Howdy market watchers!

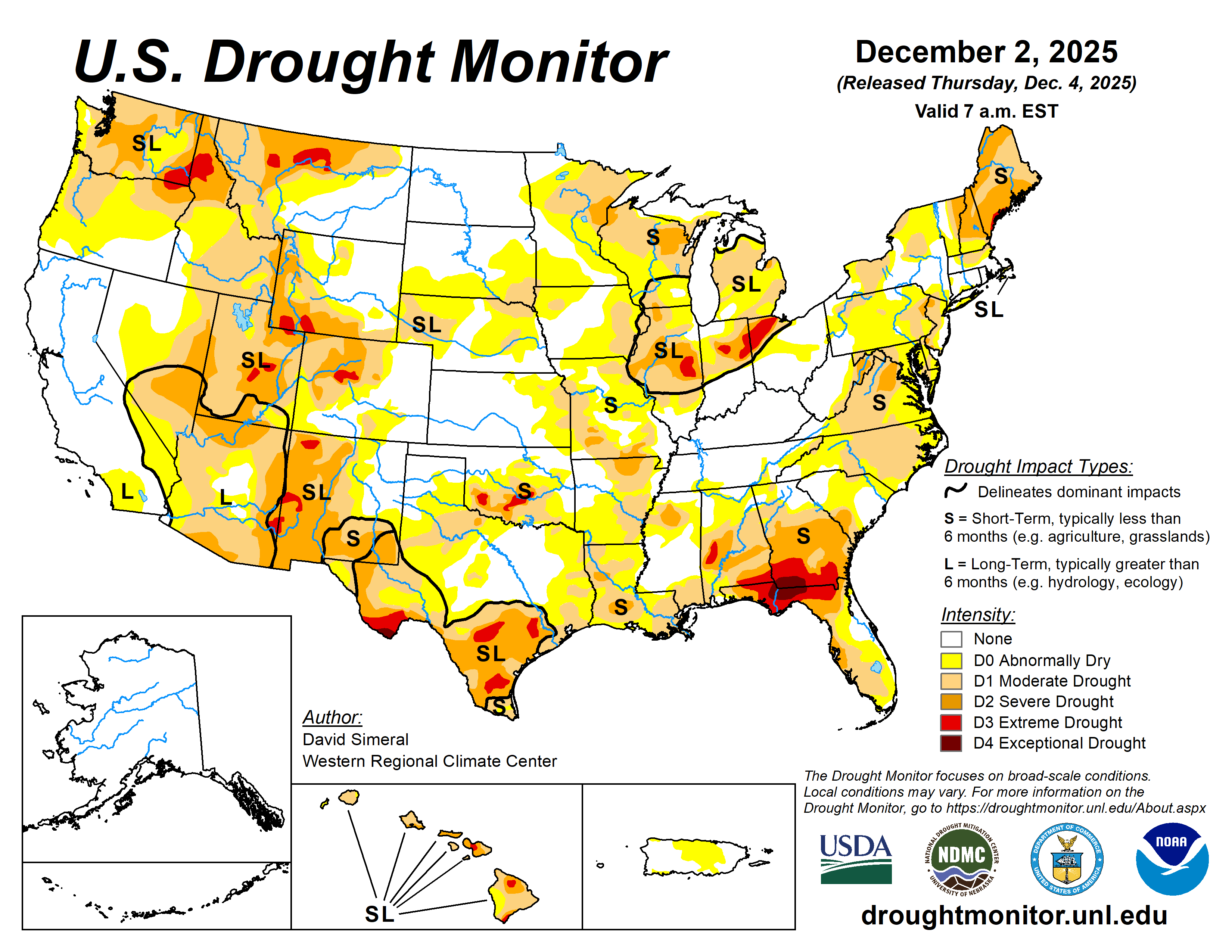

The countdown to Christmas is on! While several parts of the country received snow this week, there are plenty of areas on the dryer side void of any winter precipitation, as yet. The US drought monitor is beginning to show those deficiencies as drought expands in parts of the Midwest, Southeast and Southwest.

However, that didn’t prevent cold temperatures and natural gas demand from being abundantly prevalent this week. Such demand for heating was on full display in the natural gas market this week, but especially on Friday. At its peak, front-month January natural gas futures were up over 8 percent during Friday’s session alone, trading to a high of $5.496 while the February contract also briefly traded above $5.00. Now, that’s some movement! Strong LNG exports have also contributed to the overall demand equation. Crude oil futures also strengthened to finish the week above $60.00 per barrel.

