Where Are Markets Today?

US and European future markets are exhibiting stagnant conditions this morning, with market participants remaining cautions while awaiting important inflation data to derive guidance on the direction of the US Federal Reserve regarding their interest rate policy. US Futures on the Dow Jones Industrial Average contracted by 19, or 0.04%, while the S&P 500 and Nasdaq 100 future contracts, which many CFD broker offer, were also lower by less than 0.1%. In the European sector, European stock future markets are also exhibiting stagnant market conditions, reflecting mixed indicators derived from the US and the Eurozone on their respective economic performances. These stagnant future market conditions are expected to witness a phase of uncertainty, with participants awaiting important inflation data and consumer sentiments due to be released later today.

The big factor holding back market performance is the uncertainty surrounding inflation. Market participants are following the PCE inflation metric, which is viewed by the Fed as the barometer of inflation, along with consumer sentiment information from the University of Michigan. Market participants are very interested to learn if inflation is sticky, which could also have a bearing on the interest rate policy to be adopted by the Fed during their December meeting. As long as inflation is high, the expectation is that the Fed may pursue more aggressive rate increases, notwithstanding the weak forecast on the economy. Still, the expectation of a rate cut when the Fed meets on December 10 has given some encouragement to market participants, with the likelihood of a rate cut currently at 87%, which is significantly higher than a few weeks ago.

The US labor market statistics also influence the present market mood. The fall in jobless claims to the lowest level since September 2022 has sparked fears that the Fed needs to be very prudent about the inflationary pressures, although it is easing. Although the market is hopeful about the possibility of it slowing down, the strong labor market indicates that the economy is not so weak to face an economic slowdown. The uncertainty is keeping the future levels flat, and it is not yet clear if the Fed is more concerned about reducing the inflation rate by cutting interest rates or sustaining the stability of the economy by keeping high interest rates.

In Europe, the slow process of recovery of the important countries of the Eurozone, along with the concern of inflation, is worrying the investors. Since the countries of the Eurozone are facing stagnant growth, the important US economic indicators are also closely watched by European markets, which could indirectly affect the market mood. In total, it is clear that market activity is currently driven by anticipation of economic data, which is likely to influence the future direction of Fed policy. With PCE inflation, consumer sentiment, and jobless claims, if inflation remains stubborn and data suggests strong growth, it is likely to weaken the possibility of a rate cut, which could negatively influence market sentiment across US and European markets. On the other hand, underwhelming data could trigger strong market rallies, particularly across risk-on assets if it supports a dovish Fed policy direction.

Major Index Performance as of Friday, 5 Dec 2025

- S&P 500: Trading at 6,857.12, up 0.11%, showing resilience but with continued weakness in tech.

- Nasdaq Composite: Trading at 23,505.14, up 0.22%, as tech stocks continue to face pressure.

- Dow Jones Industrial Average: Trading at 47,850.94, down 0.07%, supported by defensive sectors but pressured by tech and energy.

- Russell 2000: Trading at 2,531.16, up 0.8%, showing relative strength in small-cap stocks, which are benefiting from a defensive tilt.

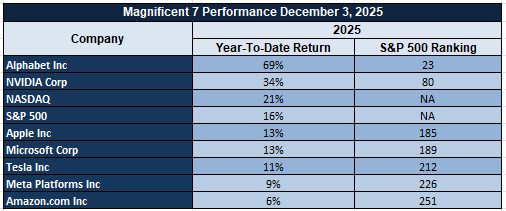

The Magnificent Seven and the S&P 500

The Magnificent Seven — Apple, Microsoft, Nvidia, Amazon, Meta, Alphabet, and Tesla — are again under pressure, with the entire lot having cohesively withdrawn by over 18% from recent highs. Tesla and Meta are leading the charge, due to margin pressure, revenue sensitivity, and a tempered approach to AI. This lot, which has been contributing disproportionately to index moves, is now impacting the S&P 500 and the Nasdaq Composite, sparking sector rotation and earnings-related angst. Without a reversal here or a sector rotation, market gains could prove elusive in December.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)