The oil markets are once again driven by geopolitical matters. The renewed interest in the vulnerable oil production infrastructure and the threat of foreign investment are a reminder of the uncertainty that surrounds marginal sources of supply. Although such occurrences are newsworthy, they are seldom useful to the investment community. Capital moves to sources of sound production that can provide meaningful volumes of oil, generate cash flow regardless of price, and return the investment without fanfare.

This has played out in Cenovus Energy's (CVE) favor. It not only has strong heavy oil resources in the oil sands, but it also has a top-of-the-line refining business. Cenovus stands out in a sector where investors have come to pucker up and kiss the devil they know. The group now values consistency above speculation.

About Cenovus Energy Stock

Cenovus Energy is an integrated oil company with operations based in Calgary, Alberta, with a market cap of about $33 billion. With its upstream operations based in the Canadian Oil Sands properties of Foster Creek and Christina Lake, its downstream presence also includes refining capacity in the United States, making it a natural hedge against fluctuations in crude oil prices.

Shares have ranged from $10.23 to $18.75 within the past 52 weeks and had been sitting just above the middle price within the $16s recently. Though CVE has retreated a bit recently, it is certainly nowhere near its lows for 2024 and is doing quite well relative to numerous other large-cap energy issues. The current weakness in the shares is more a function of oil price stabilization.

Valuation-wise, Cenovus appears to be sound rather than fully extended. The current forward P/E ratio stands at 11.9x, with P/S at 0.74. The P/CF ratio just above 5.3x with P/B at 1.46 implies the market may very well be assigning a conservative multiple to an asset base producing strong free cash flows.

Debt/equity of 0.25 with interest coverage above 9x also keeps the balance sheet solid.

Cenovus Beats on Earnings and Execution

Cenovus’ third quarter in 2025 further solidified its place in the industry as a true execute-to-plan operator. The company produced $2.1 billion of cash from operations and $1.3 billion of free funds flow in the third quarter. Its adjusted funds flow also came in at $2.5 billion. From an operations perspective, the quarter was strong:

Our upstream segment set a new company record with 832,900 BOE/d of production, including a new company record 642,800 BOE/d of oil sands production. Our downstream segment also operated at a high level, with total crude runs of 710,700 barrels per day at 99 percent utilization. Our U.S. refining runs reached 605,300 barrels per day, while our Operating Costs Per Unit improved substantially both from the previous quarter and year ago.

At the same time, the company’s management emphasized the advancements made within a number of growth and optimization initiatives. The improvement project at Foster Creek has already been closed, with more pads set to become operational early in 2026. On the other hand, the West White Rose project is almost ready for start-up, with first oil production slated for the second quarter of 2026.

Cenovus also improved its financial position by completing the divestment of its 50% interest in WRB Refining for a net proceeds value of $1.8 billion. Shareholders again received priority in terms of capital return through the payment of $1.3 billion in buybacks and dividends.

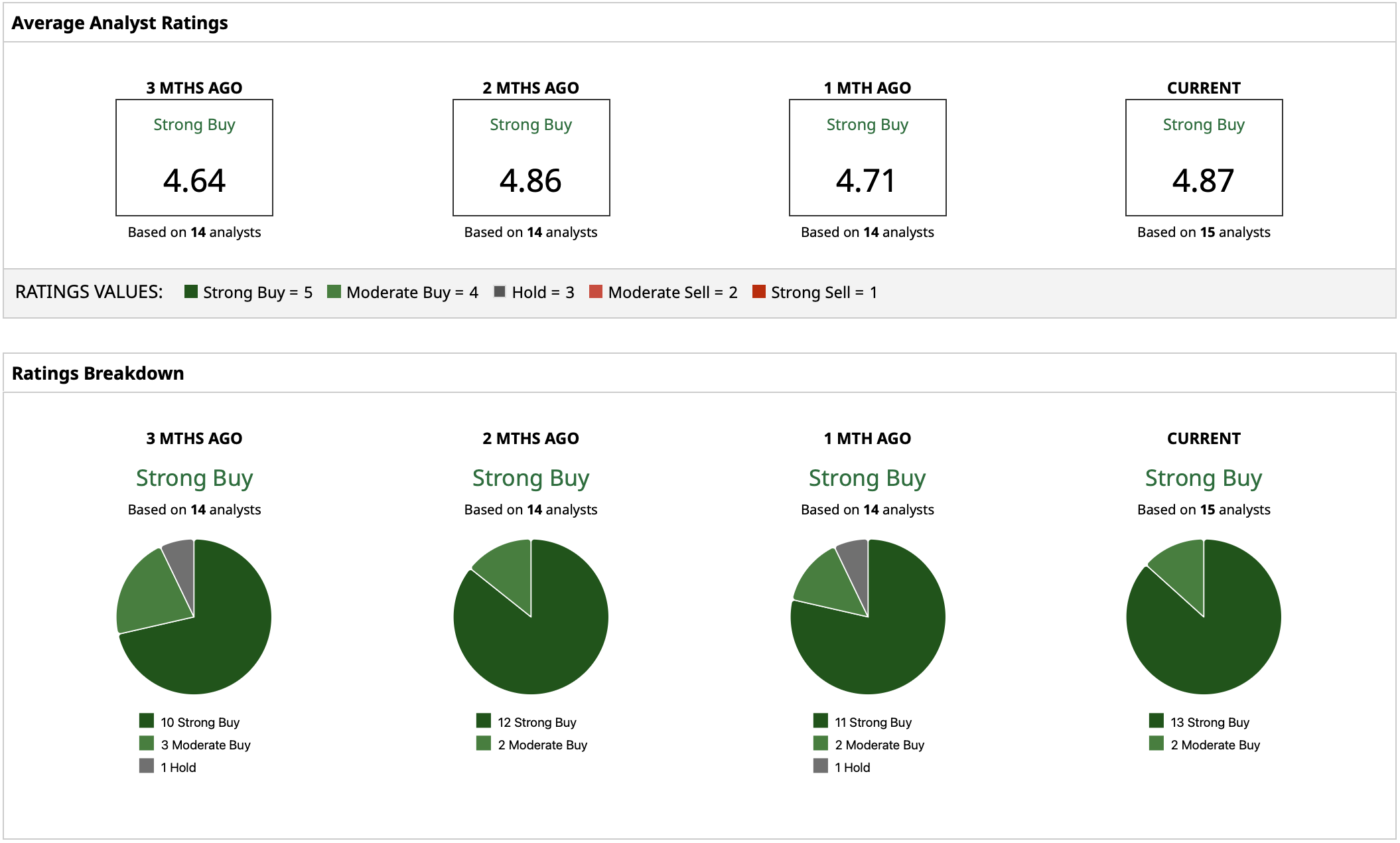

What Do Analysts Expect for CVE Energy Stock?

The outlook on CVE stock from Wall Street is still positive. In fact, analysts assign a “Strong Buy” rating consensus, and the current mean analyst price target for Cenovus is $20.74. Compared to current stock levels, the street’s mean target price could provide potential upside ranging from 28% on the current stock price. The street’s highest target price is $24.46, which could provide higher upside if the current oil prices harden. On the other hand, the lowest target price is approximately $13.60. Taken collectively, the analyst consensus is that Cenovus Energy is not priced for perfection. Rather, it seems situated as a stable compounder in the space, capable of rewarding shareholders through distributable cash flows, as well as upside if the macroeconomic environment cooperates.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)