January silver futures traded to new, all-time highs at $59.435 per troy ounces, keeping ahead of gold’s pace. The equity markets have staged a complete turnaround in the last 10 trading sessions from the light correction that ended on November 20th though yet to make new highs. As the 2025 trading year is just three weeks from turning over the calendar, investors are hoping for a Santa Claus rally. Optimism of an interest rate cut at next week’s FOMC meeting has fueled the recent recovery rally. There is now a nearly 90 percent chance of a 25-basis point interest rate cut when the Fed Reserve announces its decision on Wednesday at 1 PM CDT. I anticipate there will be dissenters, again, in both directions with some members of the FOMC believing there should be no rate cut while others believe there should be a 50-basis point cut.

Core Personal Consumption Expenditures (PCE), the Fed’s preferred inflation gauge, delayed from September, came in at 0.2 percent above the prior month and 2.8 percent over last year, which was lower than expected. This new data point further improves the odds of an interest rate cut next week as stubborn inflation does continue to be a concern. The PCE excludes food and energy prices, which are more volatile than other factors, but also very important in our daily lives. Personal income for the same period rose 0.4 percent on the month while spending increased 0.3 percent. There has been a lot of discussion recently about the strength of consumer spending given consumer debt is also rising. Having said that, consumer spending continues to climb with Black Friday retail sales reaching new records.

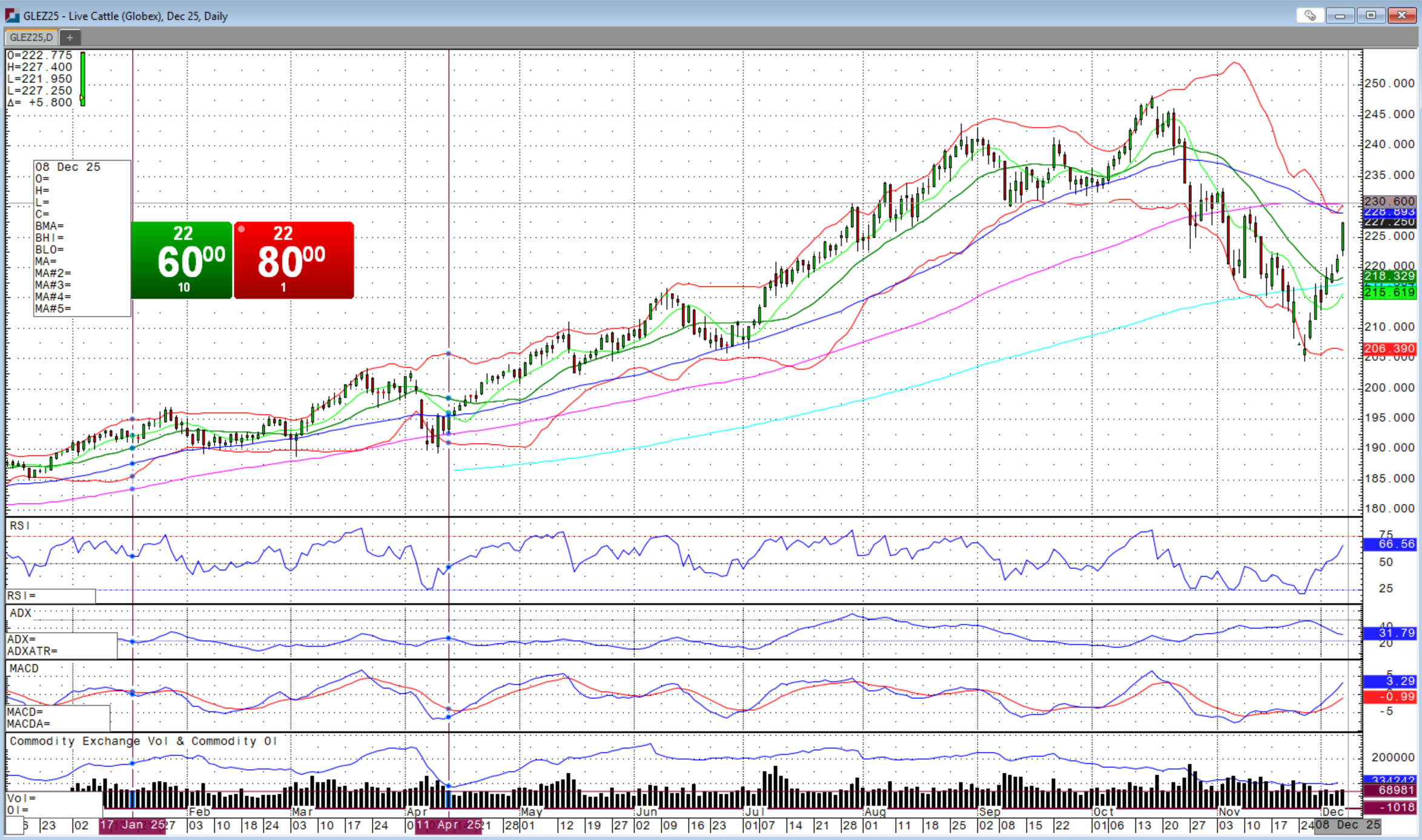

This pattern of consumer spending is critical to the significant recovery in the cattle market as beef demand remains intact despite more political attention to it. Of course, the bullish fundamentals of historic shortages of cattle have come back into focus with feeder futures reaching the 50 percent Fibonacci retracement levels and near the bottom of the large chart gap that looms another $10 per cwt above. With strong cash trade, that is precisely where I think we are headed next that also nearly lines up with the 62 percent Fibonacci retracement levels.

