Howdy market watchers!

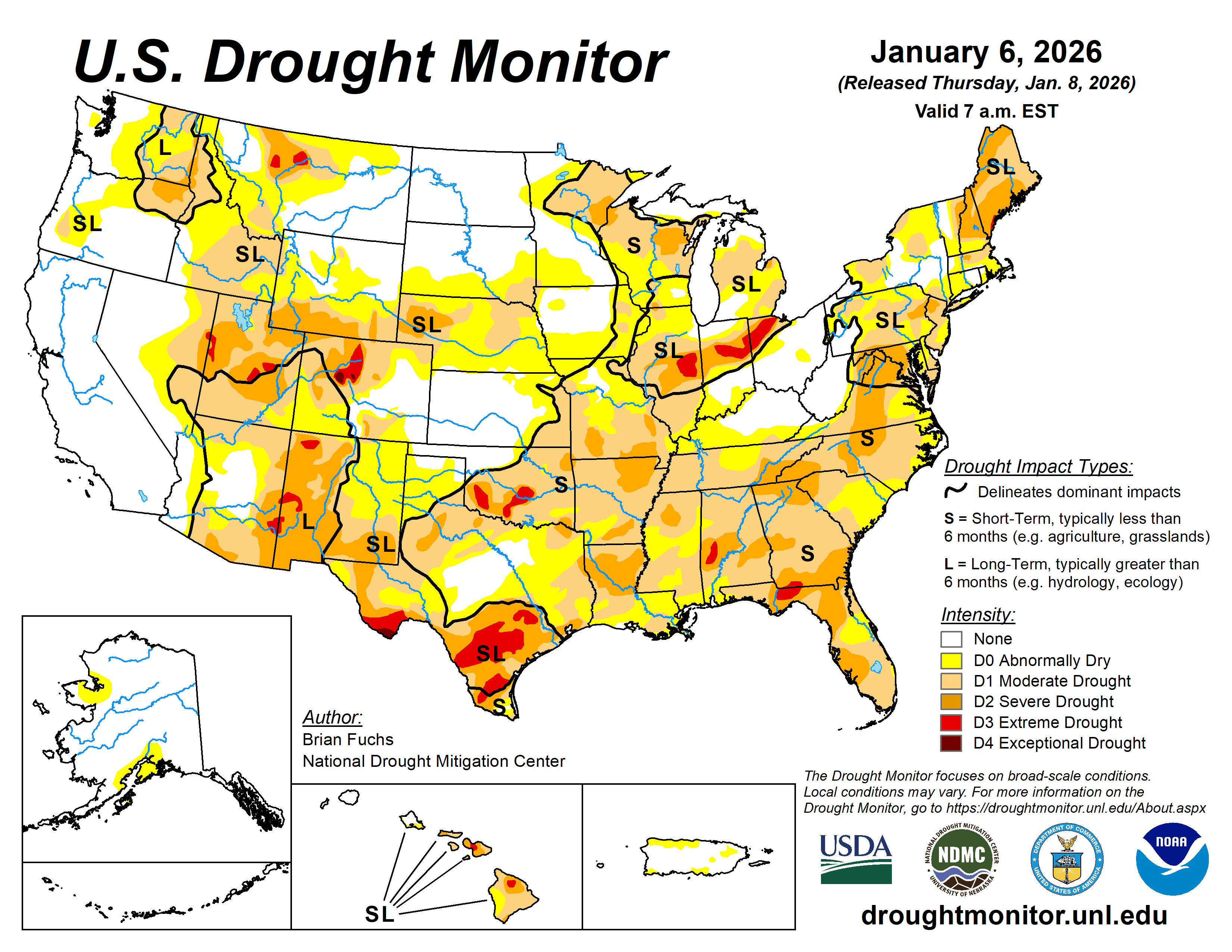

When you step outside, it’d be hard to know it’s January with these unseasonably warm temperatures, severe storm and tornado risks and threats of hail. We are thankful for the rain where it was received although limited and unpredicted for many. Drought is returning and deepening in many parts of the Midwest, Southeast and Southern Plains although it is still early for winter crops as well as ahead of spring/summer crop planting.

However, every week ahead is going to be that much closer to critical moisture being necessary. The good news is that we are beginning to see signs of a wetter spring although that can complicate planting. Having said that, we can always do more with moisture than without, but timing is important.

