Molina Healthcare (MOH) shares closed higher on Dec. 30 after Big Short investor Michael Burry said the managed care firm could be a takeover target in 2026.

In his latest Substack post, the hedge fund manager known best for correctly predicting the housing market crash of 2008 likened MOH to Warren Buffett’s transformational bet on Geico.

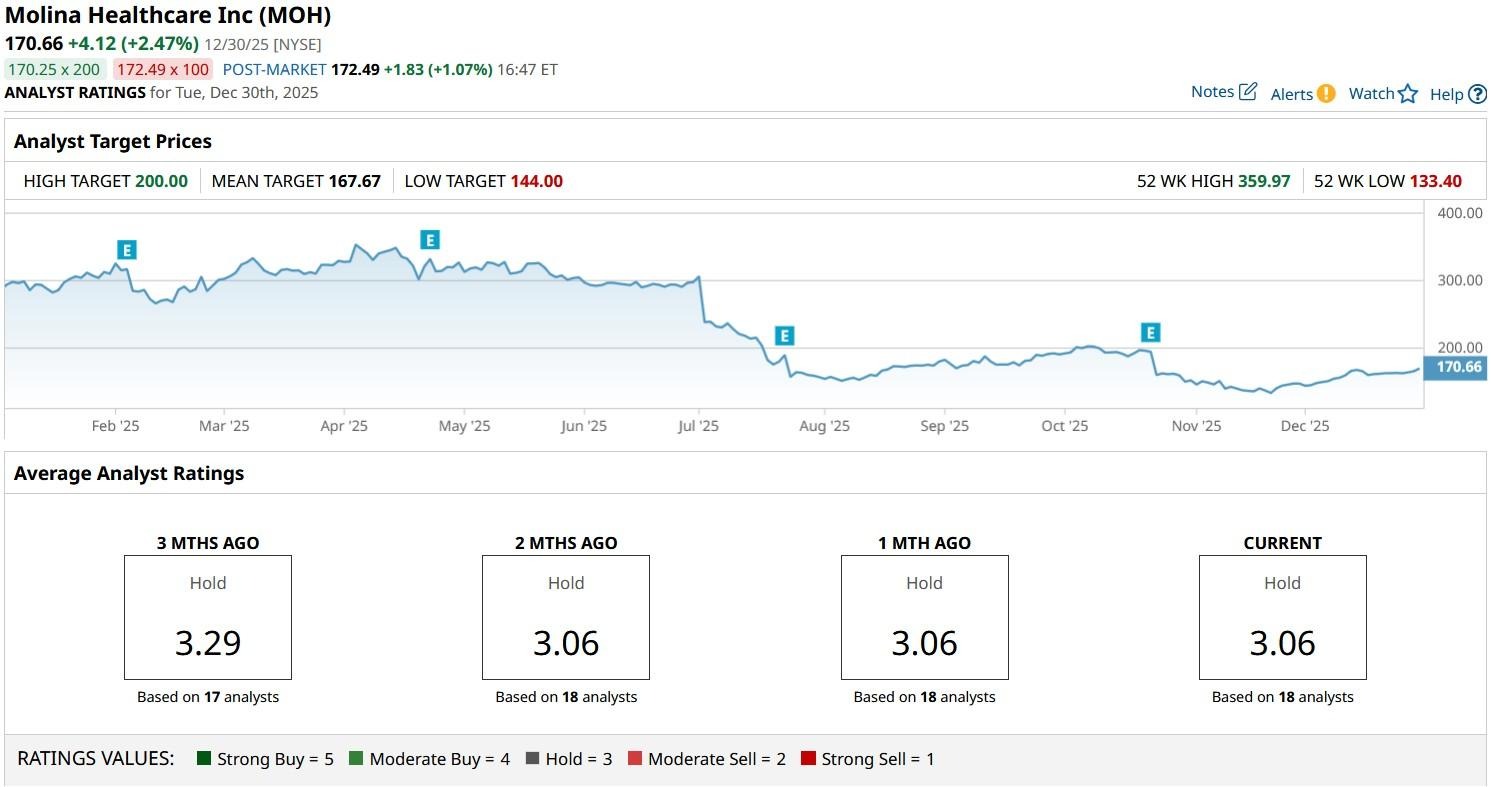

Despite Tuesday’s gain, Molina Healthcare stock is down roughly 50% versus its year-to-date high.

What Would a Takeover Mean for Molina Healthcare Stock?

Being a takeover target could prove largely positive for MOH shares in 2026 for several reasons.

For starters, it would validate the firm’s disciplined operations and profitability in Medicaid, which Burry dubbed “rare” in his online post.

This could help Molina Healthcare warrant a significant premium in a potential buyout deal.

Moreover, investors often worry about margin pressures in managed care. A larger parent company would provide scale, capital, and diversification, significantly reducing perceived risks.

On Tuesday, MOH pushed past its 100-day moving average (MA) as well, reinforcing that bullish momentum will likely sustain into 2026.

Can MOH Shares Rally Without a Buyout Deal>

Investors should also note that Molina Healthcare shares are strongly positioned to surge even if a takeover bid doesn’t materialize in 2026.

As Michael Burry put it, “MOH is looking to make money (albeit less money) in Medicaid in 2026, while most of its competition loses money,” which may prove sufficient for it to rally next year.

Additionally, the insurer’s decision to halt unprofitable ventures to focus on its core managed-care operations reflects commitment to sustainably boost its bottom line.

From a valuation perspective as well, the picture is just as attractive. Molina Healthcare is currently going for about 0.22x sales only, infinitely more attractive compared to its larger peers.

Unlike some of its rivals, however, MOH doesn’t currently pay a dividend.

How Wall Street Recommends Playing Molina Healthcare

Wall Street analysts are also convinced that MOH stock will rally further in 2026.

While the consensus rating on Molina Healthcare shares remains at “Hold” only, price objectives currently go as high as $200, indicating potential upside of another 18% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.