11/11/25

.

.

THANK YOU TO ALL OF OUR GREAT VETERANS

.

.

If you don't like the customer service or lack of personal attention you are receiving from your broker, you have options, and you don't have to stay there. Account transfers are easy and so is opening a new account. Sign Up Now

.

.

If you would like to receive more information on the commodity markets, please use this link to join my email list Sign Up Now

.

.

I will be in Amarillo Texas December 1st-5th, let me know if you would like to meet there.

.

.

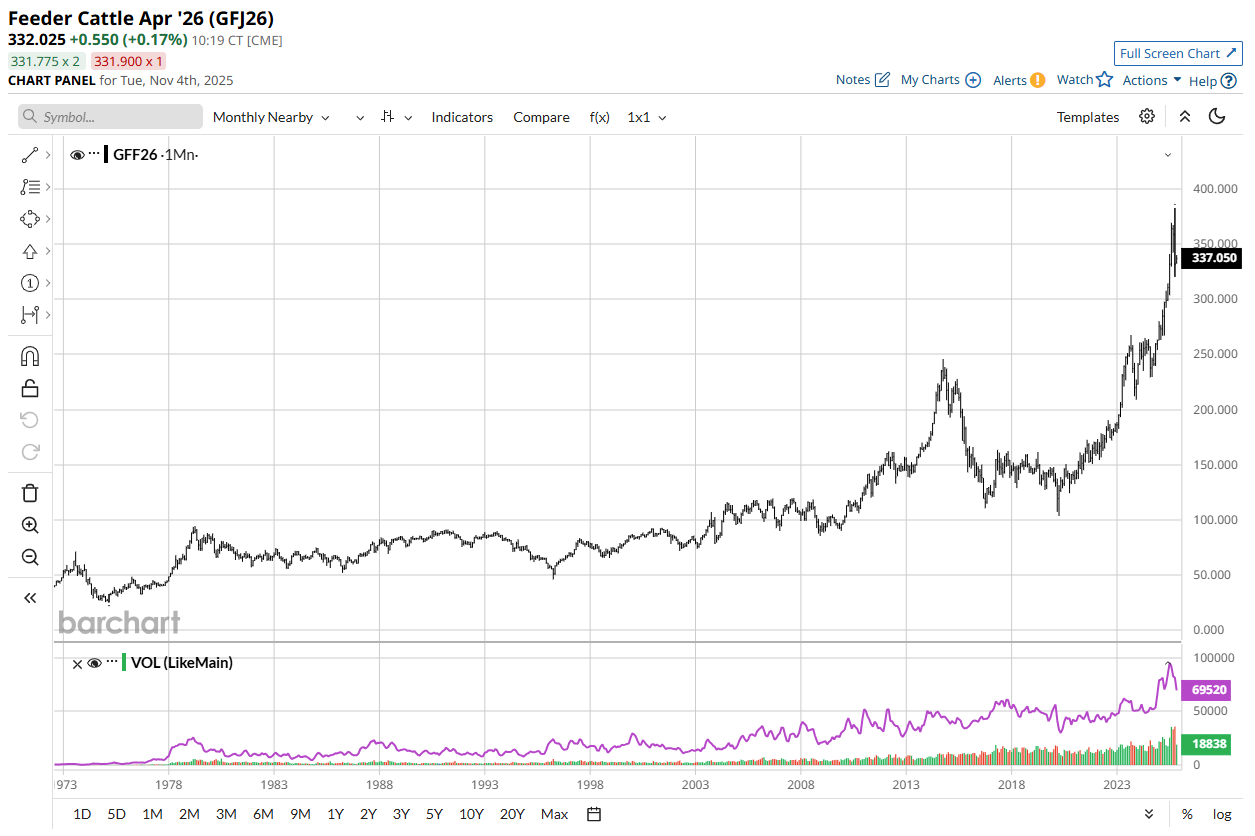

The Livestock Markets were mixed today, with the Fats dropping more than a dollar. December'25 Live Cattle were 1.35 lower today and settled at 227.20. Today's high was 229.60 and the 1-month and contract high is 248.30. Today's low was 226.27 ½ and the 1-month low is 218.07 ½. Since 10/10 December'25 Live Cattle are 15.32 ½ lower or more than 6%. The January'26 Feeders managed to stay positive today. The January'26 Feeder Cattle were 32 ½ cents higher today and settled at 329.15. Today's high was 333.47 ½ and the 1-month and contract high is 380.20. Today's low was 328.87 ½ and the 1-month low is 311.40. Since 10/10 January'26 Feeder Cattle are 42.80 lower or 11 ½%. The Hogs resumed trading lower again today. December'25 Lean Hogs were 42 ½ cents lower today and settled 82.35. Today's high was 83.25 and the 1-month high is 85.50. Today's low was 82.30 and the 1-month low is 78.80. Since 10/10 December'25 Lean Hogs are 1.67 ½ lower or almost 2%. Fear of the Government Shutdown ending, and unknow potential policy changes kept the Cattle Markets in check today. The US Southern Border will reopen eventually, tariffs could change at any time, and the government could be open again on Friday, just before the WASDE Report. The US Supreme Court has not yet ruled on the legality of the tariffs, but even if the court rules against his Presidential authority, nothing would be changed for months, but the thought of it changing could break the futures market further as well. President Trump has