If the options market is any indication, there’s something seriously brewing for Adobe (ADBE). A software giant best known for its digital media solutions, ADBE stock represents one of the more disappointing names in the market — and that’s despite the underlying company being heavily reliant on artificial intelligence. Still, the security finds itself down more than 22% on a year-to-date basis, making its options activity all the more unusual.

Specifically, options flow — which focuses exclusively on big block transactions likely placed by institutional investors — demonstrated a rising shift toward bullish sentiment last week. On Dec. 1, net trade sentiment was $857,400 below parity, with a continuation of the pessimism occurring into the following day. However, at the midweek session, net trade sentiment popped up to $916,500 above parity.

Conspicuously, the final two days of last week combined for a net trade sentiment of $25.69 million, indicating a significant shift in expectations. Before we get too carried away, it should be noted that in both days, the biggest transactions by far were for credit-based (sold) puts. Generally, these transactions feature neutral to slightly bullish implications.

Still, given the beatdown that ADBE stock has endured in the open market, any kind of optimism is a welcome change of pace.

It also shouldn’t go unnoticed that Adobe is scheduled to release its next earnings disclosure for the fourth quarter after the market close on Dec. 10. Analysts overall are bullish on ADBE stock — though with some skeptical voices thrown in the mix — with many experts anticipating growth in the top and bottom lines.

Even better, the quantitative methodology — which relies on the empirical pricing data of the target security to calculate probabilistic (distributional) expectations — suggests that there could be additional upside to be extracted from Adobe stock.

Identifying and Analyzing the Geometry of Risk

As with many events in life, risk in the financial markets is a gradation. In most cases, profitability isn’t a binary concept. Instead, there are different degrees of profitability (or lack thereof). As such, a model or system shouldn’t just strive for forecasting a stock price but rather aim for deciphering the range of likely outcomes.

As a starting point, we can use Barchart’s Expected Move calculator, which leverages implied volatility and the Black-Scholes-Merton (BSM) model to calculate the expected total range of outcomes. For the Jan. 16, 2026, options chain, the lower price boundary is forecasted to be $313.26 while the upper bound stands at $379.26 (assuming an anchor price or starting point of $346.26).

Without getting too deep into the math, BSM incorporates what’s known as a parametric formula; that is, the formula assumes a specific distribution or parameters. This distribution is modulated primarily by implied volatility, which makes it useful for understanding what the market believes is possible.

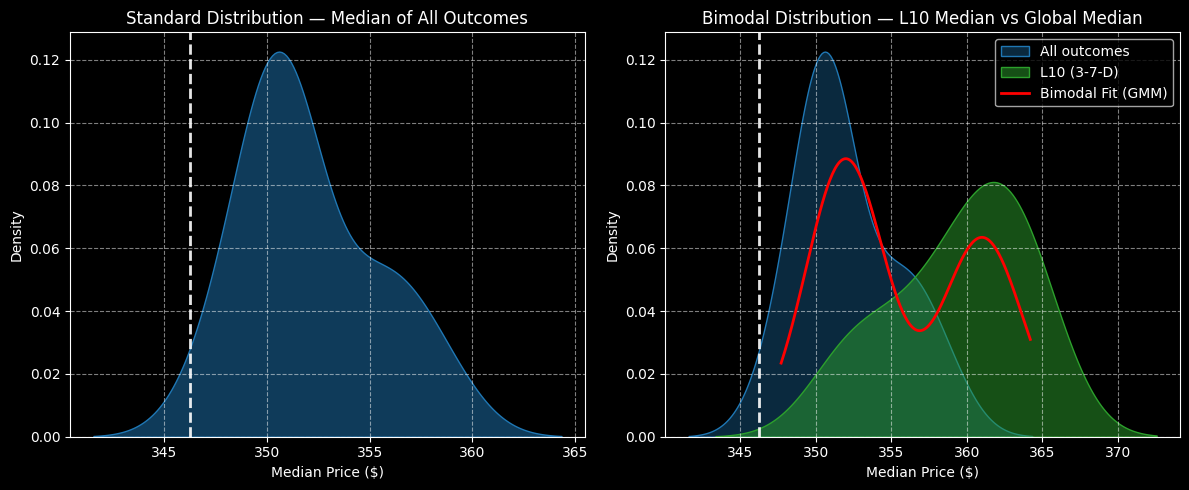

However, my proposition is to go one step further to find out where the target security is likely to cluster given specific conditions. This process is known as non-parametric. In other words, we’re going to calculate the historical distribution of the stock in question without relying on a prearranged distribution like BSM.

