/A%20concept%20image%20of%20a%20self-driving%20car%20image%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

WeRide (WRD) is a global autonomous driving company focused on Level 2 to Level 4 technologies across robotaxis, robobuses, robovans, and robosweepers. The company looks to make urban mobility safer, greener, and more efficient by deploying driverless solutions in mobility, logistics, and sanitation and is recognized as one of the first commercial-scale robotaxi players worldwide. Operating in more than 30 cities, its autonomous vehicles have been tested/operated across 11 countries, including China, Singapore, the United States, Switzerland, and more.

Founded in 2017, the company is headquartered in Guangzhou, China.

WeRide Stock Performance

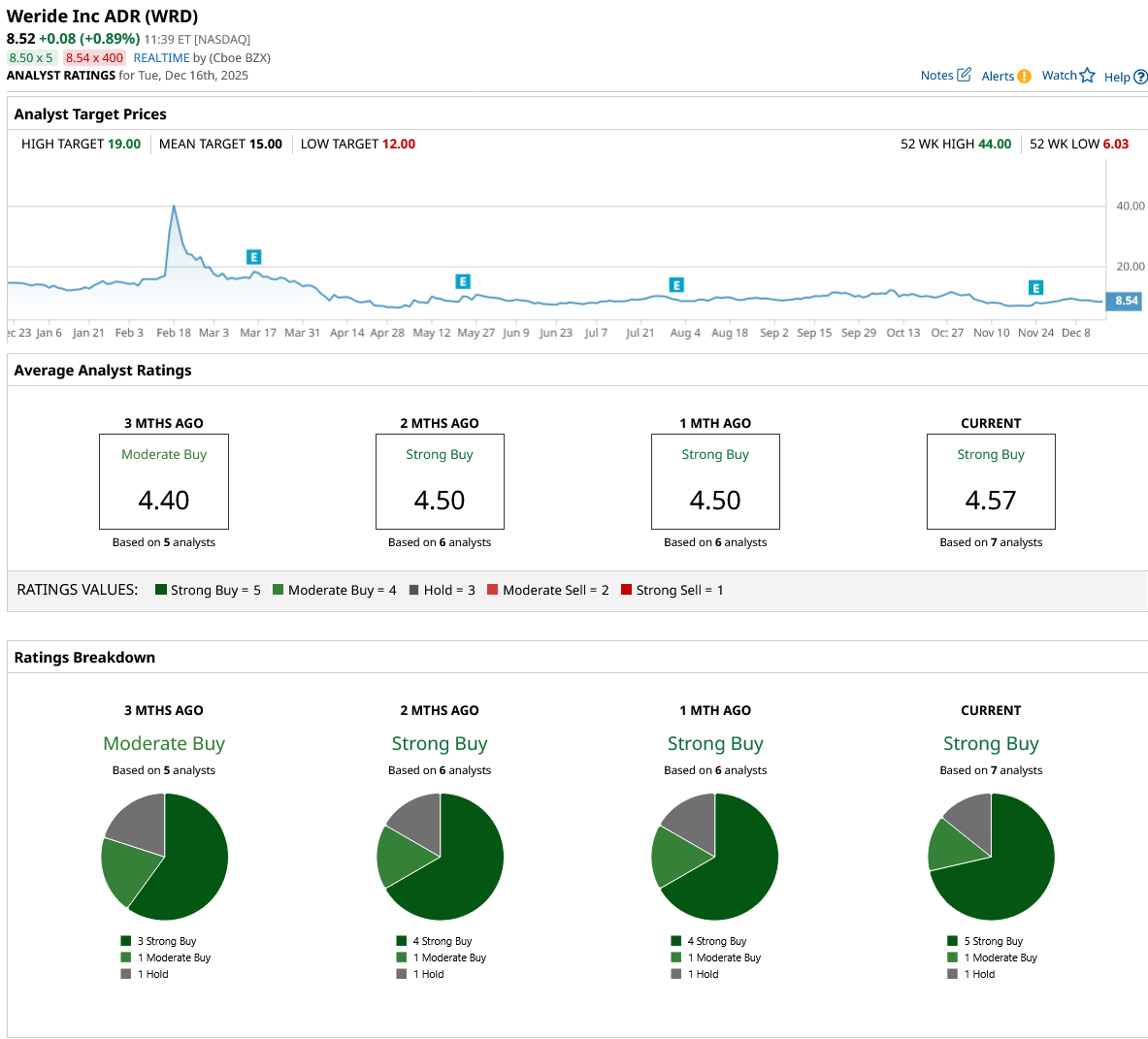

WeRide trades near its 52-week low of $6.03 after multiple sharp corrections post speculative highs. Over the last five days, the stock has declined by 4%, but over the past month, it has improved by an impressive 21% as investors react to its third-quarter results and strong commercial growth numbers.

On the year-to-date (YTD) timeframe, WeRide again turns negative, slipping close to 40% while being 80% below its 52-week high set in February this year. WRD remains deeply negative and far worse than the modestly positive performance of the Nasdaq Composite ($NASX) over the same period.

WeRide’s Successful Q3 Results

WeRide reported Q3 2025 results on Nov. 24 with revenue of about $56–$57 million, up roughly 140–145% year-over-year (YoY) and well ahead of analyst estimates around $50 million, driven by rapid growth in robotaxi, robobus, and robovan deployments. Adjusted EPS remained negative but improved versus expectations, with a narrower loss per share than the Street anticipated as operating leverage began to kick in on higher volumes.

Gross margin expanded to 33%, up from 6.5% a year ago, as software, autonomous driving services, and higher fleet utilization drove gross profit to $56 million, a 1,124% increase, with service revenue surpassing products at RMB 92 million ($13 million). The company posted an operating loss amid heavy R&D spending totaling RMB 318 million ($45 million) but narrowed its net loss 71% to RMB 307 million ($44 million). Cash reserves stood robust at RMB 4.5 billion ($600 million) plus RMB 926 million ($132 million) in wealth management products, supporting expansions. Free cash flow remained negative but improved with better unit economics.

For Q4 2025, WeRide guided continued double-digit sequential revenue growth via new launches in the Middle East and Asia, targeting 500 robotaxis in the region by 2026. Investments in tech, safety, and compliance will constrain near-term profitability, prioritizing contribution margins over net income; medium-term breakeven remains on track as mobility-as-a-service scales to tens of thousands of vehicles by 2030.

WeRide and Uber Partner in Dubai

WeRide has launched robotaxi passenger rides in Dubai through a strategic partnership with Uber (UBER) and Dubai’s Roads and Transport Authority (RTA). Starting immediately, users in high-traffic tourist hubs like Umm Suqeim and Jumeirah, which are prime spots near public beaches, can hail WeRide’s advanced autonomous vehicles directly via the Uber app’s “Autonomous” booking option. Local operator Tawasul oversees the fleet, ensuring seamless integration and management of WeRide’s cutting-edge robotaxis.

This rollout builds on a successful pilot and rigorous testing initiated after the April partnership reveal, marking a key commercial milestone for WeRide’s Level 4 technology. Currently, rides feature an on-board vehicle specialist to prioritize safety and reliability, setting the stage for fully driverless operations in early 2026.

Should You Buy WRD Stock?

WeRide has had a difficult time this year, but WRD stock still has its fair share of supporters on Wall Street with a consensus “Strong Buy” rating and a mean price target of $15, reflecting an upside potential of 76% from the market rate.

The stock, which has been rated by seven analysts in total, has received five “Strong Buy” ratings, one “Moderate Buy” rating, and one “Hold” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)