shifted gears as well, now focused on the packers, as that is where any scrutiny should be. The December'25 Fats traded up to 229.60 but were unable to trade at the 100-Day moving average of 229.84 ½ and fell apart from there. The January'26 Feeders tried to stage a large two-day rally, after yesterday's limit up move, but faded lower after running out of juice several dollars higher. The January'26 Feeders stayed positive but had a small 32 ½ cent gain for the day. If the January'26 Feeders can close above the 100-Day moving average of 336.10 ½, it could attract new buying in the Cattle Markets. My short-term market view is friendly in the Cattle Markets, but long-term does not look good, unless things in Washington are clearly stated, and not changed, but I would not hold my breath for any of that to happen. I did buy the January'26 Feeder Cattle 335/350 Call spread early yesterday, but I will get out of it before the government reopens. There are Trades below in the Feeder Cattle, Soybean Oil, and Natural Gas markets. If you have any questions, give me a call. Yesterday's Walsh Gamma Trader is shown below as well. I would like a chance to work with you, and I am always available, have a great night.

.

.

NOW IS THE TIME TO OPEN AN ACCOUNT BEFORE ANOTHER MONTH PASSES BY - (Only 2 Months Left This Year) If you hit the link and provide your information, you will have a wealth of Market information at your fingertips. Sign Up Now

.

.

The need for a successful business to have a trading account is immeasurable. Look at the market movement in all markets over the last three months. Opening an account sometime in the future will not help you if you need access now. To be successful, and able to manage risk, you need to be proactive now and secure your access to markets in real time. You can be both Prepared and Patient at the same time. ***WATCH FOR TRADE DEAL NEWS***

.

.

Through Walsh Trading I have built the best 5-man team in the business. Give me a call and let me show you how the Pure Hedge Division can help your bottom line.

.

.

