/An%20image%20of%20the%20Snowflake%20logo%20on%20a%20corporate%20office_%20Image%20by%20Grand%20Warszawski%20via%20Shutterstock_.jpg)

On December 3, Snowflake, Inc. (SNOW) reported strong adjusted free cash flow and FCF margins for its fiscal Q3 ended Oct. 31. Moreover, management maintained its 25% FCF margin guidance for the full FY.

That could lead to a 22% higher price target for SNOW stock at $276.49 per share. This article will show how that works out and some ways to play SNOW stock.

SNOW is trading at $226.82 midday on Monday, Dec. 8, well off its recent high of $265.00 just before its earnings results on Dec. 3.

SnowFlake's FCF Results

That was even after Snowflake, which calls itself the AI Data Cloud company, reported 29% YoY growth, and its adjusted free cash flow (FCF) rose 57%.

The market wanted to see more. For example, over the last 12 months its adj. FCF margin was just 19.0%. That is well below the 25% adj. FCF margin guidance that management maintained.

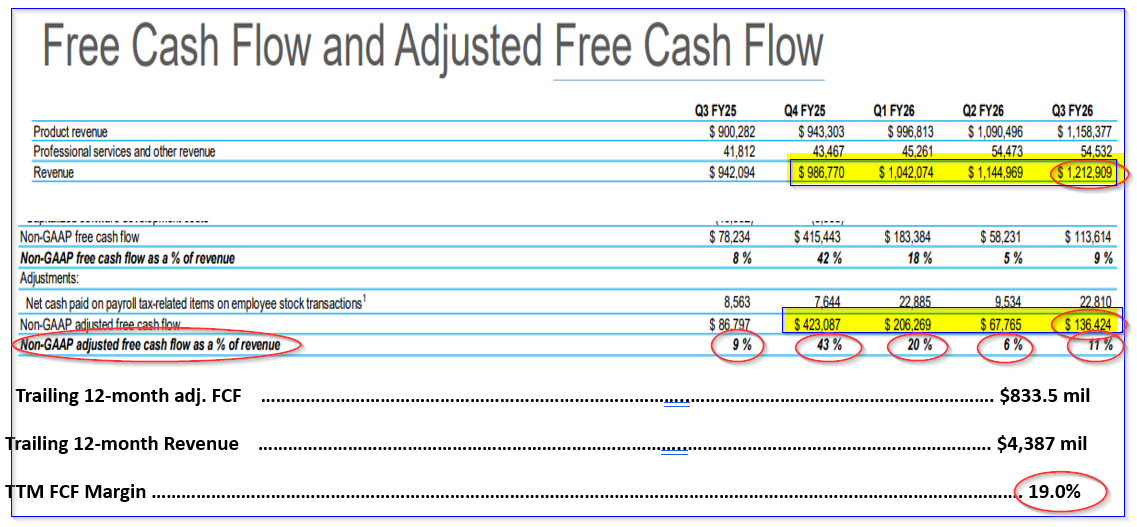

This can be seen on page 33 of Snowflake's investor presentation deck:

It shows that the trailing 12-month adj. FCF of $833.5 million was 19% of the $4,387 million trailing 12-month revenue (see also data provided by reported by Stock Analysis).

Even though this is lower than management's guidance of 25% for the full year, look at how high the Q4 margins have typically been. Last year, it was 43% of sales.

This implies that, given most of its clients renew their subscriptions during the upcoming quarter, it might be able to meet this 25% guidance.

Let's see if that is the case.

Forecasting FCF

Based on analysts' Q4 revenue forecasts, we can project its full-year adj. FCF margin. For example, Seeking Alpha reports that 42 analysts have an average Q4 sales forecast of $1.26 billion.

So, assuming it makes a similar 42% adj. FCF margin, the full year adj. FCF will be:

$1,260m x 0.42 = $529.2 million (i.e., +25% over last year's $423.087m)

$529.2m +$833.5m - $423.087m = $939.66 m adj. FCF for FY 2026

And, based on analysts' revenue forecasts of $4.65 billion:

$939.66m / $4,650m revenue = 0.202 = 20.2% adj. FCF margin

That is well below management's 25% full-year adj. FCF margin guidance. That could be why SNOW stock is faltering.

However, it does not take too much higher FCF to get to the 25% guidance:

$4650m x 0.25 = $1,162 full-year adj. FCF

That implies that Q4 adj. FCF will be $751.5 million (i.e., $1,162m - $410.5m YTD adj. FCF). That represents a 59.6% adj. FCF margin on the estimated $1.26 billion in Q4 sales.

