/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

A new report released by Moody’s Ratings is already changing the perspective of investors on the next generation of the artificial intelligence (AI) cycle. Moody’s believes that at least $3 trillion of investments are set to be made in the next five years in relation to the data center industry, which encompasses servers, computers, infrastructure, and power. This indicates that the AI era has really just begun.

The report points out that the competition to add data center capacity remains in the early stages and is set to pick up pace over the coming 12 to 18 months. Currently, just six U.S. hyperscalers alone are set to commit around $500 billion to data center infrastructure by the end of 2026.

In light of these developments, however, the most straightforward play on these infrastructure developments remains Nvidia (NVDA). As the leading manufacturer of AI accelerators and data center GPUs, Nvidia finds itself squarely in the middle of virtually all large-scale deployments of the technology, which makes the Moody’s forecast particularly pertinent to NVDA stock in January 2026.

About Nvidia Stock

Nvidia is an innovation leader in designing high-performance graphics processing units and AI computing solutions that power gaming, data centers, AI, and autonomous machines. With its headquarters in Santa Clara, California, Nvidia has grown from being a graphics chip manufacturer to the AI compute infrastructure backbone in the global AI computing ecosystem. The firm is currently valued at a market capitalization of about $4.5 trillion.

NVDA stock is currently trading at about $182, which is in the middle of its 52-week range of $86.62 to $212.19. Although NVDA stock has fallen slightly in the last five days, its overall performance over the last year remains good, as indicated by its weighted alpha of +37.74.

From a valuation point of view, it is clear that Nvidia is not undervalued. However, its valuation is still defensible on account of its growth and earnings ratios. The current forward price-to-earnings (P/E) ratio of 41.7 times and price-to-sales (P/S) ratio of 34.4 times imply that investors expect continued growth in Nvidia's earnings. However, it is important to note that Nvidia’s profitability ratios continue to be outstanding, as indicated by its profit margin of 55.9%, return on equity of 99.2%, and low leverage, which is indicated by its debt/equity ratio of only 0.06.

Nvidia Tops Earnings Estimates as AI Demand Surges

The company's latest quarterly earnings illustrate the close tie between its investment cycle and data centers. For the third quarter of fiscal 2026, the company recorded a new record revenue of $57 billion. This marked a 22% increase from the previous quarter and a 62% increase year-over-year (YOY). Diluted EPS was at $1.30 per share, whihc was a 67% increase from the same quarter of the previous year.

Margins held up well, with GAAP gross margins of 73.4%, despite increased operating expenditures to support product launches as well as building supply-chain capacity. Notably, management reiterated that it is seeing demand outstrip supply, especially for its new Blackwell architecture, as it is sold out of cloud GPUs.

Looking ahead, Nvidia provided Q4 fiscal 2026 revenue guidance of $65 billion, plus or minus 2%, which indicates yet another sequential increase. Gross margins are expected to rise even closer to the 75% range, which underscores the leverage inherent in the Nvidia model. During the first nine months of fiscal 2026, the company repurchased stock and paid dividends to the tune of $37 billion. Nvidia also has another $62.2 billion available under its repurchase program.

What Are Analyst Targets for Nvidia Stock?

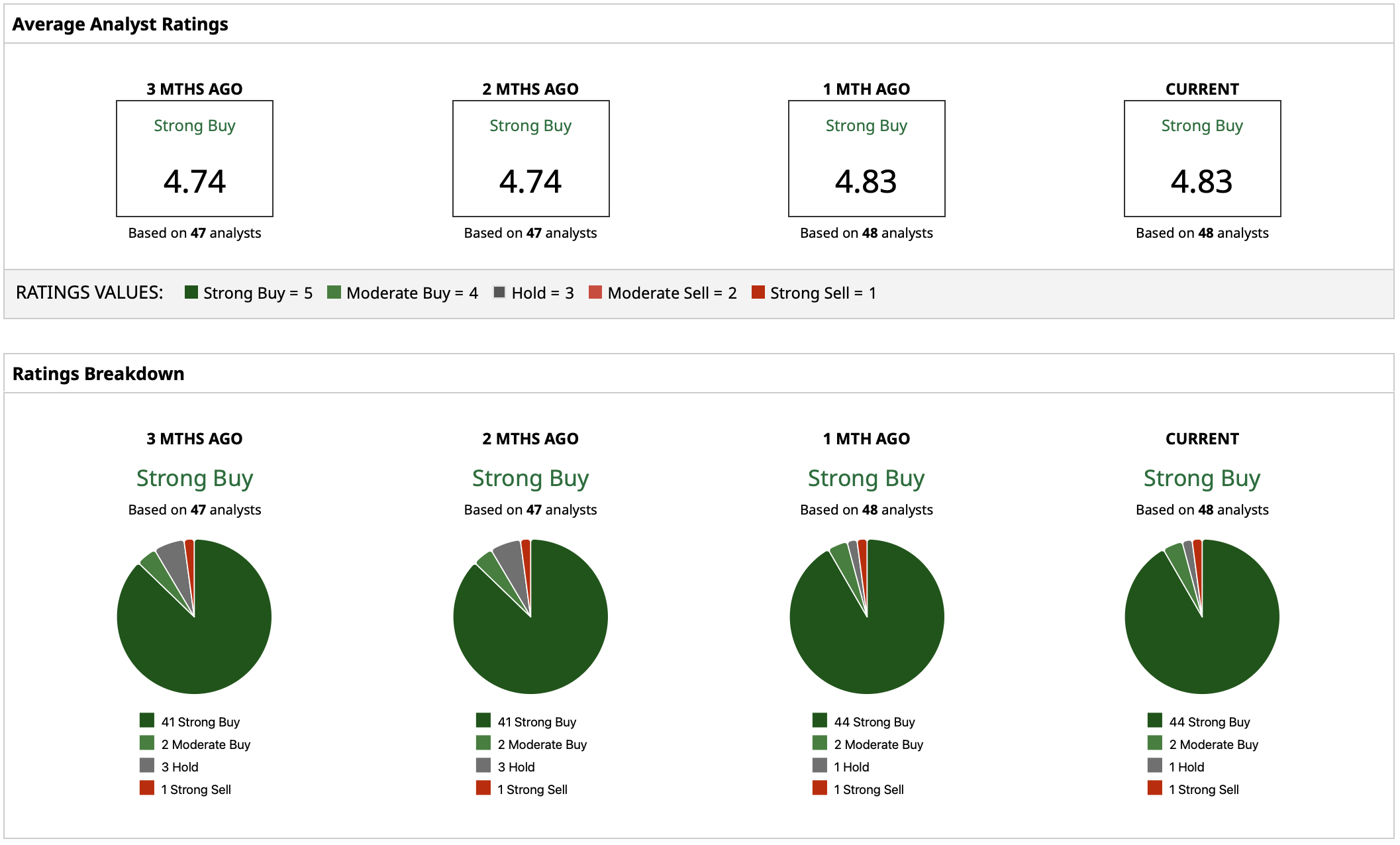

Wall Street analysts are generally positive about the future of Nvidia with a “Strong Buy” rating consensus and a mean price target of $255.07. That target for Nvidia stock implies potential upside of about 40% from current prices. What's more, the high-end price target of $352 reflects continued confidence in the company’s position as a leader in AI compute, while the low target of $140 implies that there’s not much downside risk based on Nvidia’s earnings capabilities and balance sheet strength.

On the date of publication, Yiannis Zourmpanos had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)