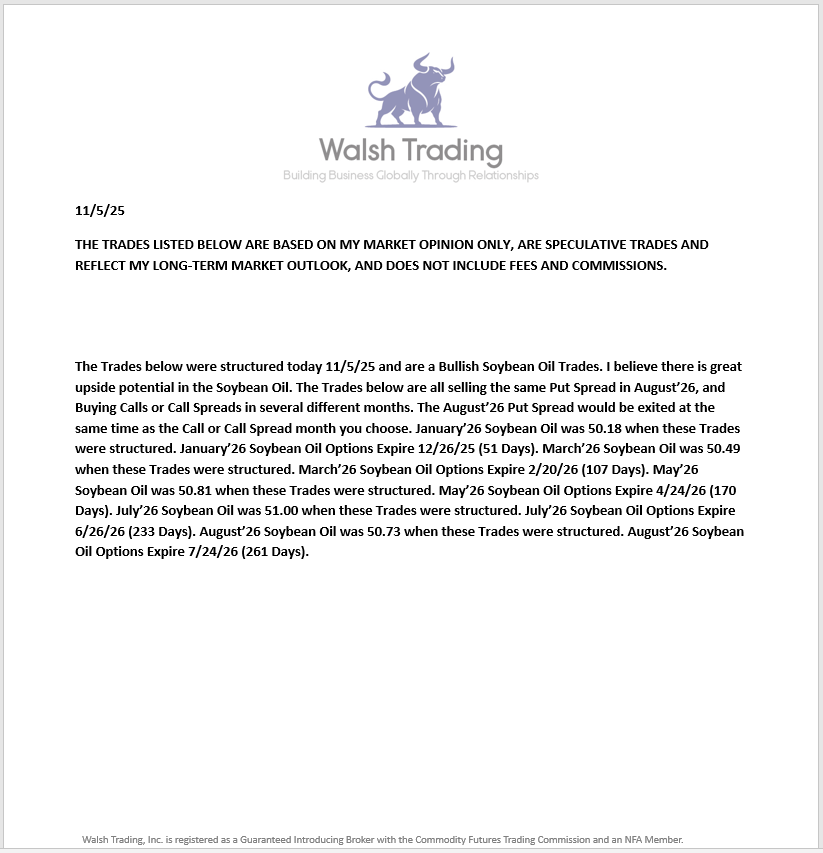

The Grain Markets were mixed today; without the standard large price swings we have seen recently. January’26 Soybeans settled a little lower today. January'26 Soybeans were 2 ¾ cents lower today and settled at 1127 ¼. Today's high was 1130 ¼ and the 1-month and contract high are 1137. Today's low was 1119 ¼ and the 1-month low is 1018 ½. Since 10/10 January'26 Soybeans are 1.04 higher or more than 10%. December'25 Corn closed in the green today. December'25 Corn was 2 ¼ cents higher today and settled at 432. Today's high was 432 ¾ and the 1-month high is 437. Today's low was 428 ½ and the 1-month low is 409 ¼. Since 10/10 December'25 Corn is 19 cents higher or more than 4 ½%. The Wheat stayed positive as well today. March'26 Wheat was 1 ¼ cents higher today and settled at 551 ¾. Today's high was 554 and the 1-month high is 568. Today's low was 546 and the 1-month and contract low is 508 ½. Since 10/10 March'26 Wheat is 36 ½ cents higher or just over 7%. If the US Government reopens by the end of the week, there could be lots of new market information available. The WASDE Report was changed from this past Monday to this Friday 11/14/25. Grain inspections were released earlier this week, and they looked very strong for the Corn, Beans, and Wheat. With several Trade Deals secured with multiple countries over the last couple of weeks, we could see very strong demand numbers. I would be interested in hearing any yield updates as well. It would be great to see one more run higher in all the grains to close out the week. This is what I wrote about the Soybean Oil contract on 10/31/25. "The Soybean Oil actually has a story, and I feel it can start rallying next week. Today I bought the March'26 Soybean Oil Futures and Sold the July'26 Futures. I purchased the March'26 0.55 under the July'26. Customers are also long the Soybean Oil in several different Option Trades. Here is why I like the Soybean Oil. The Palm Oil supply is getting tight, and export controls seem very possibly next year. The Indonesian Government must be worried about their supply, as they seized land in Palm Oil producing regions and place them under State Owned Control. At the same time, the production and export supplies of Sunflower Oil are expected to decline, as the price continues to climb and make cheaper Soybean Oil more attractive. Sunflower Oil supplies are already tight, as production estimates have decreased throughout Europe, Russia, and Ukraine, which will limit the amount of Sunflower seed crushing, again making the cheaper Soybean Oil more attractive. Biofuel percentages are set to increase in Brazil, Indonesia, and Malaysia, and I would not be surprised if the Biofuel blend rates were raised domestically as well. Argentia has already sold most of their Soybeans to China, so their crushing will be limited as well. It all points to what could be a very dramatic price increase in the Soybean Oil Market". I have continued to buy Soybean Oil Future Spreads and Options Spreads as the market continues to rally. March'26 Soybean Oil settled at 51.95 and I feel we can see it trade much higher. The August'26 Soybean Oil Settled at 52.24 and I feel we can see that contract month trade into the 60.00's. I have been buying Natural Gas Futures and Option Spreads the last couple of days as well. There is still time to be involved in the Soybean Oil and Natural Gas Trades. Give me a call if you are interested. There are Natural Gas, Soybean Oil, and Feeder Cattle Trades below. Have a great night.

