If we analyze the returns of all major asset classes over the last 20 years, commodities are one of the most undervalued groups. Within the commodities space, there has also been significant price action in industrial commodities specifically — due to geopolitical reasons, tariffs, demand related to artificial intelligence (AI) and data centers, monetary policies, and more. And narrowing down further, copper has been in the thick of action over the last 52 weeks. During this period, copper has surged by roughly 38%. Considering multiple fundamental factors, it’s likely that copper will remain firm through 2026. Why?

For one, Moody’s economist Mark Zandi believes that the Fed will surprise with three rate cuts in the first half of 2026. Expansionary monetary policies, in general, are positive for industrial commodities. Specific to copper, there are also two factors driving prices higher. First, analysts expect demand for copper to remain firm from industries like data centers and defense. Secondly, supply-chain disruptions and tariffs pose a threat in terms of widening the demand-supply gap.

Overall, J.P. Morgan Global Research expects the price of copper to rise to $12,500 per metric ton (mt) in the second quarter of 2026. Further, the average price for the year is expected to remain elevated at $12,075/mt.

With that in mind, here are three copper stocks investors may want to consider.

Copper Stock #1: Freeport-McMoRan (FCX)

Headquartered in Phoenix, Arizona, Freeport-McMoRan (FCX) is primarily engaged in copper mining with properties in North America, South America, and Indonesia. Further, the company is also involved in the mining of gold, silver, and molybdenum.

FCX stock has rallied by 36% in the last 52 weeks. This upside has been backed by improving fundamentals and cash flows as copper trends higher.

However, from a valuation perspective, FCX stock is still relatively inexpensive. The stock trades at a forward price-to-earnings (P/E) ratio of 28 times. FCX stock's P/E-to-growth ratio of 0.95 underscores the view on attractive valuations.

For Q3 2025, Freeport-McMoRan reported total revenue of $6.97 billion. For the same period, operating cash flow was robust at $1.7 billion. Cash flows are likely to remain strong on the back of higher copper prices. At the same time, a cash buffer of $4.3 billion and net-debt-to-adjusted-EBITDA of 0.5x points to a strong credit profile.

It’s also worth noting that, for 2026, Freeport guided for copper sales in-line with 2025 at 3.5 billion pounds. However, copper production in 2027 is expected to increase to 4.1 billion pounds. Therefore, the next 12 to 24 months look good from the perspective of firm prices and production growth.

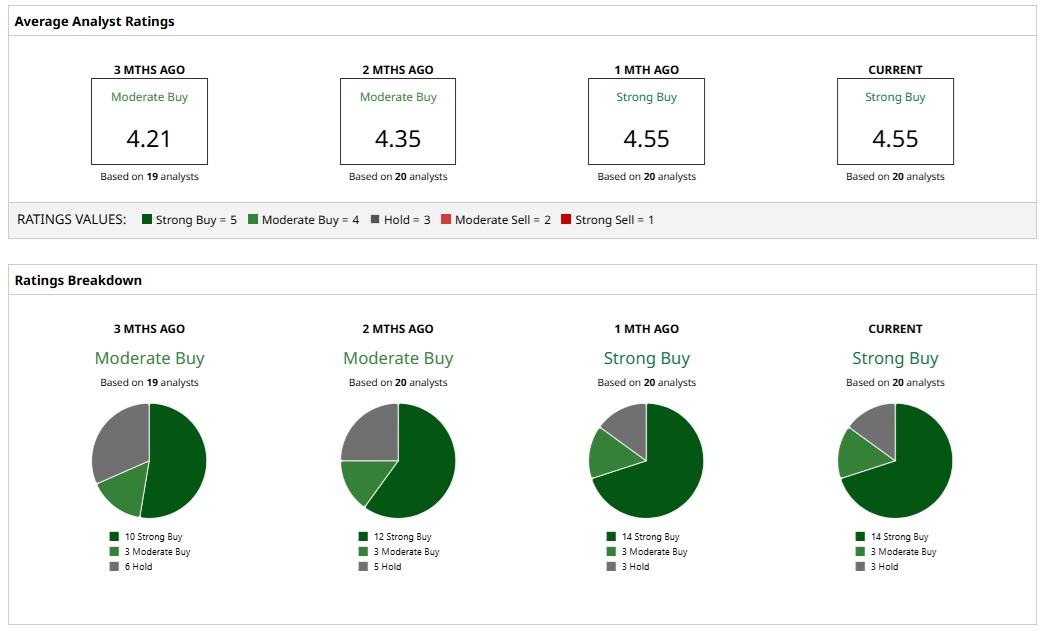

With positive industry tailwinds, FCX stock has a “Strong Buy” rating based on the consensus estimate of 20 analysts. However, the mean price target of $52.26 implies downside potential of 4% from here.

