With rising geopolitical tensions, global military spending has been going through the roof. In 2024, global defense spending touched $2.7 trillion, and if the current trend persists, spending is likely to swell to $6.6 trillion by 2035.

From an investment perspective, there seems to be visibility for sustained growth for some top defense companies. Lockheed Martin (LMT) is among the attractive names to consider.

It was recently reported that U.S. President Donald Trump has floated a proposal for a $1.5 trillion defense budget for 2027. This is likely to keep the market participants excited about the defense sector, as positive price action is likely as the order backlog swells for major defense contractors.

About Lockheed Martin Stock

Lockheed Martin, headquartered in Bethesda, Maryland, defines itself as a defense technology company. The company operates through four segments that includes aeronautics, space, mission & fire control, and rotary & mission systems.

While the company’s key market is the United States, Lockheed has been spreading its wings with orders from U.S. allies globally. For Q3 2025, the company reported revenue of $18.6 billion and an EPS of $6.95.

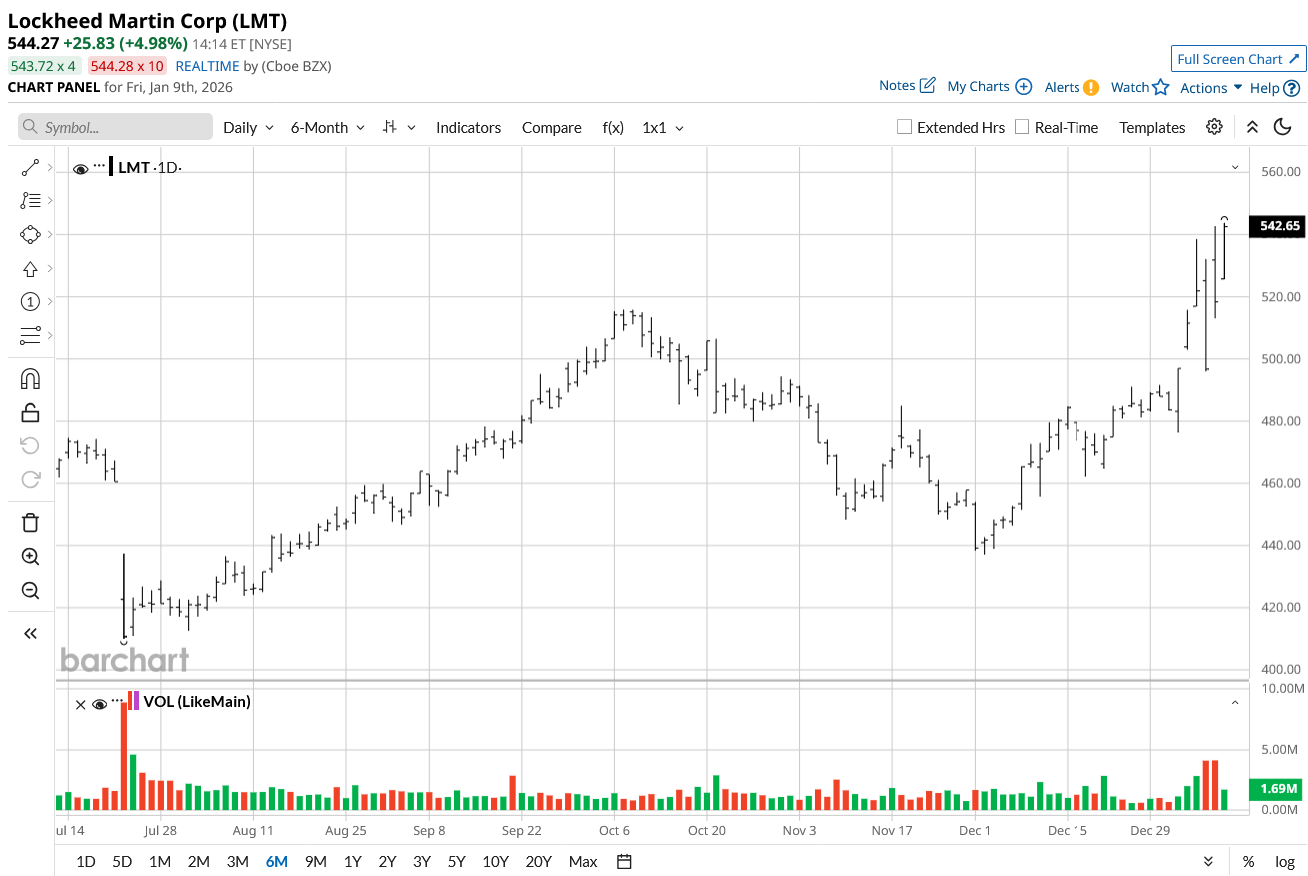

With a positive outlook for the defense sector and healthy guidance, LMT stock has trended higher by 17% in the past six months. As defense spending swells, it’s likely that growth acceleration will translate into further upside.