.

.

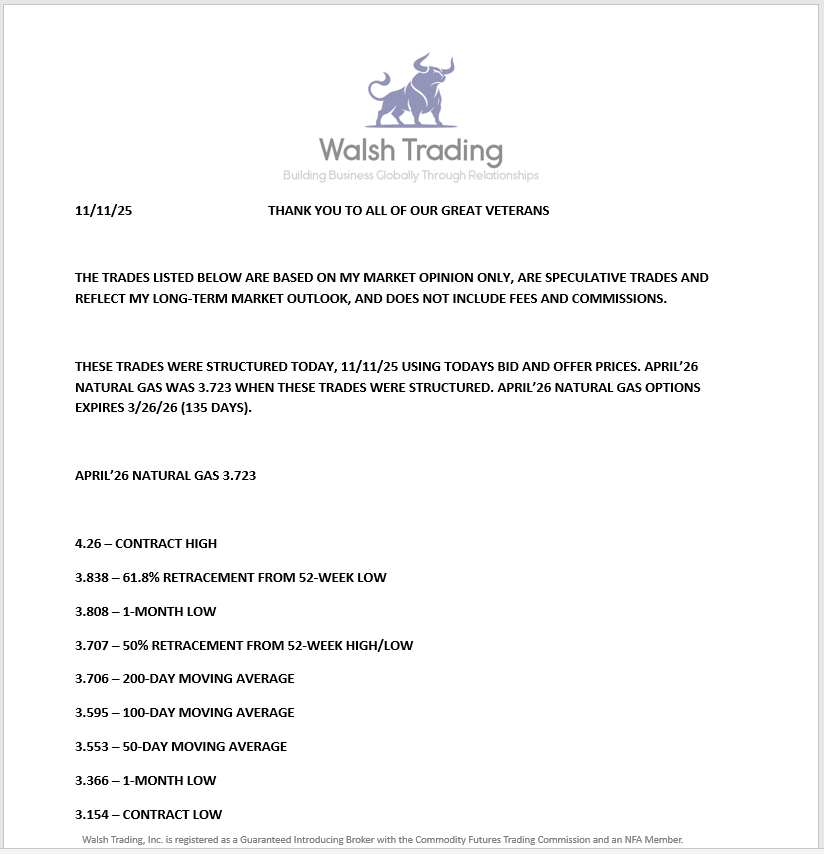

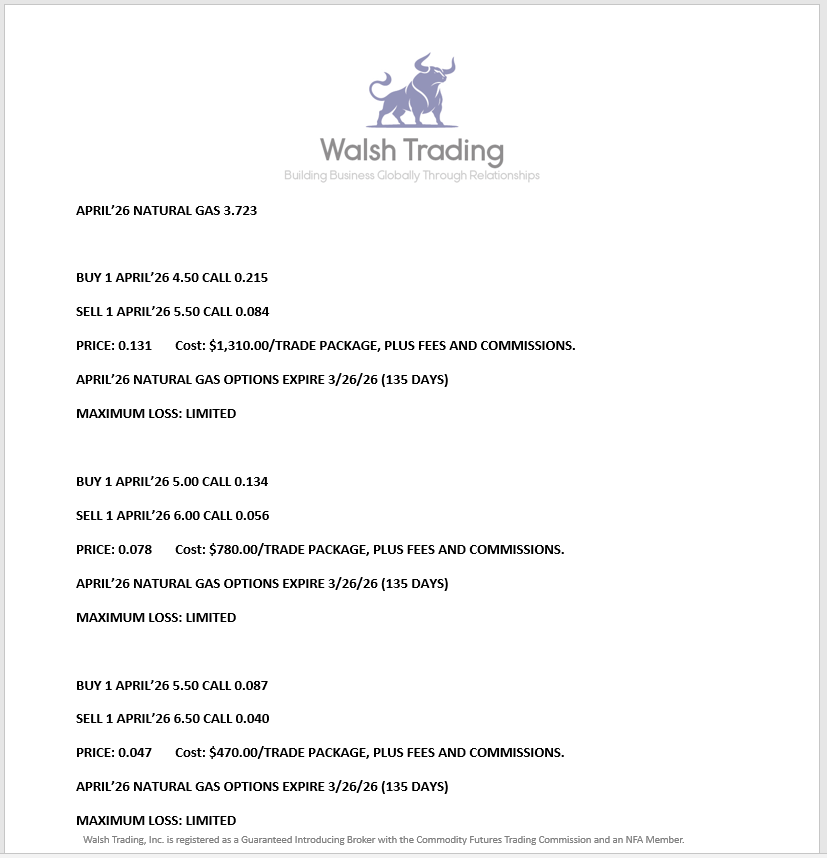

APRIL'26 NATURAL GAS TRADES STRUCTURED TODAY 11/11/25 BELOW - IF YOU WOULD LIKE TO SEE MY TRADE RECOMMENDATIONS RIGHT AFTER THEY ARE STRUCTURED - JUST SEND ME AN EMAIL

.

.

.

.

