/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Wedbush analysts, led by Dan Ives, believe that software company Palantir Technologies (PLTR) will continue to build on its commercial success in 2026 and could be a leader among software names in the artificial intelligence (AI) revolution.

The company’s expected success is based on its Artificial Intelligence Platform (AIP), which has gained significant popularity since its launch. Wedbush analysts also see Palantir hitting a $1 trillion valuation over the next two to three years.

Given this bullish outlook, we take a deeper look at Palantir.

About Palantir Stock

Based in Denver, Colorado, Palantir focuses on big data analytics platforms serving both government agencies and businesses. It unifies disparate data streams to enable real-time decisions in areas such as national security and corporate processes. Key offerings encompass Gotham for public-sector analysis, Foundry for business data management, and Apollo for deployment.

A significant advancement, the AIP, links large language models to secure operational datasets. AIP drives AI applications in demanding fields such as healthcare and industry by integrating generative AI with practical execution. The company has a market capitalization of $460.91 billion.

The stock has been trading higher as the company’s commercial operations continue to expand. Moreover, Palantir has been in the spotlight amid strong demand for AI. Over the past 52 weeks, the stock has gained 140.82%, and over the past six months, 41.28%. It had reached a 52-week high of $207.52 on Nov. 3, but is down 7% from that level.

Palantir’s stock has been trading at a stretched valuation. Its price-to-earnings ratio sits at 447.92x, considerably higher than the industry average of 31.09x.

Palantir’s Third-Quarter Results Were Above Expectations

Palantir reported a successful third quarter, closing 204 deals of at least $1 billion, 53 of which were valued at least $10 billion. The company’s financials were also better than Wall Street expected. Its total revenues increased 63% year-over-year (YOY) to $1.18 billion, exceeding the $1.09 billion Wall Street analysts expected. Excluding strategic commercial contracts, Palantir’s revenue rose 65% YOY.

Palantir’s commercial operations are expanding at a robust pace. Its total commercial customer count increased by 49% YOY, while the U.S. commercial customer count grew 65% annually. Commercial revenue increased 73% YOY, well above the 55% growth reported by the government segment.

Palantir’s top line gains are also creating profitability expansion. The company’s adjusted operating income grew 118% YOY to $600.54 million, representing 51% of adjusted operating margin. Based on this and the revenue growth, Palantir reported a 114% rule of 40 score. Its adjusted EPS of $0.21 exceeded the $0.17 analysts expected.

What Do Analysts Think About Palantir Stock?

Following Palantir’s third-quarter earnings release, numerous analysts have reiterated their views on the company’s stock. Analysts at UBS maintained a “Neutral” rating on the stock. However, they also raised the price target from $165 to $205. Despite the neutral stance, UBS analysts highlighted an earnings beat, accelerating revenue growth, and its commercial contract value and bookings.

Goldman Sachs analysts also maintained a “Neutral” rating. Still, they raised the price target to $188, noting that Palantir is among the few software companies benefiting from AI deployments. Goldman analysts noted the company’s larger deal sizes and higher revenue per customer.

Contrary to this neutral stance, there are some differing opinions on Palantir. After the Q3 results, analysts at RBC Capital maintained an “Underperform” rating on its shares. However, they also raised the price target from $45 to $50.

Wall Street analysts are robustly optimistic about Palantir’s future earnings. They expect the company’s EPS to climb by 1,800% YOY to $0.17 for the current quarter. For the current fiscal year, EPS is projected to surge 550% annually to $0.52, followed by a 51.9% growth to $0.79 in the next fiscal year.

While RBC Capital analysts acknowledged Palantir’s growth, they also noted that results remain U.S.-centric and future profitability has limited visibility once AIP deployments mature and normalize. On the opposite side of the spectrum, analysts at Piper Sandler maintained coverage of Palantir’s stock with a bullish “Overweight” rating.

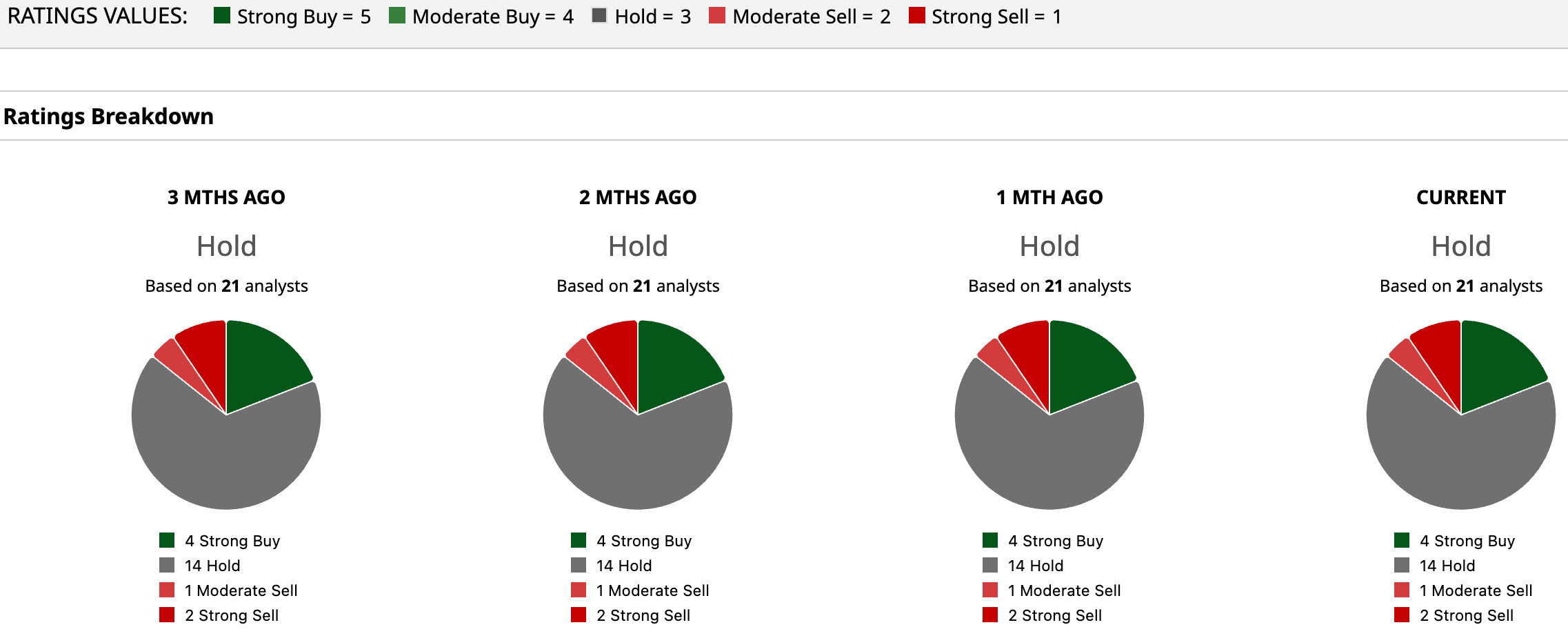

Wall Street analysts are taking a cautious stance on Palantir’s stock now, with a consensus “Hold” rating overall. Of the 21 analysts rating the stock, four analysts gave a “Strong Buy” rating, while a majority of 14 analysts are playing it safe with a “Hold” rating, one analyst gave a “Moderate Sell” rating, and two analysts gave a “Strong Sell” rating. The consensus price target of $193.67 represents a marginal downside from current levels. However, the Street-high price target of $255 indicates a 31.7% upside from current levels.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)