/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

The internet offers nearly infinite information, and consumers are increasingly turning to search engines or generative artificial intelligence (AI) to find what they need. As traditional queries convert into AI generated answers, discoverability is shifting from links to citations.

In this new paradigm, Reddit (RDDT) consistently accounts for 20% to 40% of all citations, underscoring its growing authority. Against this backdrop, Needham analysts expect Reddit to emerge as a key beneficiary.

As users move away from clicking links and toward consuming AI-generated answers, overall referral traffic continues to shrink. Platforms cited within AI responses gain disproportionate value, positioning Reddit as a clear frontrunner.

Needham pointed to research from Pew, Semrush, and Similarweb to support this thesis. Studies found that Reddit was “cited in a majority of AI-generated responses,” alongside reduced clicks for search visits that included AI summaries.

Beyond discoverability, Reddit is also capturing upside through data licensing for large language model (LLM) training. Its content library includes 1 billion human-created posts and 16 billion comments accumulated over 18 years. Each day adds 1.2 million posts and 7.5 million comments, ensuring a continuously refreshed, high-value dataset.

That being said, as investors look ahead to identify the most compelling AI beneficiaries of 2026, Reddit stands out less as a speculative choice and more as a clear, front-of-mind contender.

About Reddit Stock

Headquartered in San Francisco, Reddit is a global, interest-driven platform built around subreddits. More than 100,000 active communities support authentic discussion across countless topics on the platform. With more than 100 million daily active users worldwide, Reddit sustains scale, engagement depth, and defensible network effects.

With a market capitalization of approximately $43.5 billion, RDDT shares have gained 42% over the past 52 weeks. Over six months, the stock has surged 48%, while the past month has delivered a 6% gain, signaling accelerating momentum.

Speaking of valuation, RDDT stock is currently trading at 99 times forward earnings and 34 times sales. These figures trade significantly above the industry averages, indicating a hefty premium.

Reddit Surpasses Q3 Earnings

On Oct. 30, Reddit reported third-quarter fiscal 2025 results that decisively beat the Street’s expectations. Revenue grew 68% year-over-year (YOY) to $584.9 million, topping analyst estimates of $550.4 million. EPS rose 400% from the year-ago value to $0.80, surpassing analyst estimates of $0.52.

Net income increased 443% to $163 million, while adjusted EBITDA rose 151% from the prior year’s quarter to nearly $236 million. Cash and equivalents rose to $911.7 million from $562.1 million on Dec. 31, 2024, enhancing balance-sheet durability.

The company delivered this outperformance through robust advertising growth, product-led user expansion, and meaningful profitability gains. Management improved the core Reddit product, drove higher engagement from new user cohorts, and successfully scaled new ad formats, creating sustained quarterly momentum.

Building on this strength, guidance surprised to the upside. Management expects fourth-quarter fiscal 2025 revenue of $655 million to $665 million and adjusted EBITDA of $275 million to $285 million, reinforcing confidence in continued execution.

On the other hand, analysts project Q4 fiscal 2025 EPS to gain 169% YOY to $0.97 and expect full-year fiscal 2025 earnings to jump 170% to $2.35. Fiscal year 2026 is expected to show further gains of 64% from the prior year to $3.86.

What Do Analysts Expect for Reddit Stock?

Needham reiterated a “Buy” rating with a $300 price target on RDDT stock, calling Reddit the best idea in 2026. The firm emphasized Reddit’s 100% human-created content, which enhances trust, authenticity, and long-term value to LLMs competing on answer quality.

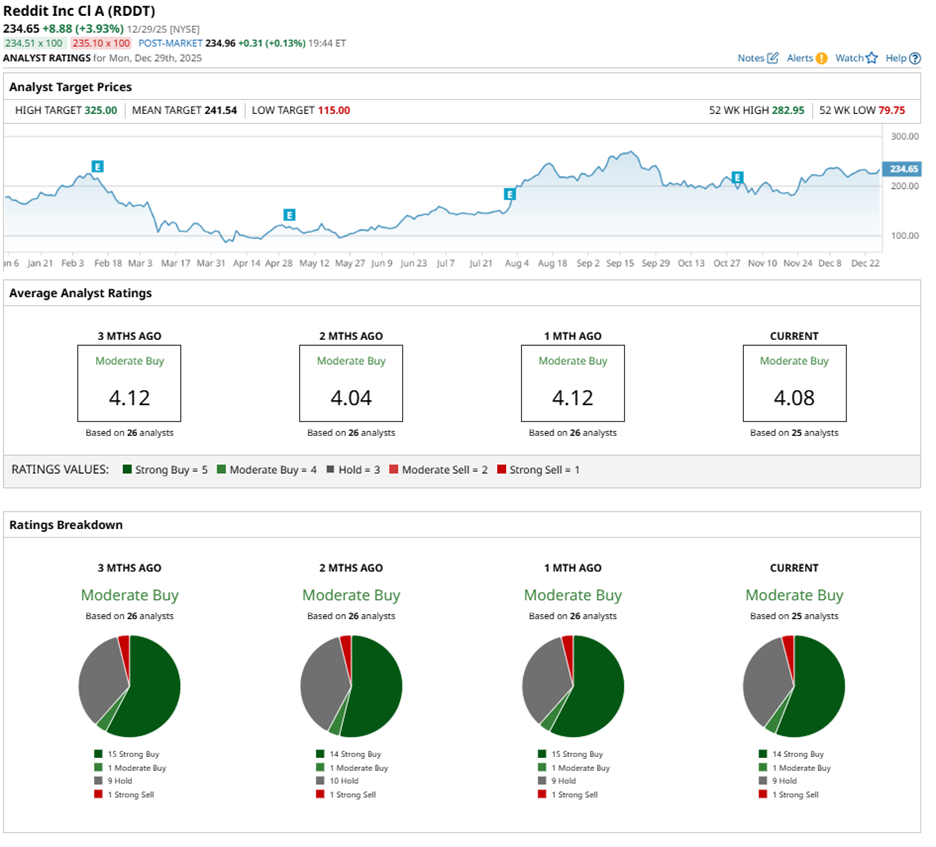

Wall Street continues to lean constructive with a “Moderate Buy” consensus rating. Among 25 analysts with coverage, 13 issue a “Strong Buy,” one assigns a “Moderate Buy,” 10 recommend a “Hold" rating, and one analyst has a “Strong Sell.”

The average price target of $241.54 implies a modest potential gain of 1% from current levels. Meanwhile, the Street-high target of $325 suggests potential upside of 36% from current price levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)