26-ZWH26 traded up to +11 cents and settled there, so we reached our objective of +9½ cents and made a profit (on paper) of 24 Cents or $1,200 Per Spread, plus fees and commissions.

Long at -14½

Hard Red Winter Wheat minus (-) Soft Red Winter Wheat is more commonly known as the Kansas City-Chicago Wheat Spread.

**** (11/13/25) The (KEZ25-ZWZ25) – (KEH26-ZWH26) Condor opened up yesterday at +¼ and traded up to +1¼, so we could have sold evens or 0’s (par). So, we would have rolled our KEZ25-ZWZ25 long position at -14½ to being long the KEH’26-ZWH’26 spread at -14¼.

**** 12/17/2025 – We now have nice lead on this spread, so I am suggesting we lower our stop again (on paper) to -6½. That would give us a profit of 8 cents or $400 (our initial risk on the trade).

New Parameters: We are now looking to make 8 cents (price of –6 ½) = $400 OR to make 24 cents (price of +9½) = $1,200 Per Spread, plus fees and commissions.

- 10/1/2025: SBH26-SBK26 (MAR-MAY’26 Sugar #11 Spread)

Today’s settlement: 0.42, Long at 0.42

On 10/1/25 I said, “I think it might be a good play to bid today’s settlement (42 cents) or better when the Sugar market opens.”

On 10/2/25 the market opened at .41, so we are long at .42.

Risk 24 cents (price of .18) or $268.80 Per Spread to make 50 cents (price of .92) or $560.00 Per Spread plus fees and commissions.

If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link Sign Up Now

Rich Moran

Senior Commodities Broker

Direct: (312)985-0298Cell: (773)502-5321

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involve substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)