Under a non-parametric framework, I’m calculating a distributional outcome over the next 10 weeks between $342 and $364.50. However, this distribution is based on all data aggregated since January 2019. What we’re looking for is the current signal, which is a 3-7-D sequence; that is, in the past 10 weeks, ADBE stock printed three up weeks and seven down weeks, with an overall downward slope.

Under this setup, the forward outcomes would likely range between $343 and $373, with price clustering likely to be predominant at $362. That’s quite similar to the upper range forecasted by the BSM model. The key difference is that we believe the bullish outcome is likelier given the historical tendencies of ADBE stock.

Pinpointing a Trade by Minimizing Potential Opportunity Costs

One of the difficulties regarding options trading is that, from the perspective of the long-side speculator, the concept basically revolves around buying future contract value. However, the premium could be excessive considering that, in the near term, most securities tend to have upside ceilings. Therefore, a vertical spread becomes an ideal strategy for relatively limited moves.

However, the problem with strategies such as the bull call spread is that they are capped-risk, capped-reward transactions. In other words, to maximize their potential, a trader must be confident not only in the range of upside outcomes but also in understanding where the probability drop-off occurs. Otherwise, speculators risk leaving money on the table — an obviously undesirable situation.

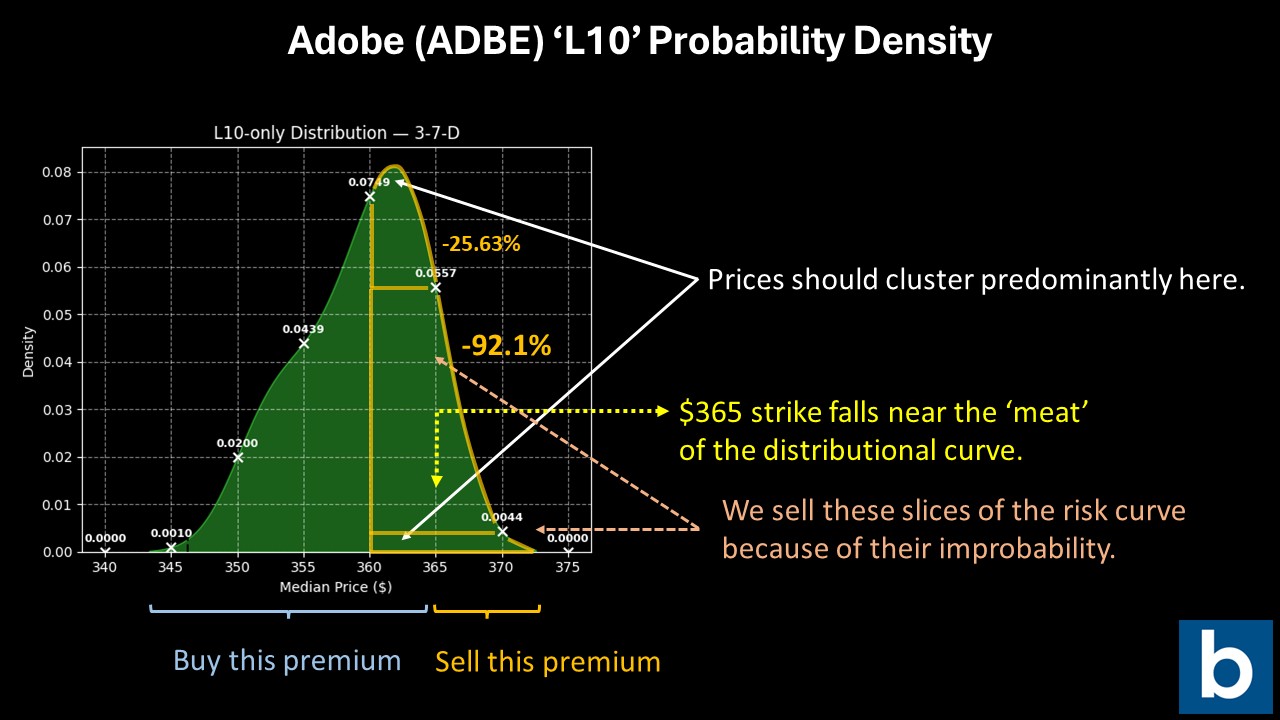

With that said, traders may consider the 355/365 bull spread expiring Jan. 16, 2026. Why? From the anchor price to $360, probability density — essentially the likelihood that a security will cluster at a specific price point — screams higher. But between $360 and $365, density declines by 25.63%. Nevertheless, the relative density is such that there’s still a good chance that ADBE stock will trigger the $365 strike price over the next 10 weeks.

However, between $365 and $370, probability density plunges by 92.1%. In other words, for every tick beyond $365, the likelihood of ADBE stock triggering the strike becomes exponentially less. As such, we should buy premiums associated with the realistic portion of the distribution curve — and sell the rest of the curve to everyone else.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)