Corcept Therapeutics (CORT) crashed on Dec. 31 after the Food and Drug Administration (FDA) rejected its application for relacorilant, its investigational treatment for Cushing’s syndrome.

The agency’s Complete Response Letter cited insufficient data for conducting a favorable benefit-risk assessment, requiring additional evidence of effectiveness for the hypertension treatment in patients with hypercortisolism.

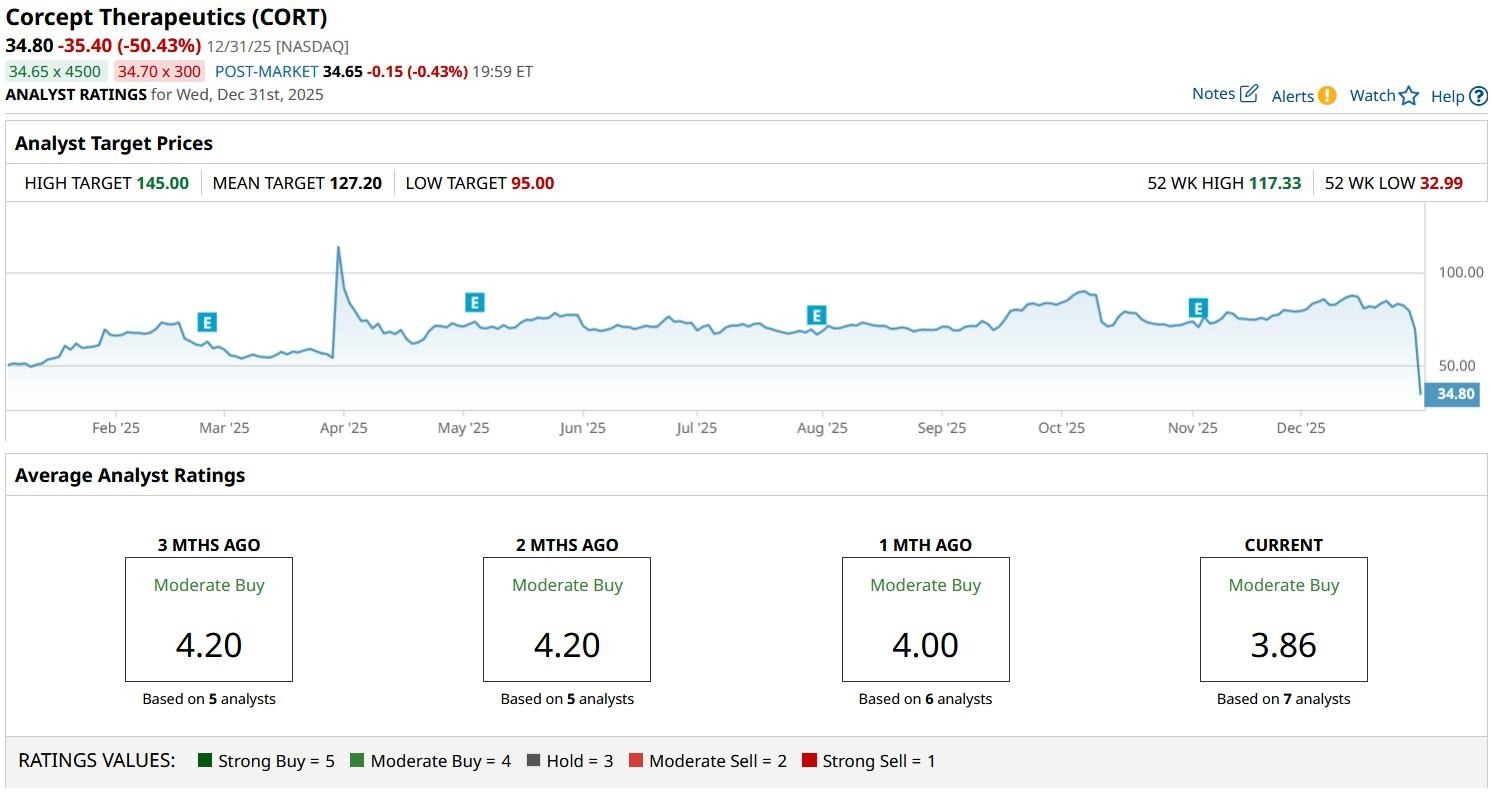

Following the nosedive on Wednesday, CORT stock is down some 70% versus its March high.

Why FDA Rejection Is a Major Setback for Corcept Stock

The relacorilant setback was particularly shocking because investors had expected approval based on positive phase 3 results, creating a massive disconnect between market expectations and reality.

FDA’s rejection strikes right at the core of Corcept’s growth strategy since relacorilant was widely expected to be the critical successor to diversify beyond its Korlym franchise.

Relacorilant represented a safer, more selective treatment with fewer side effects for Cushing’s, making it central to the biotech firm’s expansion and future revenue.

In short, the regulatory setback means significant uncertainty for Corcept shares, as the company will now have to conduct additional costly and time-consuming trials to address FDA’s concerns.

Is It Worth Buying CORT Shares on the Pullback?

FDA rejection has significantly tempered Corcept Therapeutics’ ability to rival Xeris Biopharma’s (XERS) competing “Recorlev” in the Cushing’s syndrome market.

In fact, the extended timeline will enable Recorlev to win a bigger chunk of that market that experts believe will triple from the current $1 billion through the end of this decade.

Meanwhile, technical setup isn’t any better for CORT shares either. At the time of writing, they’re trading decisively below their major moving averages (MAs), signaling continued weakness ahead

Note that insiders have predominantly unloaded the biotech stock in the trailing 12 months, which reinforces the bear case for Corcept Therapeutics heading into 2026.

How Wall Street Recommends Playing Corcept Therapeutics

Ahead of Dec. 31, Wall Street firms had a consensus “Moderate Buy” rating on Corcept stock with a mean target of about $127, indicating potential upside of about 80% on its previous close.

However, significant downward revisions on CORT shares are likely in the days ahead as analysts remove relacorilant from their financial models after the FDA setback.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)