It was a busy week of headlines and data beginning with the surprise weekend news of Venezuela President Maduro’s capture in a US military operation. By the end of the week, President Trump had assembled executives of the largest US oil companies at the White House to discuss their re-entry into the oil fields of Venezuela that they were previously forced out of when nationalized. This historic action and the subsequent discussions around the US “running” the country through Maduro’s existing regime seems like fiction but is actively playing out.

With the world’s largest untapped oil reserves, Venezuela is strategic for so many reasons. The initial expectation was that crude oil prices would drop dramatically on last Sunday nights energy market opening. While it did initially, crude oil prices finished that Monday session higher with an outside day on the chart.

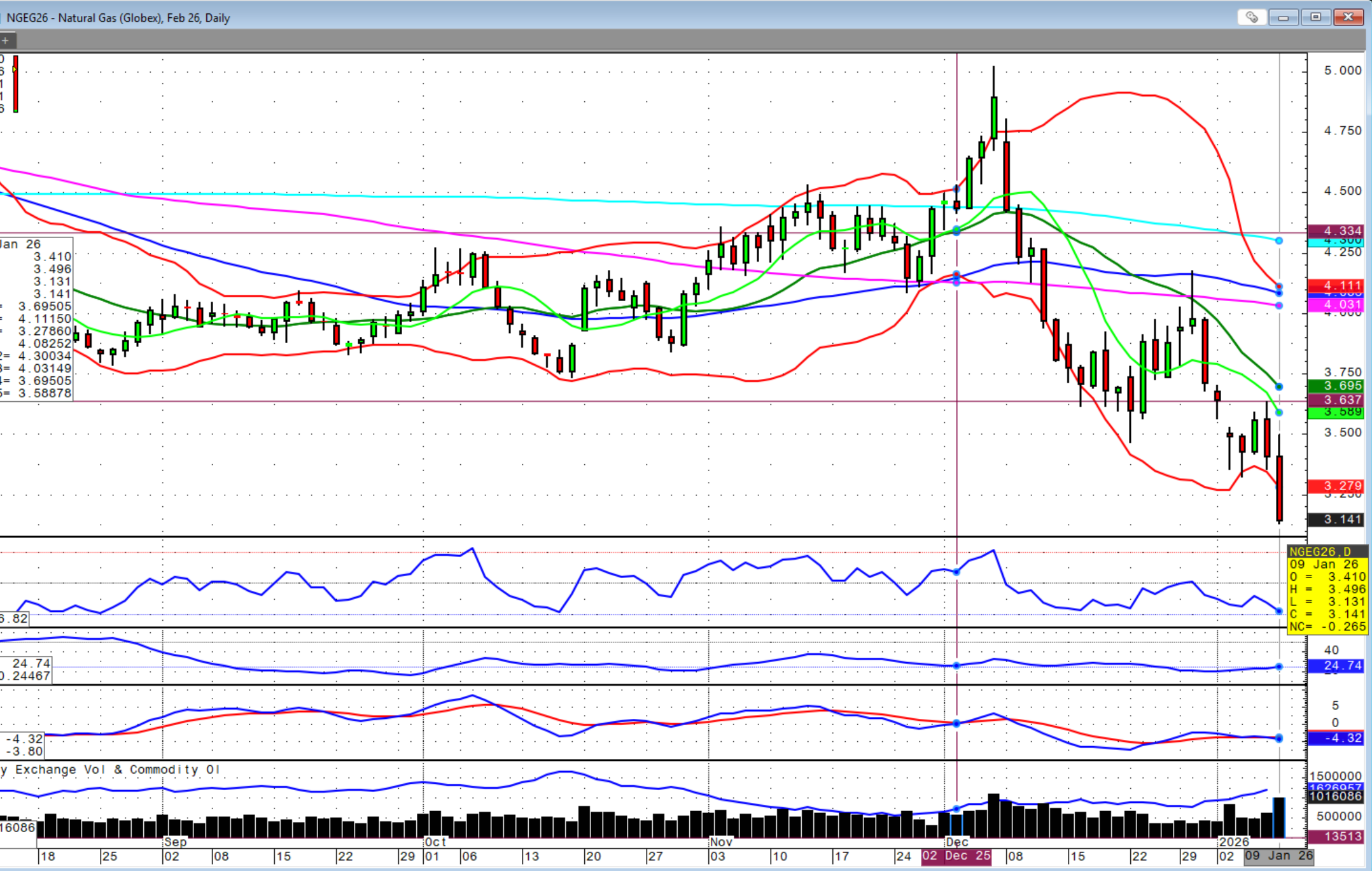

It was a volatile week in the oil market, but finished higher on the week with a late week surge. RBOB gasoline and Heating Oil diesel contracts also surged late week. The exception was natural gas that just cannot catch a bid at present with warmer temperatures despite this week’s greater than expected inventory withdrawal despite higher temps. The weather models evolve daily with plenty of unusual shifts taking place, but there is growing consensus that cold is returning especially for the middle of the country to the east coast while warmer temperatures are expected out west. Surely there will be some relief to nitrogen prices from the significant drop in natural gas prices as of late, but it may be short lived if colder weather returns and growing export demand continues to climb with Europe in a cold spell.

There is also extremely cold temperatures in Black Sea wheat areas that have provided some support for wheat markets as of late. After last week’s selloff that saw Chicago make a new, recent low, these contracts have rebounded led by Kansas City wheat. Friday session weakness in March KC wheat finished the day in the top third of the daily range and managed to close above the 50-day moving average. This set up could be leading to another bounce depending on the fresh news out of USDA’s key reports to be released on Monday at 11 AM.