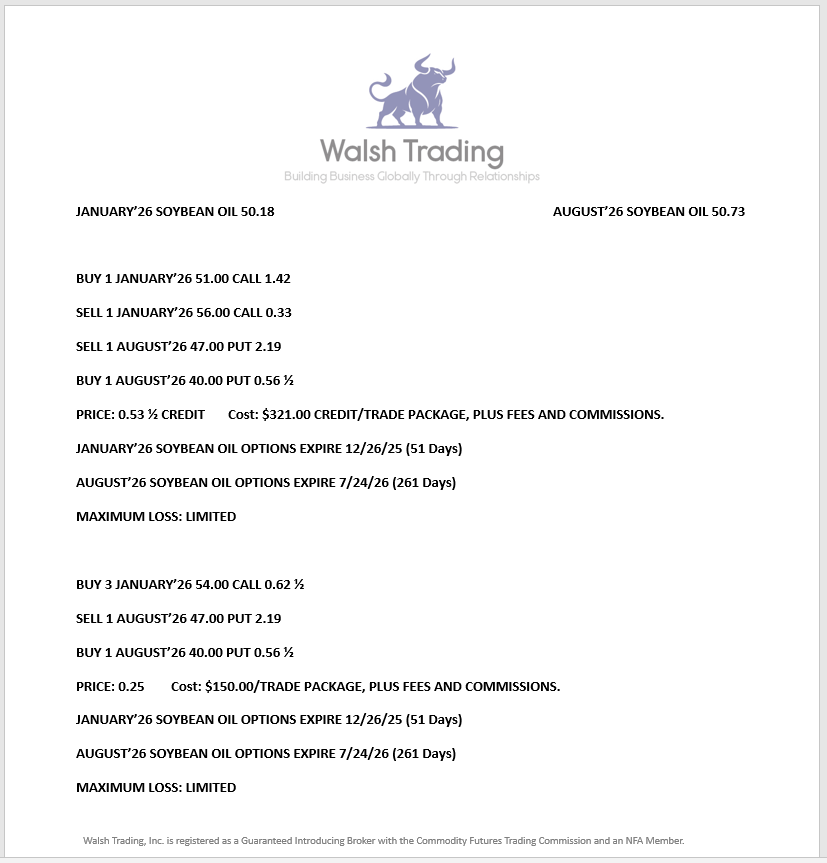

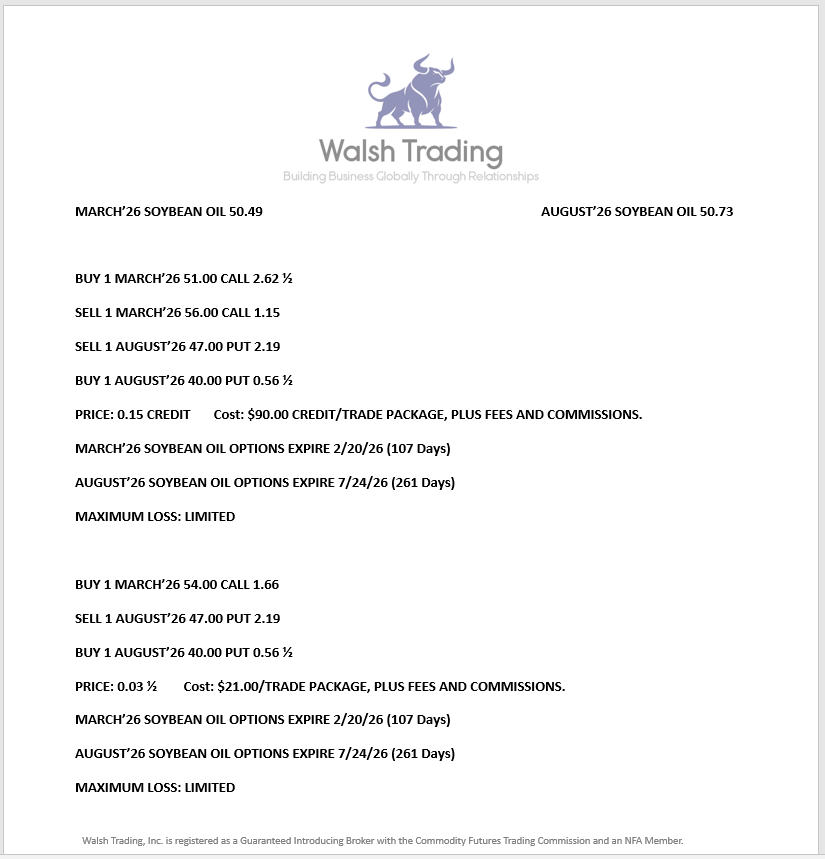

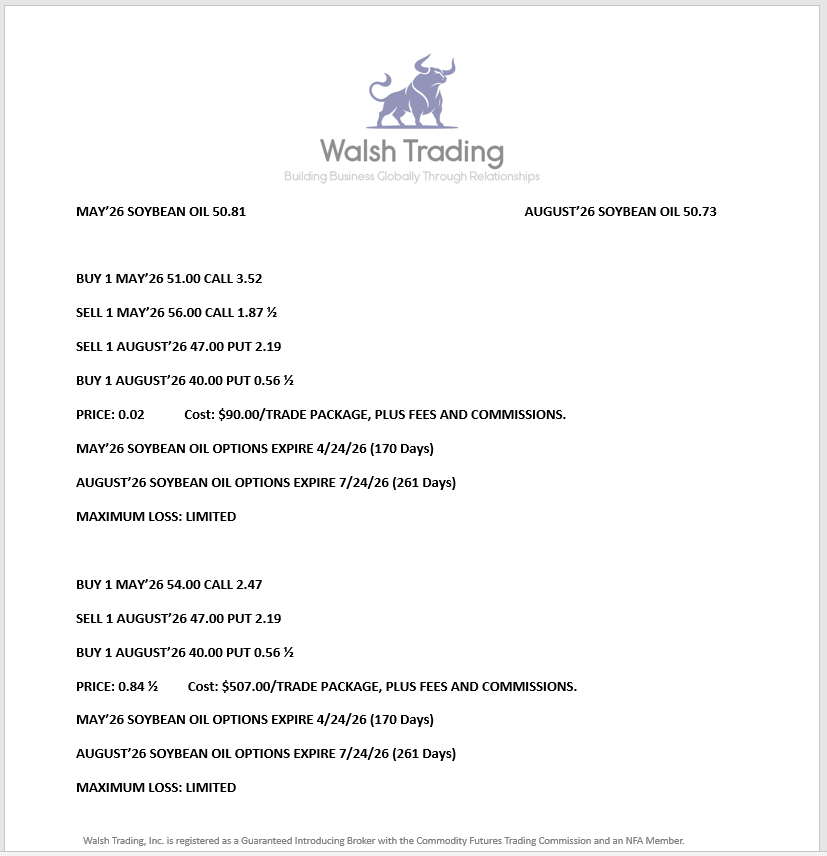

