Sports betting stocks are back in focus as a scaled business that is still putting up double‑digit revenue growth even after the initial legalization rush. Sports betting revenue is expected to reach $77.18 billion in 2025 and grow at about 5% a year from 2025 to 2030, which would put the market near $98.53 billion by 2030.

That kind of steady expansion has drawn more attention from investors, who are looking for names that are actually growing sales and adding users, not just telling a story.

DraftKings (DKNG) sits right in the middle of that search and has been one of the most actively traded stocks in the space, with multiple sharp single-day moves as analysts repeated “Buy” calls and pointed to its traction in big markets like New York and its push into new states such as Missouri.

Now, Mizuho has pushed the call even harder by elevating DraftKings (DKNG) to its “Americas Top Picks” list, signaling that DKNG is one of the firm’s highest‑conviction ideas in today’s market.

With the stock still swinging between pullbacks and quick rebounds, does the current mix of sector growth, improving fundamentals, and lingering volatility make DKNG a buy at today’s levels, or is Wall Street’s enthusiasm getting ahead of the numbers? Let’s take a closer look.

DraftKings’ Latest Numbers

DraftKings runs an online gambling and entertainment business built around mobile sports betting, iGaming, and fantasy contests, earning money from betting activity and a base of regular, highly active players across its platform.

Despite that setup, the stock has had a rough stretch over the past 52 weeks, with DKNG down about 18%, and even on a year‑to‑date (YTD) basis, it is still off roughly 6%, so recent trading has not matched the growth story.

That weaker price performance sits next to a costly forward valuation, as DraftKings trades at a forward price-to-earnings multiple of about 140x compared with roughly 17x for its sector, which suggests investors are already pricing in many years of future earnings growth and leaving limited room for mistakes or a weaker economy.

Even with that, the latest results point to a company still moving forward. In the third quarter of 2025, revenue was about $1.14 billion, up 4% from the same period in 2024, and management has argued that different “sport outcome” results from quarter to quarter made the underlying growth look softer than it really was.

Customer activity also looks solid, with monthly unique payers at roughly 3.6 million, about 2% higher year-over-year (YoY), and, if the Jackpocket deal is stripped out, up 6%, which shows steady retention and efficient new customer acquisition in both Sportsbook and iGaming.

On a bigger scale, that helped produce roughly $4.8 billion of annual sales, even though the company still posted a net loss of about $507 million, and trailing twelve-month earnings per share stayed negative at about minus 0.45, with the most recent quarterly EPS at minus 0.26, underscoring that the current phase is still about moving toward lasting profitability rather than generating it in full right now.

DraftKings’ Core Fundamentals

DraftKings’ push into prediction markets is a clear sign the company is still trying to grow its reach instead of just relying on its current sportsbook business. With the Railbird acquisition, DraftKings is buying a federally licensed, CFTC‑regulated exchange plus its own technology, which lets it offer regulated event contracts on real‑world outcomes across finance, culture, and entertainment.

On the distribution side, the multiyear collaboration with NBCUniversal is about showing up wherever sports fans are already watching. The deal gives DraftKings exclusive integrations and digital sponsorships across a long list of properties, including the NFL, PGA TOUR, Ryder Cup, Premier League, major college sports, and both the NBA and WNBA.

Regulatory expansion is another key piece. Securing a direct mobile sports betting license in Missouri means DraftKings can operate across the entire state without needing to partner with a casino or professional team, adding what will be its 29th U.S. state once live, plus Washington, D.C., and Ontario already in the mix. Being able to enter new markets directly, under its own license, supports a long runway for betting volume and revenue growth as more states open up.

Wall Street’s Verdict and DKNG’s Outlook

For fiscal 2025, management now expects revenue between $5.9 billion and $6.1 billion, which would be a solid 24% to 28% increase over 2024 and shows that growth is still very much in play. The current average forecast calls for earnings per share of $0.21 for the December 2025 quarter, a clear swing from a loss of $0.28 in the same quarter a year earlier. For the full year, analysts are looking for EPS of $0.24 in 2025, which works out to YoY growth of about 122.86%.

