/Facebook%20on%20a%20phone%20by%20Firmbee_com%20via%20Unsplash.jpg)

Meta Platforms (META) is among the most-watched mega-cap tech stocks in the market, and for good reason. The company's core social media empire, which started with Facebook and has since expanded to include Instagram, WhatsApp, and Messenger, now has more than 3.5 billion daily active users across all of its networks.

Over the decades, the company has monetized these eyeballs to an incredible extent, now generating incredible profits and cash flow that the company piles into its other high-growth initiatives. Of late, that spending has materially shifted from tens of billions of dollars a quarter on its Reality Labs division (its metaverse efforts) to Meta's growing artificial intelligence portfolio.

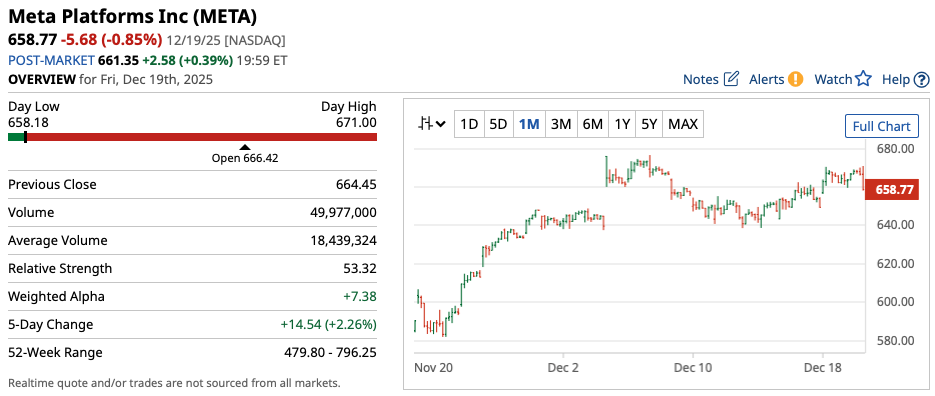

Recent headlines around Meta's potential unveiling of its new Mango artificial intelligence model alongside its Avocado model could propel significant future growth, and investors appear to like what they see (see chart above). Let's dive into why this video-focused AI model could be the future and what investors may want to think about when it comes to this tech giant's fundamentals moving forward.

What's All the Hype About?

Meta's new Mango platform brings about another fruit-named AI model to the mix, this time focusing on video content creation, something that could bolster the company's Reels and Instagram Stories profit drivers. The integration of application-specific models is something we're seeing ramp up, and Meta appears to be intent on utilizing AI to boost its profits directly. Allowing consumers to produce more content with the help of AI across its social media platforms is a use case that certainly makes sense. This launch, in combination with Avocado (which should make coding easier for the company's existing tech talent), could lead to a double whammy of a surge in content with less headcount. Those are the kinds of efficiencies Meta hopes can drive significant margin and valuation multiple expansion over time.

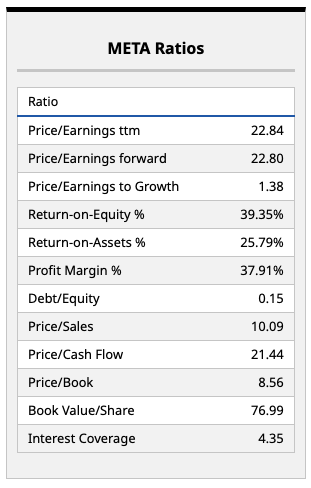

Looking at Meta's overall profit margin of nearly 38%, a hefty number for any tech company of its size, the company is clearly doing a lot right. With a price/cash flow ratio of just 21 times, investors can achieve a free cash flow yield of nearly 5% on this stock, which is certainly healthy. This, in addition to a petite dividend yield of around 0.3% at the time of writing, is more than the yield on fixed-income securities. In combination with some solid price appreciation expected in the years to come (I'll get into analyst price predictions below), META stock could be a very profitable bet right here.

I think the company's forward price-earnings multiple of just 22 times is reasonable given Meta's expected growth boost due to its AI integrations and, specifically, the margin- and efficiency-boosting nature of these launches. Of course, a lot of this stock's future upside will ultimately come down to how these launches are viewed by the public, and the jury is out on that front. But for now, I think Meta's recent dip, attributed to concerns around absolute levels of AI spending, could be alleviated if investors see the kind of upside Meta's management team is expecting to highlight next year.

What Do Analysts Think of META Stock Here?

The 55 Wall Street analysts covering Meta give this stock top grades, expecting META stock to hit an average of somewhere around $840 per share next year.

Impressively, the high target on the Street pegs META stock at $1,117 per share in a year to 18 months down the line. That would imply upside of around 70% from here, with the consensus target around $840 per share still implying more than 27% upside over the next year.

I don't think these price targets are too aggressive at all. In fact, this is a top stock on my watch list for 2026 as a potential AI winner. Given the company's strong underlying cash flow generation profile and its growth prospects tied to these new AI model releases, I think there's a lot to like about how Meta is valued currently.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)