In addition to the monthly Crop Production, US Grain Stocks and WASDE reports, the USDA will also release the US Winter Wheat Seedings report. Expectations are for All Wheat class planted acres to be nearly 750,000 acres below last year with Hard Red Winter wheat traded on the KC contract accounting for over 460,000 acres of that reduction. While that is a bullish indicator, US wheat stocks are expected to come in just over 60 million bushels above last year. World ending stocks for wheat are expected to come in well above last year and slightly above USDA’s last estimates. Bottomline, there is no shortage of wheat at present although demand has improved. If we get supportive news from the report and fund buying, I believe the next stop for KC wheat is the 78.6 percent Fibonacci retracement at $5.42 ¾.

Support from corn would be welcome and vice versa, but while US corn exports have been strong, US corn stocks are well above last year despite expectations for some reductions from prior estimates. South America corn production is expected to increase slightly from previous estimates while world ending stocks are expected to decline from last year, but increase slightly from last month’s figures.

US soybean production is expected to decline from prior estimates while ending stocks are expected to increase. The main figure for the market will be what the USDA does with US soybean exports vis-à-vis China specifically, who have made some rather large purchases this week getting closer to the 12 million metric ton Trump agreement that they have yet to confirm. Brazil’s soybean production is expected to increase above last year as well as prior estimates. Favorable weather there has failed to offer risk premium to soybean futures that many had hoped for after the China bump faded. Soybean futures are trading above the downward sloping trendline that have capped this market since mid-November and may have potential to get back to the low $10.80s, but we will have to see where the data comes in.

