The utilities sector is heading into 2026 with a clear shift in demand that's influencing what investors pay attention to. Data center electricity use in the United States is expected to more than quadruple between 2023 and 2030, which would mean more than 450 additional terawatt-hours of power.

AI data centers currently make up 4.4% of total U.S. electricity consumption, but that share is projected to rise to between 12% and 20% by 2030. With that kind of demand coming online, utilities stocks could benefit as the industry invests more in power generation and grid upgrades, and as utilities gain more room to adjust pricing, which can matter for income-focused investors starting the new year.

Two energy stocks stand out as dividend ideas for 2026: Constellation Energy (CEG) and NextEra Energy (NEE). Constellation Energy has a market capitalization of $114.4 billion and an annual dividend yield of 0.42%. NextEra Energy has a market cap of $168.5 billion and offers an annual dividend yield of 2.8%. Even though these dividend yields are very different, both companies sit close to the center of the clean energy push and the growing need for reliable, large-scale power generation.

As investors try to balance dividend income with exposure to long-term growth in 2026, can these two utility giants deliver both dividend stability and capital appreciation in a market where electricity demand is no longer a slow-growth story? Let’s find out.

Dividend Stock #1: Constellation Energy Group (CEG)

Constellation Energy Group is a power producer and energy supplier that runs one of the largest emissions-free nuclear fleets in the United States. It also has other generation assets and a large commercial retail energy business that sells power and related products to customers across the country.

