/Capital%20One%20Financial%20Corp_%20bank%20exterior-by%20Brett_Hondow%20via%20iStock.jpg)

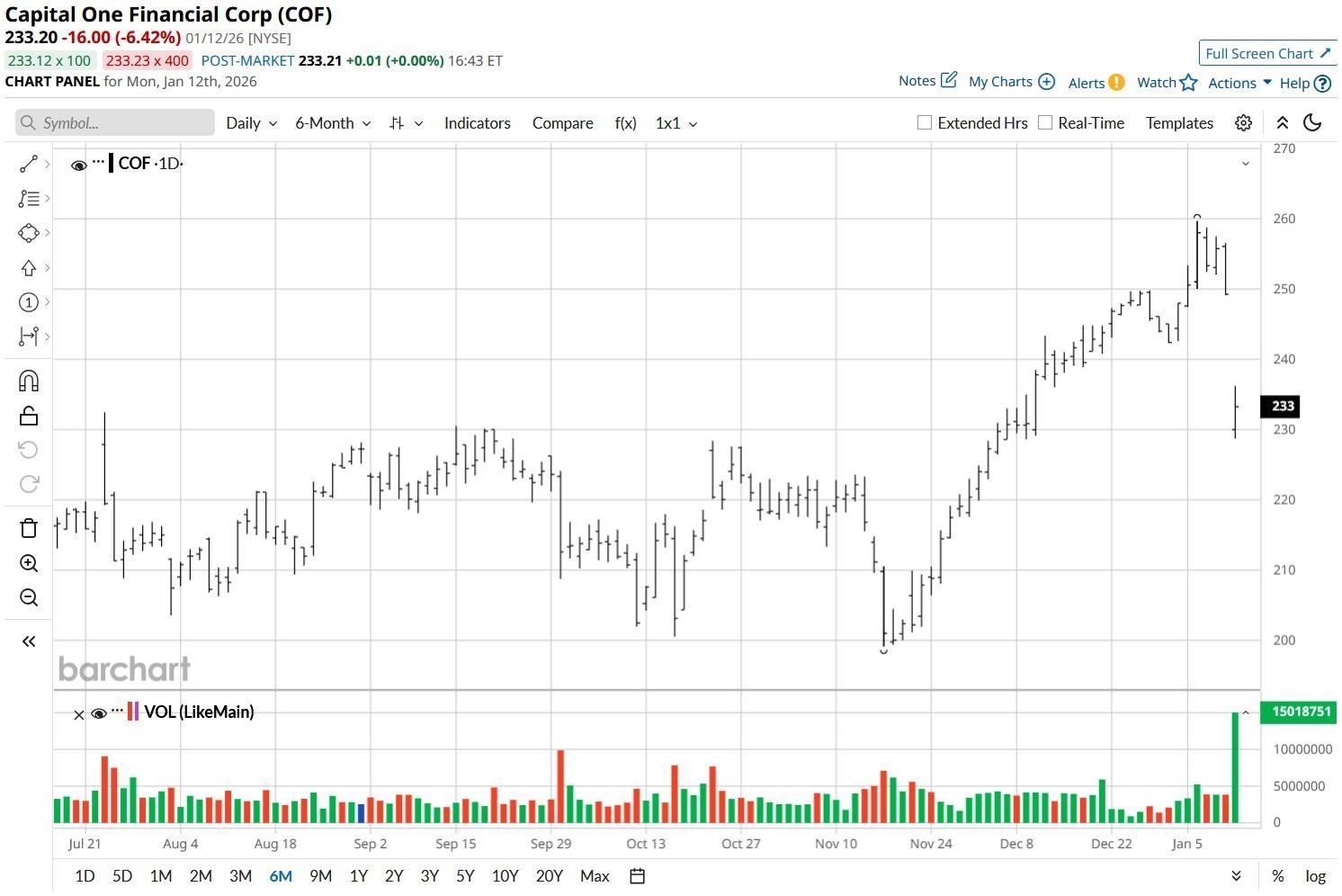

Capital One (COF) stock witnessed its largest single-day declines in nine months on Jan. 12 after President Donald Trump proposed a one-year cap on credit card interest rates at 10%.

On Truth Social, Trump said the policy shift will take effect next week on Jan. 20, making investors bail on COF as it threatens the firm’s most profitable revenue stream.

Despite Monday’s decline, however, Capital One shares remain up some 60% versus its 52-week low.

Capital One Stock Remains Worth Buying

In the U.S., the average credit card annual percentage rate (APR) hovers around 21% currently.

COF stock slipped rather significantly on Monday mostly because cutting it roughly in half as the U.S. president proposed in his social media post would notably compress the firm’s lending margin.

However, Trump needs congressional support to enforce such a seismic change, and it seems lawmakers are unlikely to support it.

Why? Because what he’s proposing will push Capital One and its peers to shrink credit availability, potentially driving at least some borrowers to “less regulated, more costly alternatives,” as CBA warned Monday.