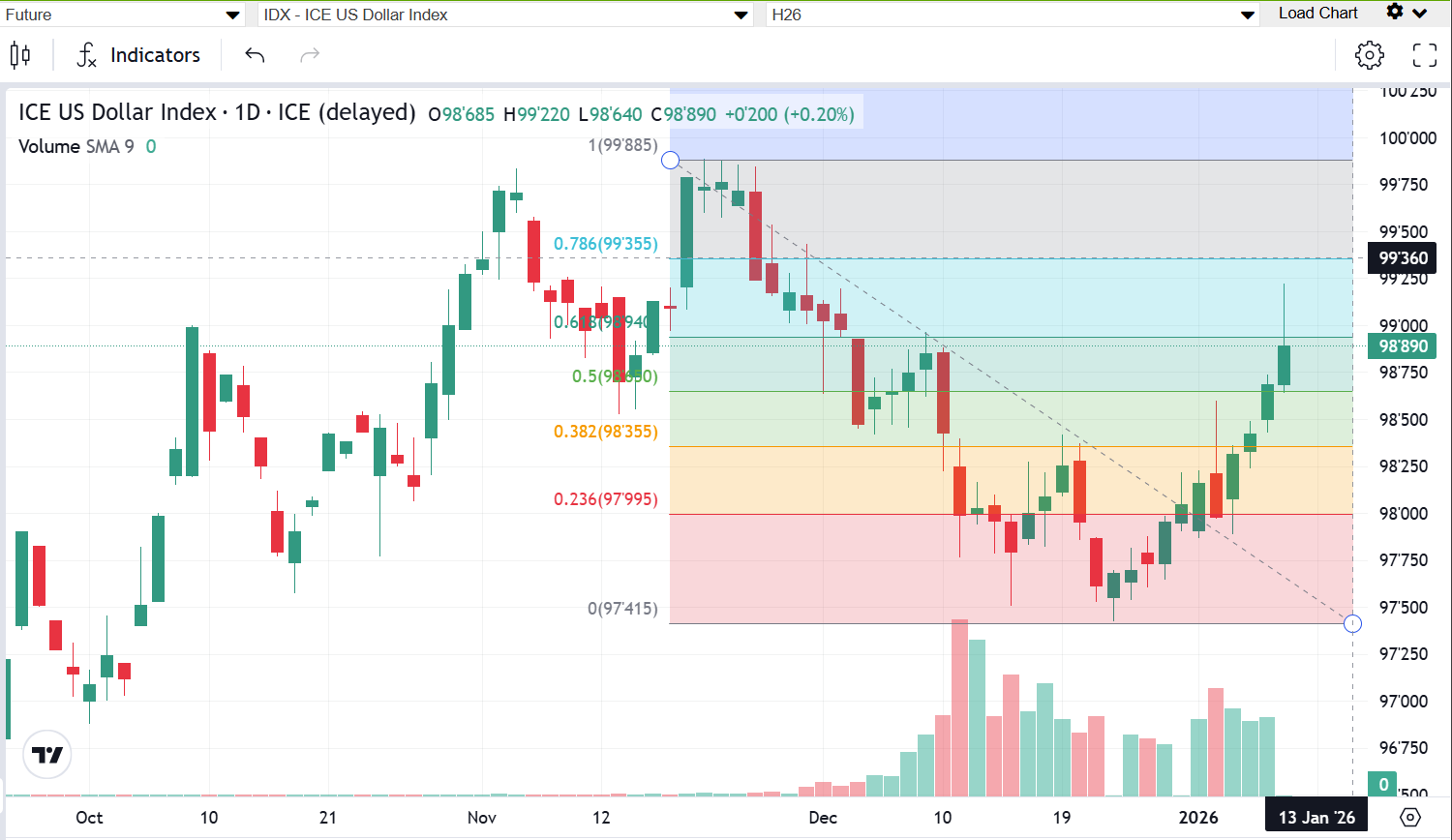

The US dollar’s rebound in recent weeks has been a headwind for US exports, but the less than expected US jobs number on Friday could bring some downward pressure back next week. It is said that Venezuela’s oil exports will now all be priced in US dollars again that will increase demand for the Greenback to resecure its dominance in global (energy) trade, but could also add relative strength to the index. The next FOMC interest rate decision will be announced on January 28th and we will see how much job market weakness is balanced against inflationary concerns.

The Secretaries of Health and Human Services and the USDA this week released the revised dietary guidelines for the country. The food pyramid has flipped many of the prior guidelines with protein consumption specifically from meat and dairy prioritized along with healthy fats, vegetables and fruits as well as whole grains. Prioritization on meat is welcome news for the livestock sector at a time when cattle and beef prices are elevated, but consumers continue to buy. Below is the old versus the new food pyramid.

This resilient demand for beef has reinstated the bullish fundamentals of the cattle complex with historically tight supplies, a closed US-Mexico border amid strong consumer demand. After filling the large chart gap, markets chopped sideways before legging higher. There is still a chart gap remaining from the initial break after the all-time high. Perhaps this market has a shallow retracement, but with extremely strong cash markets, I believe we could see futures in January continue to press higher. A return of winter weather should also support the market. We could still see an announcement regarding the reopening of the Mexican border although it feels ill-advised at present given the continued cases.

I hate to say it out loud, but it seems that a screwworm case in the US is an inevitability with odds only increasing if and when the border is reopened. President Trump has just announced intentions to fight the drug trade on Mexican soil and it is difficult to know the extent of his meaning and what it will mean for US-Mexico relations, which is an important export market for US agriculture, specifically corn.

The best advice given all of this geopolitical friction is probably to capture meaningful rallies when they present themselves.

The US Supreme Court was to release the decision on the constitutionality of President Trump's tariffs on Friday. However, the decision was delayed. This could be the most consequential decision of the year ahead for the Administration as well as for markets. The majority of odds still favor a ruling against the tariffs, but it is hard to believe any of such speculation.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)