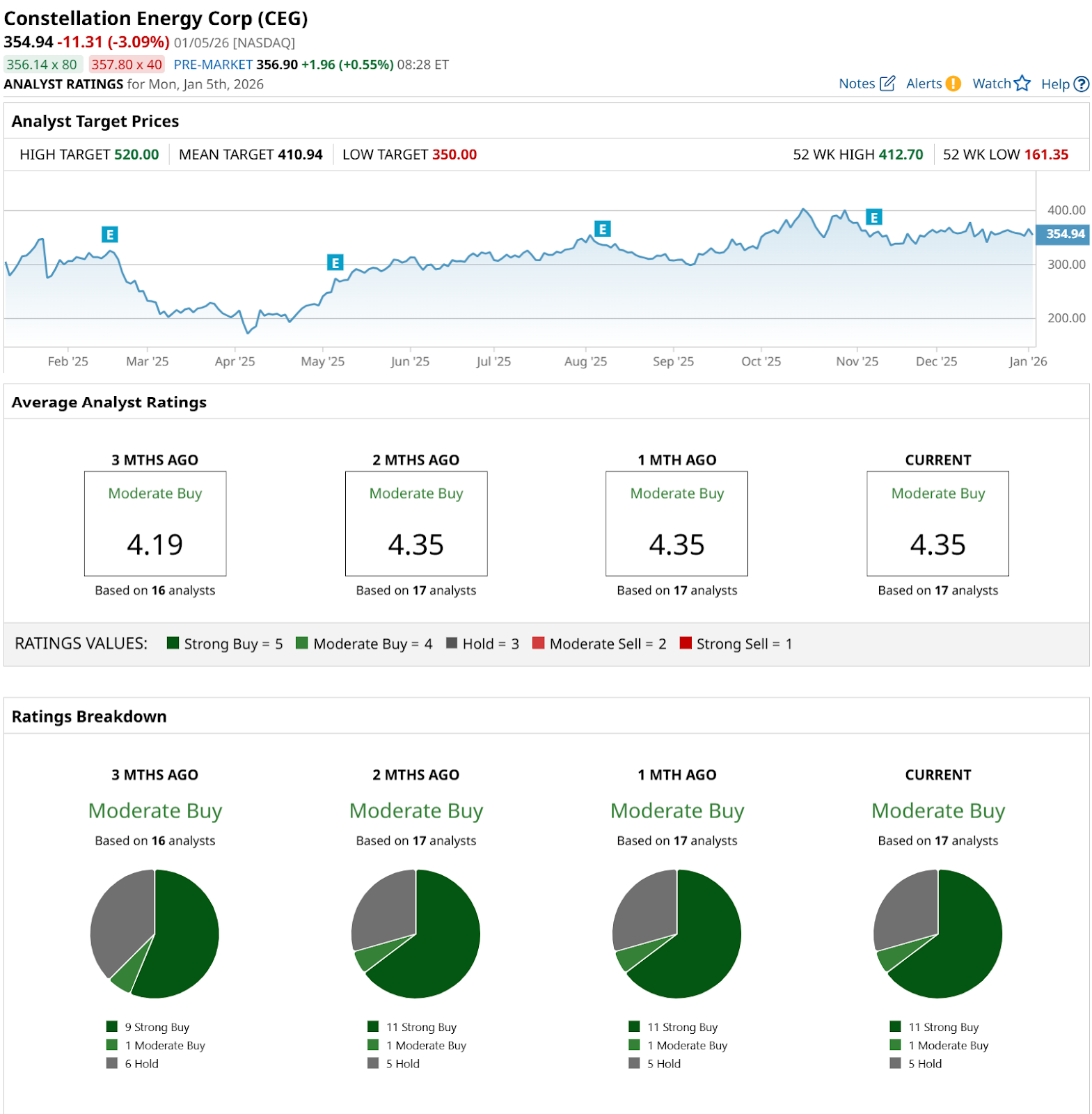

CEG stock has been strong over the past year, up 33% over the last 52 weeks, while it is down slightly year-to-date (YTD. That may appeal to 2026 buyers looking for a cleaner entry after a big run.

Even so, CEG stock is not “cheap” on valuation. The stock has a forward price-to-earnings ratio of 31.3 times, well above the sector, which suggests that investors are paying up for steadier earnings and growth tied to clean and reliable power.

The dividend supports the long-term income angle, even if the yield is small today. CEG yields about 0.42% annually, has raised its dividend for three-straight years, and has a modest forward payout ratio near 16% with quarterly payments. That leaves room to keep reinvesting while still building a growing income stream.

Operationally, the latest quarter helps explain why CEG stock commands a premium. Third-quarter 2025 GAAP earnings were $2.97 per share, while adjusted operating earnings increased to $3.04 from $2.74 a year earlier. Management tightened its full-year 2025 adjusted operating earnings guidance to between $9.05 and $9.45 per share.

Looking ahead, two developments stand out for 2026. The U.S. Department of Energy closed a $1 billion loan to support Constellation’s Crane Clean Energy Center restart, a project expected to add 835 megawatts (MWs). That should lower financing costs and strengthen the case for nuclear as dependable baseload power as data-center and AI demand rises.

Separately, Constellation’s work with GridBeyond to roll out AI-powered demand response in PJM is aimed at cutting peak-demand costs and improving grid flexibility. That becomes more valuable as reliability and capacity constraints get tighter.

Wall Street sentiment remains supportive. Analysts have a consensus “Moderate Buy" rating, and the average price target of $410.94 implies about 21% potential upside from current levels.

Dividend Stock #2: NextEra Energy (NEE)

NextEra Energy is a utility-and-infrastructure mix. The company's Florida Power & Light business delivers regulated, rate-based cash flows that support the company, while NextEra Energy Resources develops and runs renewables, storage, and other energy infrastructure across the United States.

