Viking Therapeutics (VKTX) may be flying under the radar, but it could soon become one of the most closely watched biotech stories heading into 2026. It is a high-risk, high-reward biotech company trying to build the next generation of obesity treatments. Over the past year, the company has made significant strides in advancing its lead obesity treatment, VK2735, while strengthening its clinical pipeline and positioning its balance sheet to support multiple future catalysts.

Let’s find out if it is a good time to buy the stock before the year ends.

Viking's Solid Progress and Financials

Valued at $4.2 billion, Viking Therapeutics is a clinical-stage biotechnology company that focuses on developing medicines for metabolic and endocrine diseases, with its biggest emphasis right now on obesity treatment. Viking’s lead drug, VK2735, is a dual agonist targeting the GLP-1 and GIP receptors, two pathways that have reshaped the obesity treatment landscape. Viking is uniquely advancing both subcutaneous and oral tablet formulations of the same molecule, a strategy that could reduce safety risks when patients transition between dosing methods.

Recent clinical data has been highly encouraging, leaving Wall Street optimistic about the stock. In a Phase 2 oral dosage study, patients using VK2735 lost statistically significant and progressive weight over 13 weeks, with reductions reaching double-digit percentages at higher doses. Importantly, the medication was generally well tolerated, with the majority of adverse events classified as mild or moderate, and gastrointestinal problems gradually decreased.

Viking has already pushed VK2735 to Phase 3 development through the Vanquish Registration Program. These large-scale trials are looking at weekly subcutaneous dosage in both obese individuals and those with Type 2 diabetes. The company intends to complete enrollment in one study by the end of this year and the second in early 2026.

Simultaneously, Viking is exploring innovative maintenance strategies, including monthly injections and oral dosing regimens designed to help patients sustain weight loss. Results from these maintenance studies are due by mid-2026, which might be a turning point for the stock. Because Viking is still in clinical trials, the company currently generates no commercial revenue and spends heavily on research and development. Rising R&D expenses have driven a heavier net loss of $90.8 million compared to $24.9 million the year before, but those costs reflect aggressive investment in late-stage trials and manufacturing rather than operational weakness.

But the company’s financial position remains strong. At the end of Q3, it had $715 million in cash, cash equivalents, and short-term investments. This sizable war chest is expected to fund its Phase 3 trials and continued pipeline development without immediate financing pressure.

Why 2026 Could Be Pivotal

Looking ahead, 2026 could be a defining year for Viking Therapeutics. Key catalysts include Phase 3 enrollment milestones, regulatory discussions with the FDA for the oral formulation, publication of clinical data in leading medical journals, and readouts from maintenance dosing studies. Together, these events could significantly reshape the company’s long-term potential.

For investors willing to tolerate the volatility associated with a clinical-stage biotech, Viking is a small but increasingly powerful contender in one of healthcare’s fastest-growing markets. If its momentum continues, this under-the-radar stock could deliver some big surprises in 2026.

What Does Wall Street Say About VKTX Stock?

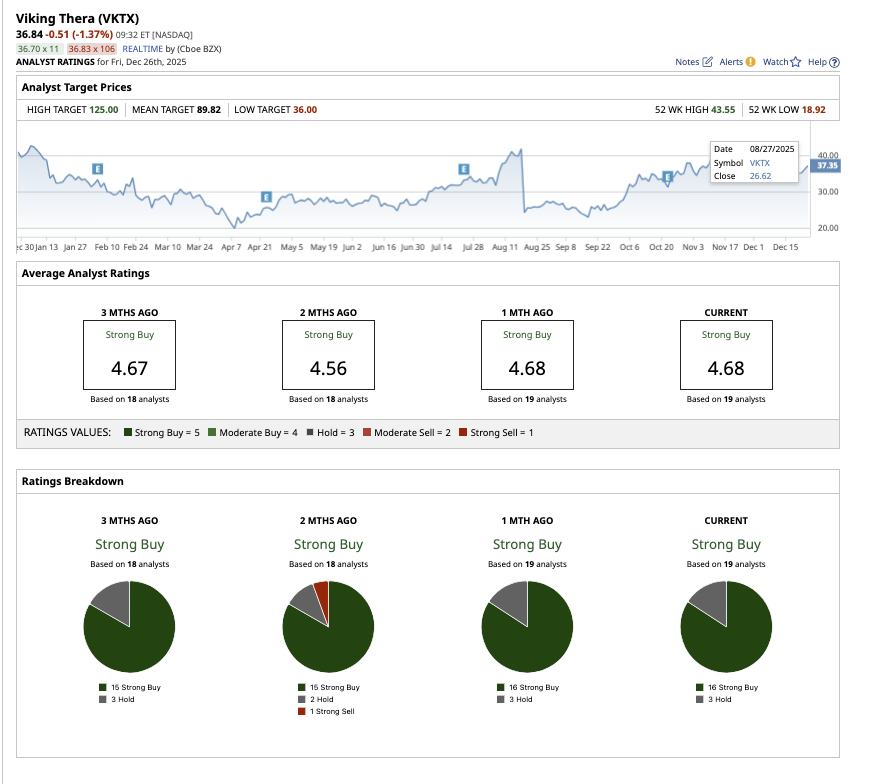

On Wall Street, overall, VKTX stock is a consensus “Strong Buy.” Out of the 19 analysts that cover the stock, 16 rate it a “Strong Buy,” and three rate it a “Hold.”

Viking stock is down 9% year-to-date (YTD), compared to the broader market gain. Nonetheless, the average target price of $89.82 suggests analysts predict an upside potential of 141% above current levels. The high price estimate of $125 implies 235% upside over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)