Copper Stock #2: Rio Tinto (RIO)

Rio Tinto (RIO) is headquartered in London and involved in the exploring, mining, and processing of industrial commodities. The company’s biggest segment is iron ore, although Rio is also involved in the mining and sale of copper and aluminum.

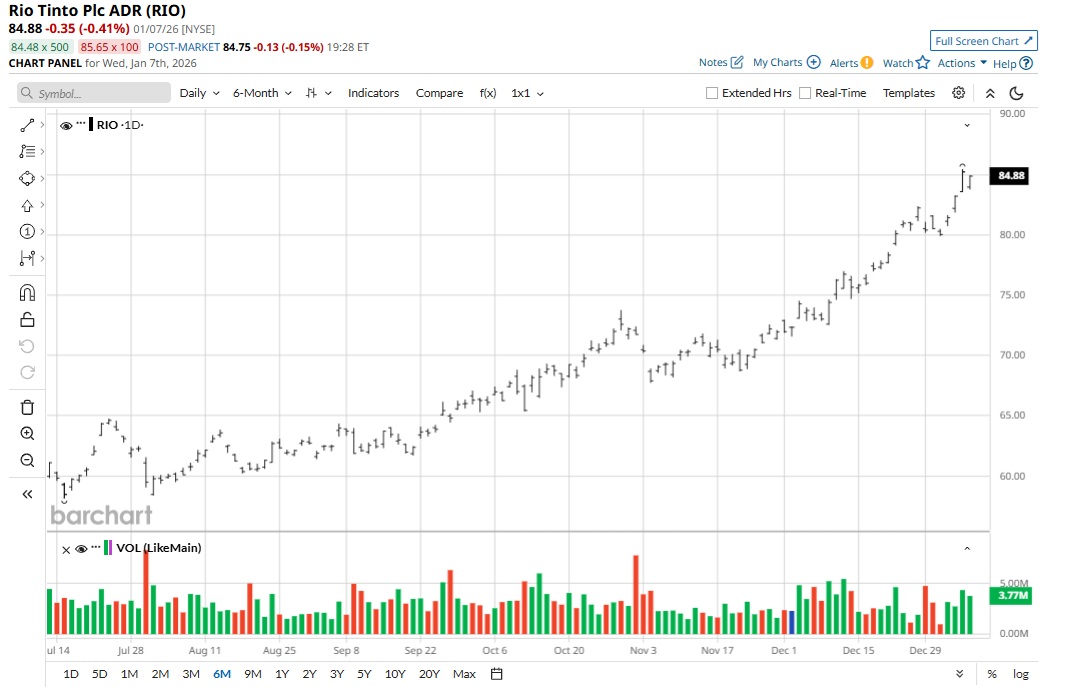

RIO stock has witnessed a meaningful rally of 44% in the last 52 weeks. Further, the stock offers an attractive forward dividend yield of 3.46%.

While the rally in RIO stock has been significant, valuations remain attractive at a forward P/E ratio of 12 times. Additionally, the P/E-to-growth ratio of 0.96 is indicative of the potential for further upside.

For the first six months of 2025, Rio reported revenue of $26.9 billion and operating cash flow of $6.9 billion. Further, with rising contribution from the aluminum and copper business, EBITDA margin expansion is likely for the firm. It’s also worth noting that, between 2024 and 2030, Rio has guided for production growth at a compound annual growth rate (CAGR) of 3%. Sustained growth will ensure higher free cash flows and continued improvement in credit metrics. Rio's EBITDA and cash flow upside story is also likely to be supported by a sustained decline in unit cost through 2030.

