The TTM Squeeze is a powerful volatility indicator that identifies periods of low volatility and anticipates potential breakouts. However, it can also sometimes indicate periods of indecision and a lack of conviction.

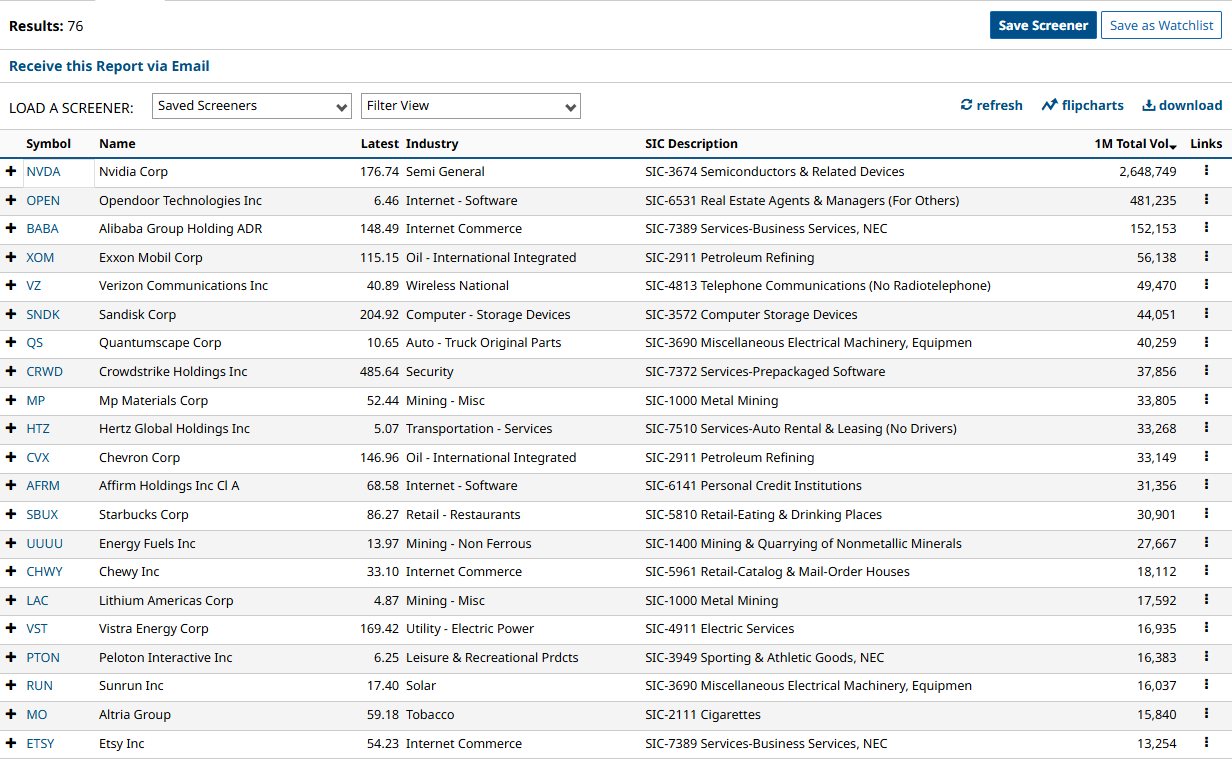

Pulling up today's results from Barchart's investing ideas page, TTM Squeeze Triggered, highlights exactly this mood in the market. This list represents squeeze candidates whose Bollinger Bands are compressed within their Keltner Bands.

The screen applied below filters the results to show only those stocks with an active options market. The results show a mixed bag of sectors and industries just inside the top 10: semiconductors; software; oil, communications; autos; cybersecurity; and mining stocks.

But what I found particularly interesting is that their charts look eerily similar – i.e., there’s a recent top, a minor drawback, and a period of considerable consolidation.

Utilizing Barchart's TTM Squeeze Chart Template, the technical trader will also notice that many of these stocks are also trading at or below their intermediate exponential moving averages, such as the 34-day EMA.

This could indicate two potential outcomes. The broader market is waiting for a new catalyst to propel prices out of the current range, and recent activity is leaning toward a move to the downside. However, assumptions are dangerous in trading, and only a "firing" of the TTM Squeeze indicator can confirm a new period of volatility (in other words, directional movement).

But what this indicator is telling me currently is that it’s not yet the time to commit new capital to the market, and sitting on my hands might be the best trading plan right now.

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)