Moreover, analysts' Q4 revenue forecasts could be too low.

My best guess is that revenue will be 30% higher and its adj. FCF margin for Q4 will be 50%. That brings the total to $1.052 billion in adj. FCF for FY 2026, or a 22.6% margin. It's still lower than management's guidance, but it looks doable.

Moreover, using this estimate for next year could lead to a higher price target (PT) for SNOW stock.

Price Targets for SNOW

Using a 1.0% FCF yield metric, the market value of SNOW stock could be over $105 billion:

$1.052b adj. FCF / 0.01 = $105.2 billion mkt cap

That is over 37% higher than its market valuation today of $76.69 billion, according to Yahoo! Finance:

$105.2b / $76.69b = 1.3717 -1 = +37.2% upside

However, just to be conservative, let's use a slightly lower FCF value of 1.125%. That's the equivalent of an 88.89x multiple:

$1.052b x 88.89 = $93.5 billion mkt value

That is +21.9% higher than today's market cap (i.e., $93.5b/$76.69b). In other words, the PT is 21.9% higher:

$226.82 x 1.219 = $276.49 PT

Analysts tend to agree. For example, Yahoo! Finance reports that the average of 51 analysts is $281.73 per share. Barchart's mean survey PT is similar: $278.20.

The bottom line is that SNOW stock looks too cheap here.

One way to play this is to sell short out-of-the-money (OTM) puts to set a lower buy-in. That way, an investor can get paid while waiting to invest at this OTM price.

Shorting OTM SNOW Puts

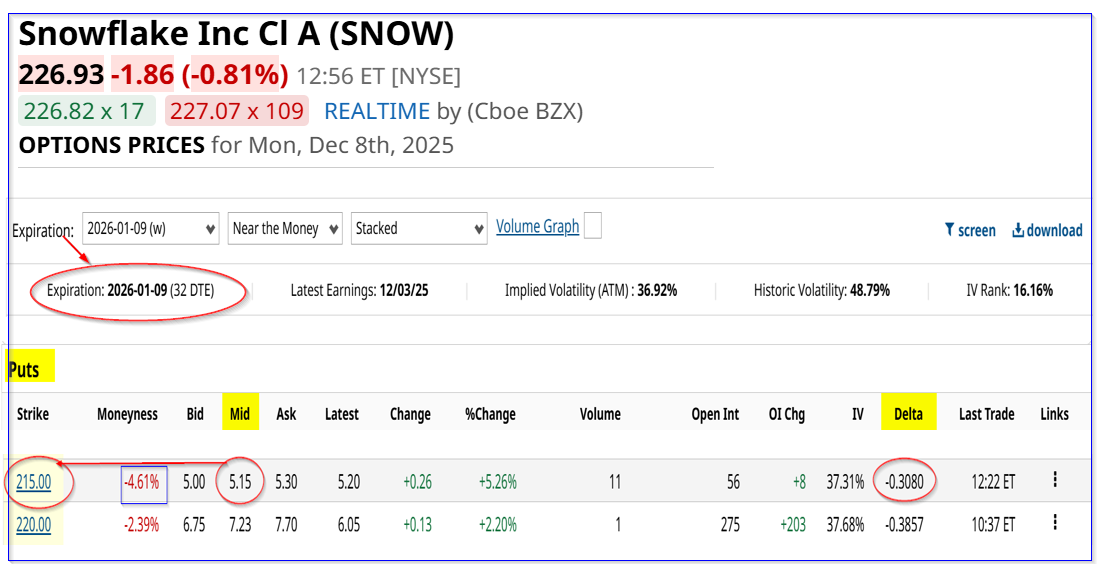

The Jan. 9, 2026, expiry chain shows that the $215.00 put option contract, which is 4.6% lower than today's trading price, i.e., out-of-the-money (OTM), has an attractive price for short-sellers.

For example, the midpoint premium is $5.15 per put contract. That allows an investor who secures $21,500 per put contract shorted to make an immediate income of $515.

This is a yield of 2.395% (i.e., $5.15/$215.00) for one month. That is a very attractive return, especially if it can be repeated for several months.

This also allows the investor to potentially have a lower breakeven buy-in point:

$215 - $5.15 income received = $209.85

That is 7.5% lower than today's price. Moreover, if SNOW rises to my PT of $276.49 over the next year, the potential upside is +31.75% (i.e., $276.49/$209.85-1).

The bottom line is that this is a great way to set a lower buy-in point.

In my last article on SNOW, I also recommended buying in-the-money (ITM) calls at $220.00 for expiry on May 15, 2025. The premium is lower today than before, but the investment is still a sound play.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)