It has been a roller coaster ride for Lululemon (LULU) shareholders in 2025. At the beginning of the year, LULU stock traded at a 52-week high near $423. A sharp correction followed on growth deceleration and LULU stock touched a 52-week low near $159.

However, there has since been some revival and LULU stock now trades at $209, still lower by 45% for year-to-date (YTD). In terms of positive developments, it was reported on Dec. 18 that Elliott Investment Management holds a stake exceeding $1 billion in LULU. As one of the largest investors, the activist investor is pushing for a management change.

Furthermore, Lululemon founder Chip Wilson has also launched a proxy fight for a board shakeup. Wilson has nominated three independent directors to the company’s board. With the exit of CEO Calvin McDonald, the management rejig could potentially be a catalyst for LULU stock. Wilson has opined that Lululemon is “running out of time” on the back of escalating competition and loss of confidence among investors.

About Lululemon Stock

Lululemon is a technical athletic apparel, footwear, and accessories company. Currently, the company has a presence in 30 markets globally through its company-operated stores, seasonal stores, and e-commerce.

As of the third quarter of 2025, Lululemon reported 796 stores globally with revenue for the quarter at $2.6 billion. For the same period, diluted EPS was $2.59, which was lower by 9.8% on a year-over-year (YOY) basis.

Amidst intense competition and muted revenue growth, LULU stock has declined by 12% in the last six months. However, with the possibility of a management rejig coupled with expansion plans, there has been a recovery in LULU stock in the recent past.

Potential Catalysts for 2026

In Lululemon's Q3 results, the firm's Americas net revenue declined by 2%. However, international net revenue increased by 33%. Further, international comparable sales increased by 18%. So, it’s clear that global markets are a potential source of revenue acceleration.

Earlier this month, Lululemon announced expansion plans with stores to open in six new markets. These markets include Greece, Austria, Poland, Hungary, Romania, and India. These markets are likely to ensure that global growth acceleration sustains for the company.

A second potential growth trigger for Lululemon is the company’s plans for a new collection. Lululemon is currently developing a strong outerwear collection. This will provide the company with a differentiating factor amidst competition and support revenue growth. At the same time, there is a likelihood of an improvement in profitability.

Of course, there is an impending CEO succession that is likely to have a significant impact on value creation in 2026 and beyond. It’s worth noting that Elliott Investment Management has been working with former Ralph Lauren (RL) executive, Jane Nielsen, for the CEO role. Needham analyst Tom Nikic believes that Nielsen would be an “extremely strong candidate” for the role.

From a financial perspective, Lululemon ended Q3 2025 with a cash buffer of $1 billion. The company also had an undrawn credit facility of $593 million. A liquidity buffer of $1.6 billion will also help ensure ample flexibility to invest in international expansion and product innovation. Also, for the first nine months of 2025, the company reported operating cash flow of about $460 million, which adds to the financial strength.

What Analysts Say About LULU Stock

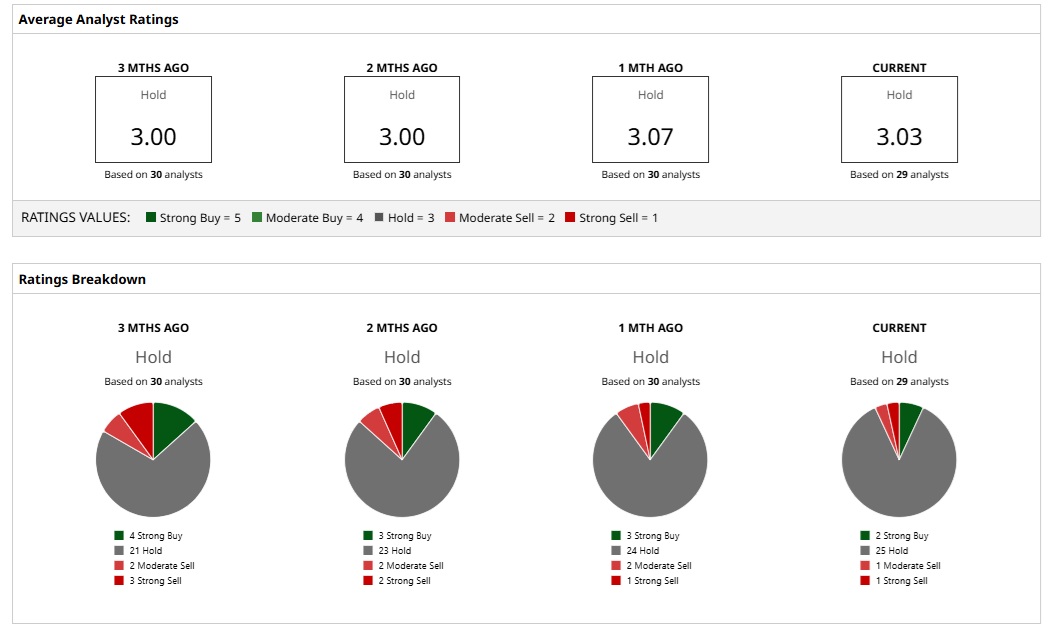

Based on the ratings of 29 analysts, LULU stock is a consensus “Hold.” While two analysts assign a “Strong Buy” rating to LULU, 25 analysts have “Hold” ratings and one analyst has a “Moderate Sell” rating. Further, one analyst has a “Strong Sell” rating on the stock.

Based on these ratings, analysts have a mean price target of $205 currently, which would imply a downside potential of 2%. However, with the most bullish price target of $303, the upside potential for LULU stock is 45%.

It’s worth noting that LULU trades at a forward price-earnings ratio of 16.25. Valuations seem attractive if there is a turnaround in terms of top-line growth acceleration coupled with EPS growth. Factoring in the leadership change and Lululemon's international expansion efforts, the outlook seems positive for LULU after a deep correction year-to-date.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.