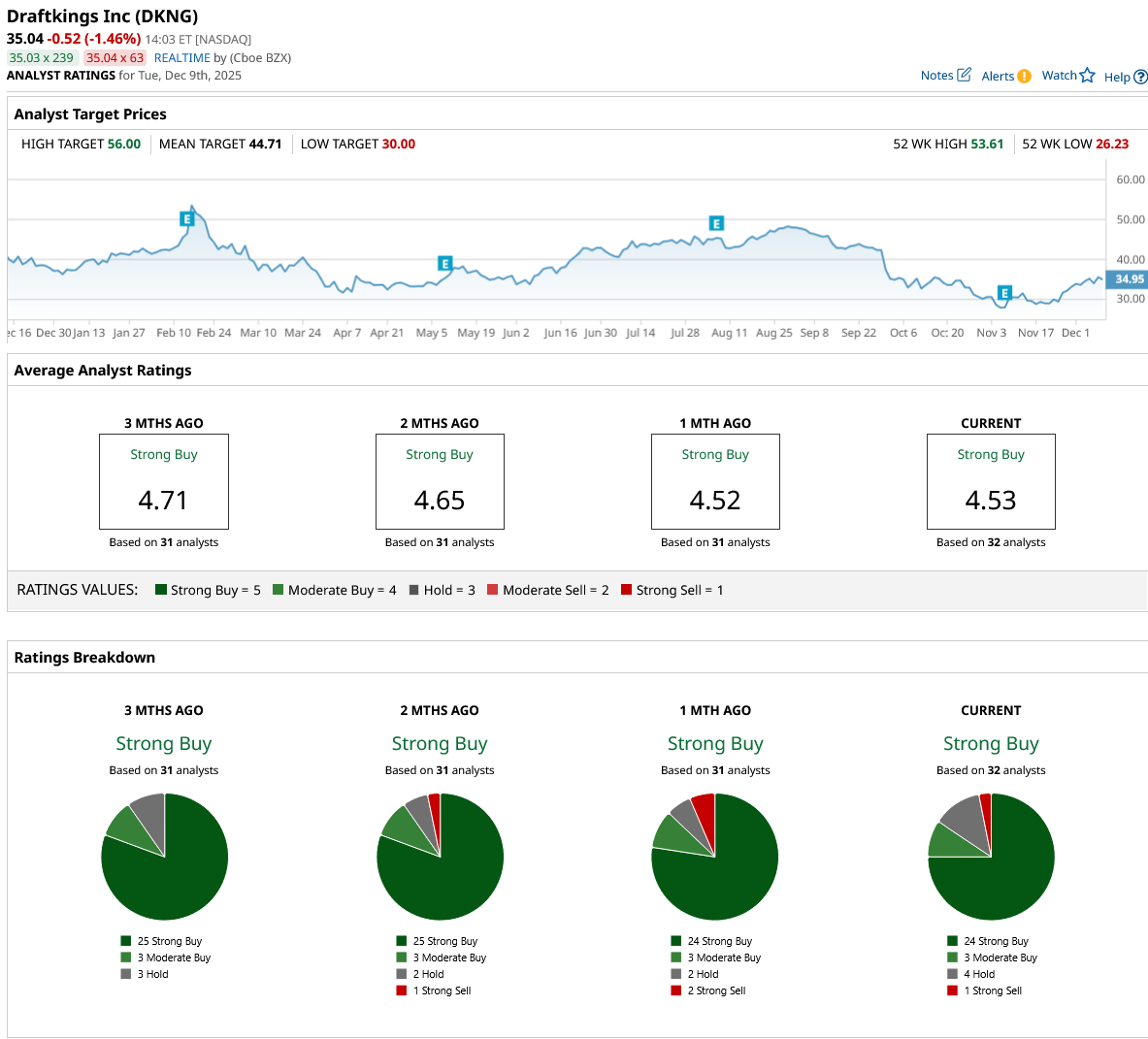

Those kinds of earnings gains help explain why Mizuho is so confident right now. Benjamin Chaiken at Mizuho Securities has kept a “Buy” rating on DKNG and set a $54 price target, describing the recent pullback as an attractive entry point despite what he sees as short‑term noise around volatility and sentiment. On the same day, Bank of America Securities’ Shaun Kelley also repeated a “Buy” rating, which supports the view that the core story is still on track even though the stock has been choppy.

Taking a step back, across 32 analysts surveyed, the consensus rating on DraftKings is a “Strong Buy.” The average price target is $44.71, which points to about 27% upside from the current share price.

Conclusion

For investors who can stomach volatility, Mizuho’s upgrade to “Top Pick” looks pretty reasonable to lean into rather than fade. The combination of mid‑20s revenue growth guidance, a sharply improving earnings profile, and real strategic moves in prediction markets, media, and new states suggests DKNG still has room to grow into its premium multiple. At the same time, a roughly 27% implied upside to the average Street target means you’re not betting on a moonshot, just continued execution and a stable macro tape. Over the next 12–18 months, the risk‑reward skews mildly higher, but expect a volatile ride, not a straight line up.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)