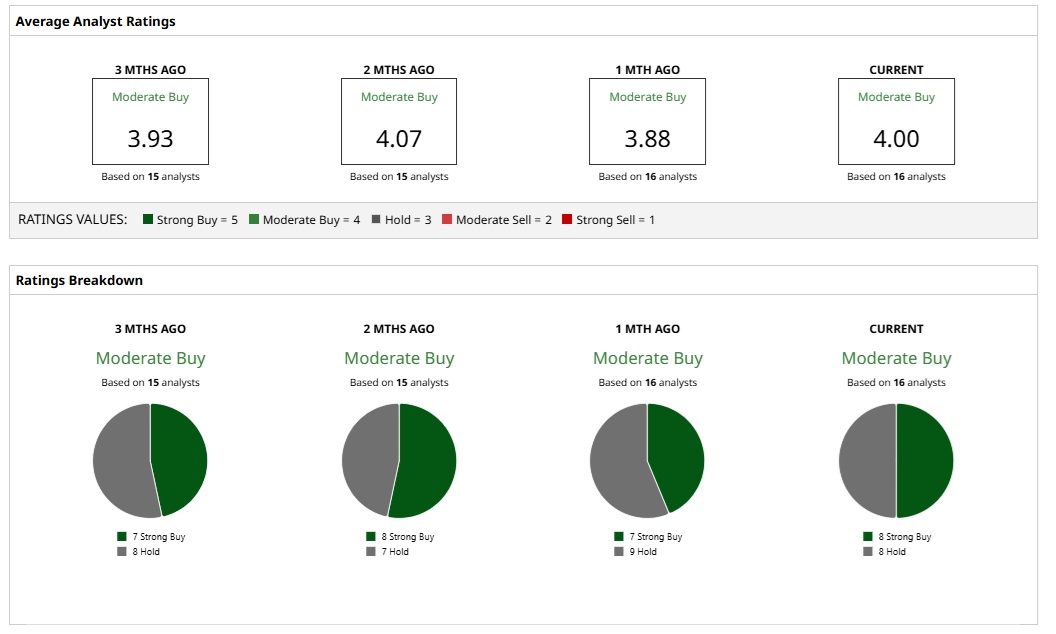

RIO stock has a “Moderate Buy” rating based on the consensus estimate of 16 analysts. However, the mean price target of $79.70 implies a downside potential of 5% from current prices.

Copper Stock #3: Teck Resources (TECK)

Teck Resources (TECK) is engaged in the exploration and development of mineral assets around the world, with current operations in the United States, Canada, Peru, and Chile. Besides primary operations in copper and zinc, the company also produces lead, precious metals, and molybdenum.

TECK stock has trended higher by 19% in the last 52 weeks. While the current dividend yield is 0.70%, it’s likely that Teck's dividends will swell as commodity prices remain firm.

Even after a decent rally in TECK stock, valuations remain attractive, with at a forward P/E ratio of 30 times. While the P/E valuation seems higher as compared to FCX and RIO, it’s worth noting that TECK stock trades at a P/E-to-growth ratio of 0.61. This indicates attractive valuations considering the earnings-growth trajectory.

In an important development, Teck Resources recently received an approval from the Canadian government for a merger of equals with Anglo American (AAUKF). The merger is likely to support growth acceleration and drive corporate synergies. It’s worth noting that Teck Resources commands an “investment grade” credit rating. Once the merger is completed, financial flexibility will be high for the company to make aggressive investments.

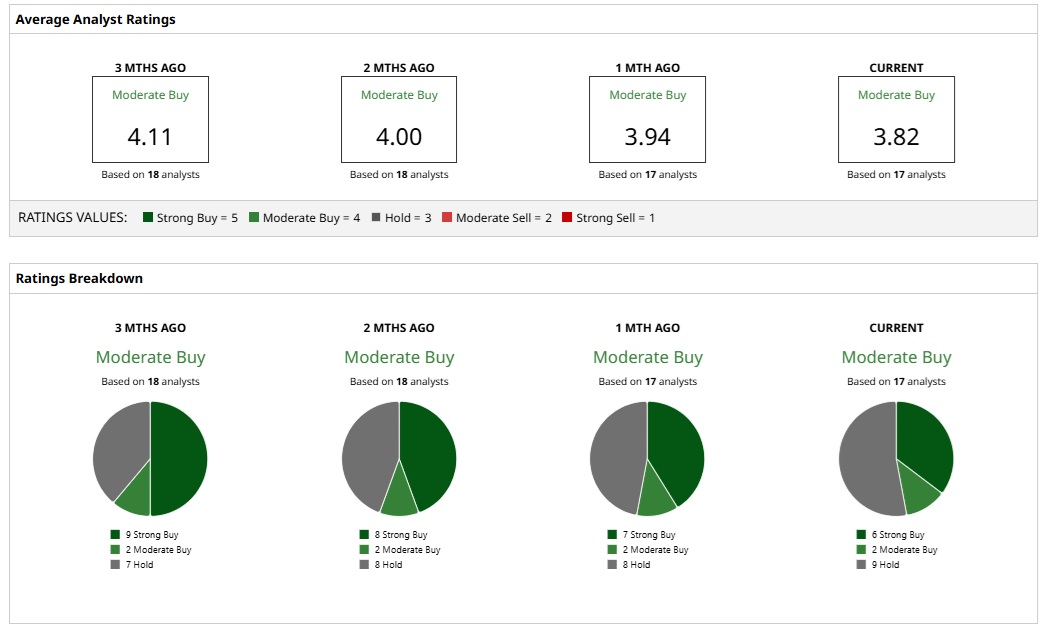

TECK stock has a “Moderate Buy” rating based on the consensus estimate of 17 analysts. However, the mean price target of $46.63 implies 6% downside potential from current levels.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)