Retail giant Target Corporation (TGT) now finds itself under activist scrutiny after a sharp sales slowdown erased a substantial portion of shareholder value this year. The pressure intensified after reports revealed activist hedge fund Toms Capital Investment Management (TCIM) built a meaningful stake, signaling rising impatience with prolonged underperformance.

While the exact size of TCIM’s holding remains undisclosed, its involvement alone carries weight. The fund recently invested in Kenvue (KVUE) ahead of its $48.7 billion sale to Kimberly-Clark Corporation (KMB), underscoring its history of pushing for strategic change.

The development compounds an existing strain on the retailer, which has lagged peers for months. Although shares climbed 3.1% following the news on Friday, Dec. 26, the stock has still lost more than 27.56% year-to-date (YTD). The decline reflects three consecutive quarters of falling comparable sales, underscoring structural challenges.

Moreover, Target appointed veteran executive Michael Fiddelke in August to restart growth against stretched household budgets and tariff uncertainties, indicating that execution, not demand, now defines the recovery route. In light of this, investors might have to reconsider whether the current backdrop warrants caution or patience.

About Target Stock

Headquartered in Minneapolis, Minnesota, Target operates as a nationwide general merchandise retailer spanning apparel, beauty, groceries, electronics, home goods, and everyday essentials. The company pairs physical stores with a robust digital platform, leaning on exclusive brands, in-store services, and a broad, value-focused assortment.

With a market cap of nearly $45.1 billion, Target’s scale remains an advantage. Yet performance has lagged. Over the past 52 weeks, the stock's decline highlights persistent headwinds. Notably, momentum has improved recently, with shares gaining 8.06% over the past month.

Valuation reflects skepticism as TGT stock is currently trading at 13.23 times forward adjusted earnings and 0.43 times sales, both at discounts to industry averages and the company’s own five-year multiples. The gap implies the market demands evidence of durable growth before rerating the stock.

Target’s dividend history provides stability but not immunity. As a Dividend King, the company has raised payouts for 57 consecutive years. It pays $4.56 annually, yielding 4.58%, with the latest $1.14 dividend paid on Dec. 1 to shareholders of record on Nov. 12. However, yield alone cannot offset operational risk.

A Closer Look at Target’s Q3 Earnings

On Nov. 19, Target reported Q3 fiscal 2025 results that topped expectations, yet shares fell 2.8%. Revenue declined 1.6% year-over-year (YOY) to $25.27 billion, roughly matching analyst estimates of $25.32 billion. Adjusted EPS fell 3.8% to $1.78 but beat the Street’s forecast of $1.71.

Management attributed softness to cautious consumer spending and weaker discretionary demand in categories like home and apparel, areas historically critical to Target’s profitability mix.

CEO Brian Cornell acknowledged the issue directly, stating the business “has not been performing up to its potential over the last few years.” Management emphasized merchandising improvements and elevated in-store and digital experiences, while noting progress in food, beverage, and fulfillment remains uneven.

Looking ahead, Target’s guidance stays conservative. For Q4 fiscal 2025, management expects a low-single-digit sales decline, signaling continued demand restraint. Full-year GAAP EPS should land between $7.70 and $8.70, while adjusted EPS, excluding one-time items, should range from $7 to $8.

Street forecasts reinforce the mixed outlook. Analysts project current quarter fiscal 2026 EPS to drop 10.4% YOY to $2.16 and expect full-year fiscal 2025 earnings to fall 17.7% to $7.29. Fiscal year 2026 is expected to rebound modestly, with EPS rising 6% to $7.73.

What Do Analysts Expect for Target Stock?

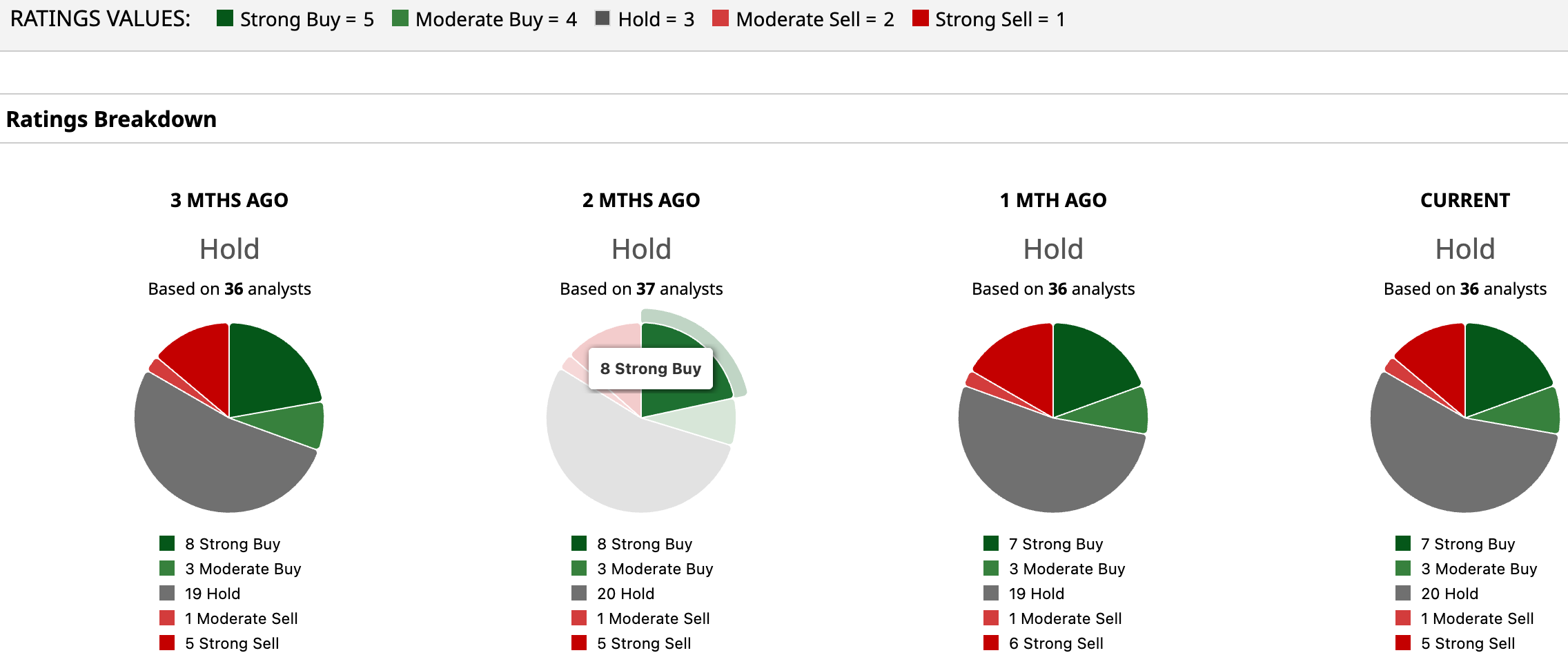

Wall Street remains cautious with a “Hold” consensus rating. Among the 36 analysts covering the stock, seven rate the stock “Strong Buy,” three say “Moderate Buy,” 20 recommend “Hold,” one assigns “Moderate Sell,” and five rate it “Strong Sell,” reflecting deep division on turnaround timing and durability.

The average price target of $100.41 implies marginal upside, while the Street-high target of $135 suggests potential upside of 37.66% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cisco%20Systems%2C%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)