Once we reach that level, which will likely be this next week, I would be vigilant about protecting the downside again. While we will likely reach that level and still feel bullish, I think prudence is warranted given that this Administration could soon turn political attacks back to beef prices not to mention more rhetoric about the US-Mexican border reopening at least at one crossing point.

However, there was another New World Screw Worm case in Mexico this Thursday, just 120 miles south of the US border, that increases the risks of accelerating the pace of the reopening. While the FDA did announce conditional approval of the “Exzolt Cattle-CA1 (fluralaner) topical solution for the prevention and treatment of New World screwworm (NWS) larval infestations, and the treatment and control of cattle fever tick in beef cattle 2 months of age and older and replacement dairy heifers less than 20 months of age,” this is not an instant solution. I could very much see the border reopening and then closing again once the first case of NWSW is detected on US soil, which I believe is a matter of when not if despite colder temperatures ahead. Link to FDA announcement: FDA Conditionally Approves Topical Drug for Cattle for New World Screwworm and Cattle Fever Tick | FDA

The USDA APHIS has now released a website with information on how to prevent and treat NWSW at screwworm.gov or Screwworm.gov | Unified Government Response To Protect the United States.

Is the reopening of the first proposed port across from New Mexico already priced into the market? Perhaps, but there will likely be choppy trade when the announcement is finally out especially given the meaningful recovery in cash and futures over the past couple of weeks. Fed cattle cash trade reached $226.50 in Texas and $225 in Nebraska on Friday. There is talk that we could see $230-233 before this push stalls, which corresponds to the movement aforementioned for the feeder futures. December Live cattle options expired late last week.

If you’ve managed to ride this market all the way to $380 per cwt, back down to $299 and hopefully back to $348 and already back to $340 without protection or selling, consider yourself getting another bite at the apple here. These next $10 per cwt could be important to do what you should have done when the market was at $380. If the market goes on up beyond $348, which is entirely possible in this environment, then also consider yourself lucky, but I would be paying close attention once this next chart gap fills and the 62 percent Fibonacci retracement level is reached. Just recall how quickly the sentiment changed just 6 weeks ago with feeder futures losing $80 per cwt!

The grain markets are starting to make us feel slightly the same especially considering soybeans selloff on Friday. While wheat and corn have been supported from strong US export demand and Black Sea tensions, the soybean have been very patiently waiting on China fulfilling purchase commitments and to limited avail. Several more China sales were made this week, but at a pace much too slow to satisfy 12 million MT by the “end of the year.”

Well, what actually was the agreed deadline? In fact, China has still not confirmed this agreement that the Trump Administration continues to pronounce. I also believe this is why the next round of government payments to US farmers continue to be delayed. The Trump Administration is hoping that the Chinese will announce these major purchases, which will result in soybean and other grain futures rallying, which translates to less payouts needed to “bridge” the revenue gap for farmers. The longer China waits, the more likely it is that soybean futures will trade lower. This means China buys those beans cheaper, but means that the USDA will have to make larger bridge payments unless they continue to delay such payments, which is a political ticking time bomb as the end of the year fast approaches.

Equipment dealers, fertilizer and seed companies are all highly anticipating these payments before year end that farmers will spend in the 2025 tax year to lower or eliminate income tax payments.

Soybean futures broke below the neckline of the head-and-shoulders pattern referenced last week, but still above the November 6th low. The chart does not look good for the bulls based on Friday’s close. Now, it is nothing that large and repeated sales to China cannot change, without which we could be headed to $10.88 and possibly lower.

Corn and wheat are still holding with key moving averages and a weaker US dollar helped by confirmation of a Fed interest rate cut this week and strong exports could continue to hold those markets together. Any further weakness in soybeans though could spillover into corn and wheat and so be aware of that.

The USDA will release its December WASDE and Crop Production reports on Tuesday, December 9th that will be key news for the grain markets. We will likely see a further yield cut for US corn, but harvested acres could still keep production and ending stocks at elevated levels. This will be a key report as will global supply and demand to shed light on how these markets will trend through the end of the year as South American weather becomes in greater focus. I foresee a quiet Sunday evening and Monday trade in anticipation of the Tuesday reports that will be released at 11 AM CDT.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)