/StartEngine%20%2492M.png)

This is sponsored content. Barchart is not endorsing the websites or products set forth below.

Here's How Everyday Investors Are Doing It

For over 92 years, private market opportunities were largely off-limits to everyday people.

While billionaires and VC firms were able to back companies like Discord and Epic Games in their early stages, the rest of us were stuck watching from the sidelines.

The barrier to entry?

Sky-high minimum investments, insider connections, and accreditation requirements that locked out a majority of Americans who are not considered to be accredited investors.

And for decades, Main Street investors had zero access to it.

And the company tearing down those barriers, is now giving investors the chance to own a piece of the platform itself.

StartEngine Is Rewriting the Rules and Has Grown 3x While Doing It

StartEngine, one of America's leading equity crowdfunding platforms, has enabled everyday investors to commit $1.5 billion into startups.¹

The platform has made it possible for regular people to back the next generation of private companies across tech, sustainability, consumer products, and more.

But here's what makes this moment unique: for a limited time, investors can back StartEngine itself — and own a stake in the platform that's democratizing private markets.

This isn't just a startup with potential. It's a company posting strong growth numbers that prove the model is working.

StartEngine’s Latest Financials

StartEngine's financials tell a compelling story:

- $92M in revenue in the first 9 months of 2025 alone—representing a 3x YoY increase.²

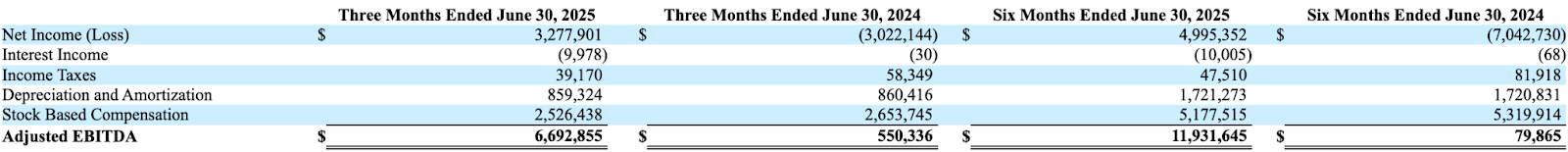

- Profitable, with $6M GAAP net income and $16M adjusted EBITDA.²

- 50,000+ shareholders have already invested over $80 million in StartEngine itself.

- 73.5% of StartEngine Private offerings have sold out, proving real demand.³

And who's championing this vision? Kevin O'Leary — better known as "Mr. Wonderful" — who serves as a strategic advisor to StartEngine.⁴

Why Kevin O'Leary is Behind StartEngine

O'Leary has spent his career identifying scalable businesses with explosive potential. After watching StartEngine open up venture capital and private equity markets to everyday investors, he joined as a strategic advisor.

For investors, this is a chance to back the same platform that "Mr. Wonderful" himself believes is transforming how Americans access private market opportunities.

Access to Deals That Were Once Out of Reach

StartEngine Private — the company's fastest-growing product line — is the engine behind that 3x revenue growth. This product gives accredited investors exposure to some of the most sought-after private companies in the world, without the six-figure minimums that typically come with private market investing.³

Through StartEngine Private, investors have gained exposure to household names and rising stars, including:³

- Acorns

- Anthropic

- Cerebras

- Databricks

- Discord

- Epic Games

- Fanatics

- Glean

- Grammarly

- Groq

- Kraken

- Lambda Labs

- Liquid Death

- Perplexity

- Stripe

- xAI

StartEngine has also launched diversified Funds that bundle multiple high-growth companies into a single investment. Five of the seven Funds launched to date have sold out, further proving investor appetite for this type of access.³

This isn't a theory. It's a proven platform with real traction, real revenue growth, and real investor demand.

Invest in The Private Market Infrastructure

StartEngine doesn't just list startup deals. The company has built the infrastructure to support the entire private investing ecosystem. Features like its Secondary Marketplace allow investors to buy and sell shares from prior funding rounds on StartEngine and other platforms.

The platform's diversified Funds provide exposure to multiple VC-backed companies with a single check.³

This is the kind of infrastructure that positions StartEngine not just as a participant in the private markets — but as one of the leading players shaping how they evolve.

Your Chance to Own the Platform, Not Just Invest Through It

Private equity has been the domain of the ultra-wealthy for nearly a century. StartEngine is changing that — and the numbers prove it's working. Revenue tripled. The platform is profitable. Kevin O'Leary is advising. Over 50,000 shareholders have already backed this vision.

This is the rare opportunity to invest in the platform itself, not just through it. Join the movement that's opening the private markets to everyone.

Invest in StartEngine alongside 50,000 shareholders →

Disclosures:

This is a paid advertisement for StartEngine made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company. There is currently no public market for the Company's Common Stock. Please read the offering circular and related risks at invest.startengine.com. Barchart has not reviewed, approved, or endorsed the content and was paid up to $3.00 per click for placement and promotion of the content on this site and other forms of public distribution covering the period of January 2026. For more information please view the Barchart Disclosure Policy here.

This Reg A+ offering is made available through StartEngine Crowdfunding, Inc. No broker-dealer or intermediary involved in offering. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information, please see the most recent Offering Circular and Risks related to this offering.

1. Count determined as number of unique email addresses in StartEngine’s database as of 04-03-2025. One individual may have more than one email address. In May 2023, StartEngine acquired assets of SeedInvest, including email lists for SeedInvest’s users, investors and founders. Click here for more details. Amount invested includes $470M in funds raised previously through offerings conducted on www.seedinvest.com outside of the StartEngine platform.

2. Based on our Q2 2025 Form 10-Q/A. This revenue growth has been driven by StartEngine Private, a new product line that offers funds in late stage companies. This product line has driven over $34.1 million of the $39 million in revenue from Q2 2025. To understand the impact on margins, see financials. Past performance may not be indicative of future performance.

We define Adjusted EBITDA as net income (loss) calculated in accordance with GAAP adjusted to exclude interest expense, interest income, income taxes, depreciation, and amortization, and stock based compensation. We present Adjusted EBITDA because it is a key measure used by our management team to evaluate our operating performance, generate future operating plans and make strategic decisions. We believe Adjusted EBITDA provides useful information to investors regarding our operational performance and our ability to generate cash flows. Non-GAAP information should be considered as supplemental in nature and is not meant to be considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP. In addition, our non-GAAP financial measures may not be the same as or comparable to similar non-GAAP financial measures presented by other companies.

The following table reconciles net income (loss), the most directly comparable U.S. GAAP measure, to Adjusted EBITDA for the periods presented:

3. The underlying companies held by StartEngine Private Funds LLC, and StartEngine Private LLC (together, “StartEngine Private”) are not participating or involved in the offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private or any of its affiliates. StartEngine Crowdfunding LLC purchases shares from current and former employees, early investors, and advisors of the companies and sells the shares to StartEngine Private for each offering. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private Funds LLC or StartEngine Private LLC, each a Delaware limited liability company (together the “Series LLCs”), which were created to hold shares of privately held companies. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLCs, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLCs interests and the underlying shares.

4. Kevin O’Leary is a paid spokesperson for StartEngine. See his 17(b) disclosure, here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)