Strong Order Backlog Provides Growth Visibility

Besides the headline numbers, there are several positives to note in the company’s Q3 2025 results. Lockheed ended the quarter with a record order backlog of $179 billion. The backlog provides clear cash flow visibility. Further, considering the positive industry outlook, it’s likely that the order backlog will continue to swell.

The second point to note is that Lockheed reported free cash flow of $3.3 billion for the quarter. This implies an annualized FCF potential of $13.2 billion. The company has increased share repurchase authorization to $9 billion besides increasing quarterly dividend by 5% to $3.45 per share. With strong cash flow visibility, value creation is likely to be sustained. It’s also worth noting that Lockheed has raised guidance for 2025. The company now expects revenue (mid-range) at $74.5 billion.

Lockheed Martin has also mentioned that as a result of strong demand from customers (US and allies), the company is “increasing production capacity significantly” across the business range. This points to potential top-line growth acceleration in the upcoming years.

From a growth perspective, another catalyst is the company’s investment in technology. Some potential high-growth areas include “integrated air and missile defense, space warfare and highly secure command-and-control systems.”

Further, in October 2025, NASA successfully completed its first test flight of the X-59 quiet supersonic jet. This has been built by Lockheed and can be a potential breakthrough for faster commercial air travel.

Therefore, considering the factors of industry tailwinds, strong fundamentals, and innovation, Lockheed Martin seems attractive.

What Analysts Say About LMT Stock

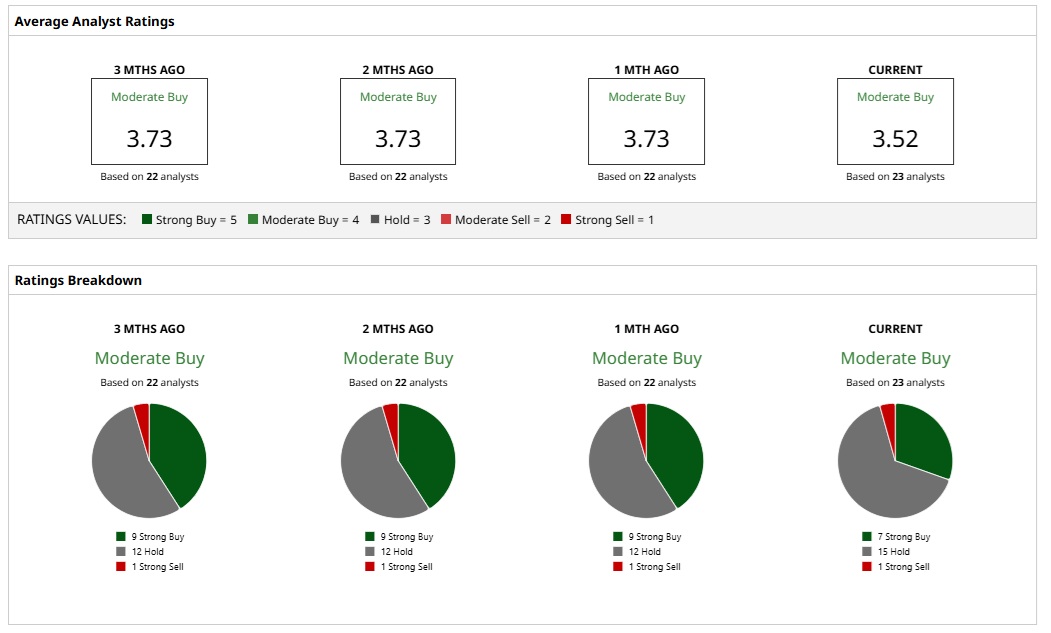

Based on the ratings of 23 analysts, LMT stock is a consensus “Moderate Buy.” While seven analysts assign a “Strong Buy” rating to LMT, 15 analysts have a “Hold” rating. Further, only one analyst has a “Strong Sell” rating for the stock.

Based on these ratings, analysts have a mean price target of $527.38 currently, which would imply an upside potential of 1.7%. Further, with the most bullish price target of $605, the upside potential for WMT stock is 16.7%.

It’s worth noting that LMT stock trades at a forward price-earnings ratio of 17.66. Valuations seem attractive for a stock with a low beta of 0.24 and a dividend yield of 2.64%. Further, industry tailwinds are likely to support cash flow upside and value creation.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)