In short, Congress may see Trump’s proposal as a risk to Americans.

Where Options Data Suggests COF Shares Are Headed

Options traders also seem to believe that this retreat in Capital One shares will prove temporary only. According to Barchart, contracts expiring mid-June have the upper price set at about $267.

Even in the near term (through the end of next week), the implied move is 5.81% indicating COF could be trading at north of $246 by Jan. 23.

Additionally, technicals currently point to a recovery as well. Despite Monday’s decline, Capital One remains decisively above its key moving averages, reinforcing that the broader uptrend remains intact.

A healthy 1.37% dividend yield makes up for another good reason to stick with COF for the long term.

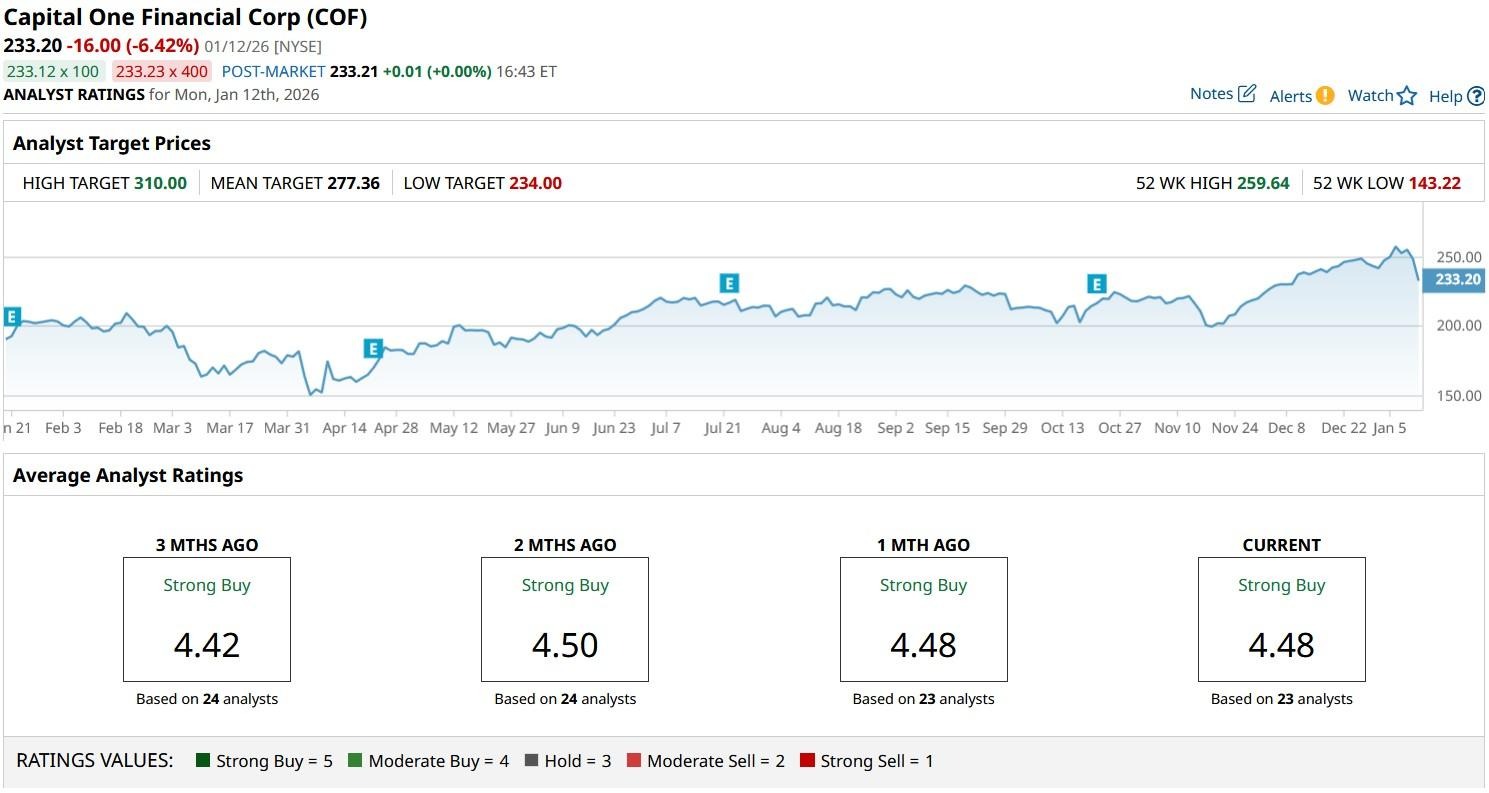

What’s the Consensus Rating on Capital One?

The market’s initial knee-jerk reaction to Trump’s social media post has failed to deter Wall Street analysts as well.

The consensus rating on COF shares remains at “Strong Buy” with the mean target of about $277 indicating potential upside of nearly 20% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)