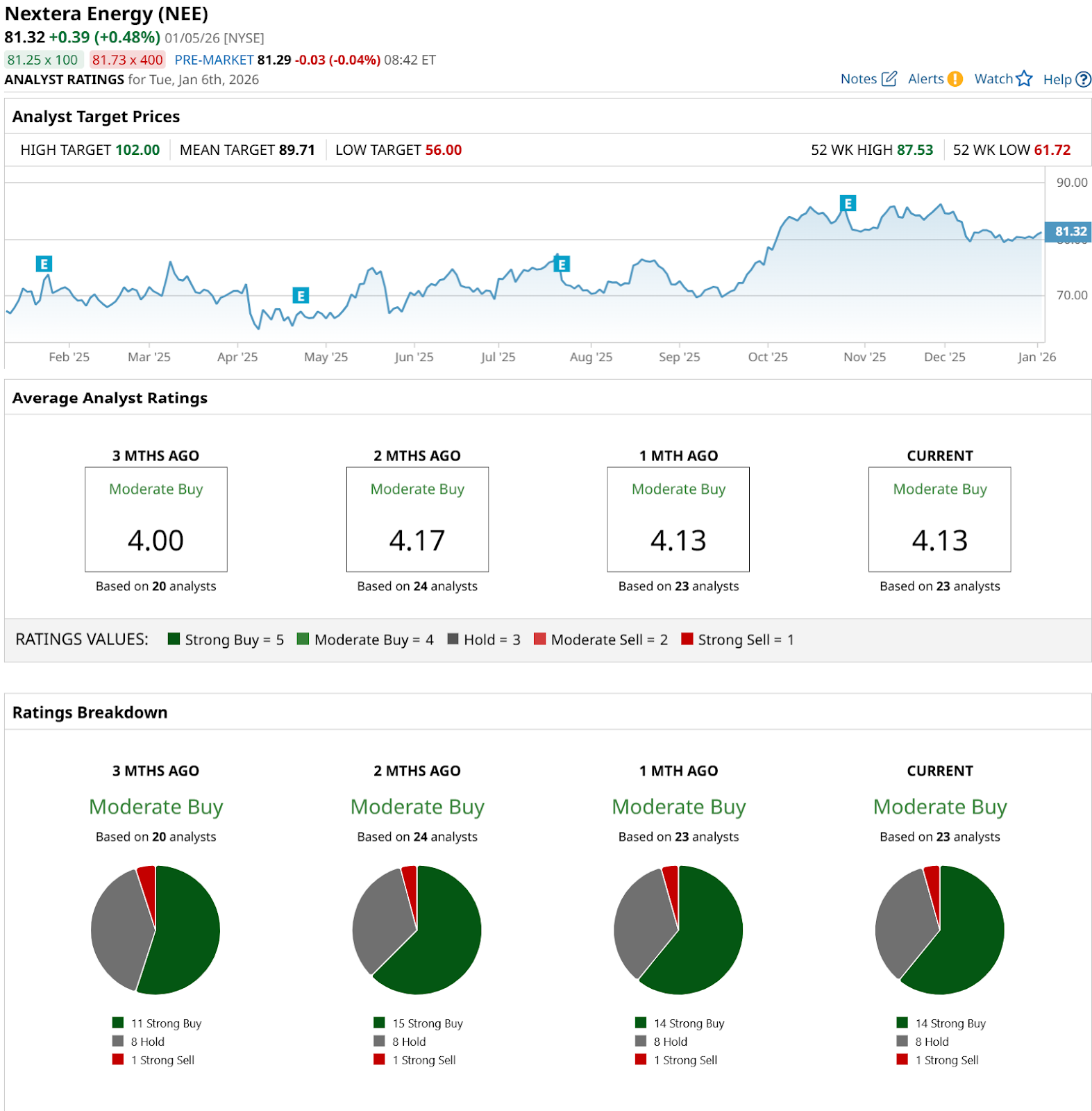

NEE stock is up 12% over the past 52 weeks, pointing to a steadier climb that may suit investors who value consistency over fast moves. That said, NEE is down about 2% YTD so far in 2026.

On valuation, NEE stock looks more like a higher-quality utility than a high-growth stock. Its forward earnings multiple of about 20 times is slightly above the sector's multiple, which suggests investors are willing to pay a small premium for NextEra’s growth outlook and track record.

The dividend plays a bigger role here than it does for CEG stock. NEE yields about 2.8%. The company has raised its dividend for 30 years, and pays quarterly, although its forward payout ratio near 60% means there is less flexibility than companies that pay out a smaller share of earnings.

Third-quarter 2025 results showed stronger profitability. GAAP net income attributable to NextEra came in at $2.44 billion, or $1.18 per share. That was up from $1.85 billion, or $0.90 per share, a year earlier. On an adjusted basis, earnings were $2.35 billion, or $1.13 per share, compared with $2.13 billion, or $1.03 per share, in the prior-year quarter. Growth also showed up in project activity, with NextEra Energy Resources adding 3 gigawatts of new renewables and storage origination to its backlog during the quarter.

Two late 2025 updates also support the 2026 outlook tied to rising electricity demand and grid reliability. NextEra expanded its partnership with Google Cloud to work on multiple new gigawatt-scale data center campuses along with the generation and capacity needed to support them. It also agreed to buy Symmetry Energy Solutions, a deal expected to close in Q1 2026, to build out natural gas supply, storage, and asset management capabilities that can complement renewables.

Analysts remain constructive, with a consensus “Moderate Buy” rating. The average price target of $89.71 implies about 14% potential upside from the current price.

Conclusion

For income investors staring down a very different power market in 2026, Constellation and NextEra look like the kind of names you buy to stay plugged into both rising demand and rising payouts. Together, they give exposure to nuclear baseload, renewables, and the AI/data-center buildout, with balance sheets and project backlogs that make their dividends look more like starting points than peak yields. Over the next few years — barring a sharp reset in rates or regulation — CEG and NEE shares seem more likely to grind higher than re-rate lower, with total returns driven by a blend of moderate multiple expansion, earnings growth, and steadily growing income.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)