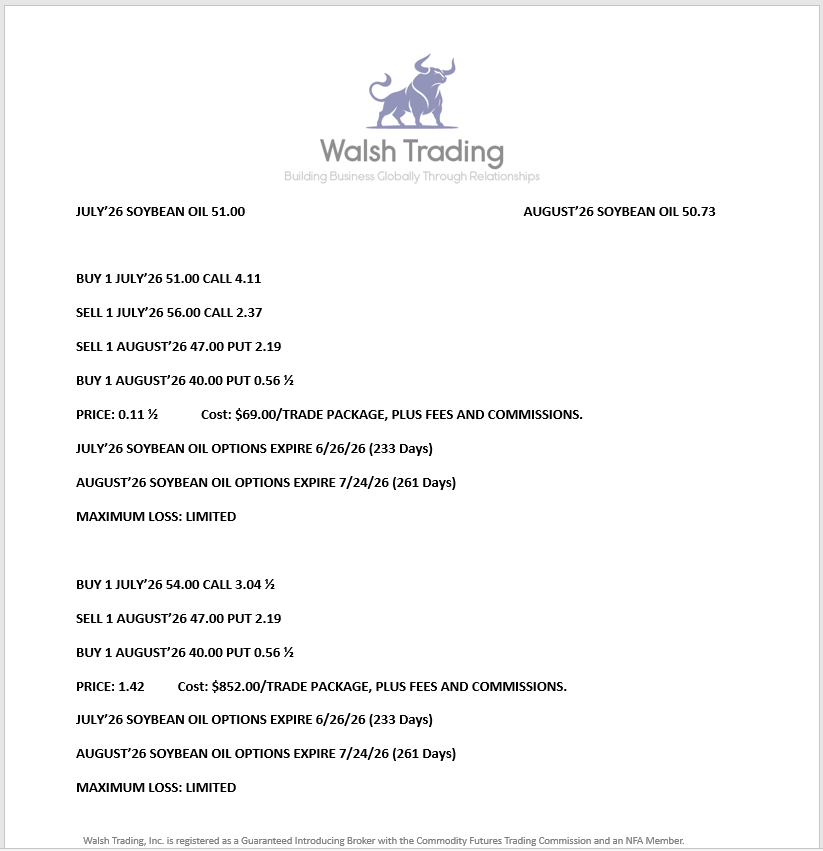

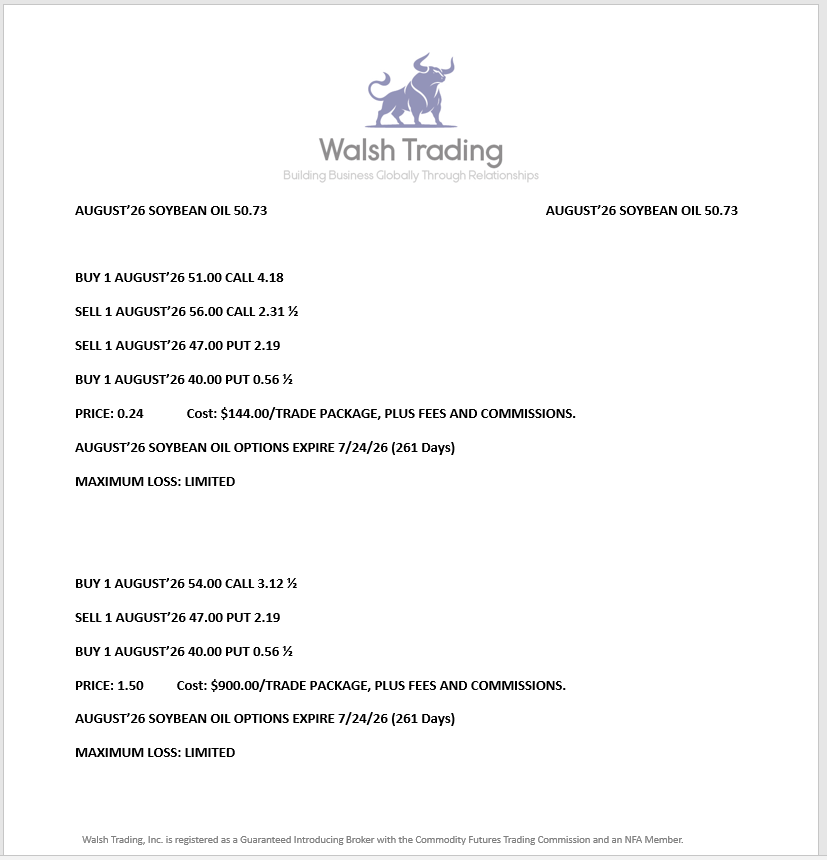

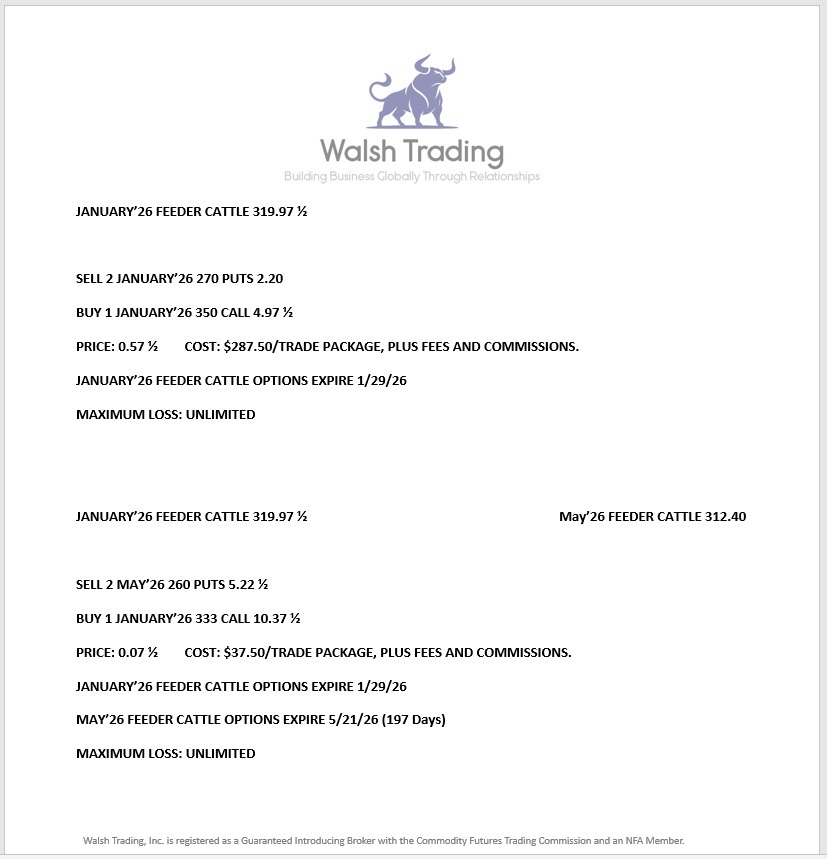

I STRUCTURED AND SENT OUT THE TRADES BELOW ON 11/5/25 - SOYBEAN OIL AND FEEDER CATTLE - IF YOU WOULD LIKE TO SEE MY TRADE RECOMMENDATIONS RIGHT AFTER THEY ARE STRUCTURED - JUST SEND ME AN EMAIL

.

.

SOYBEAN OIL

.

.

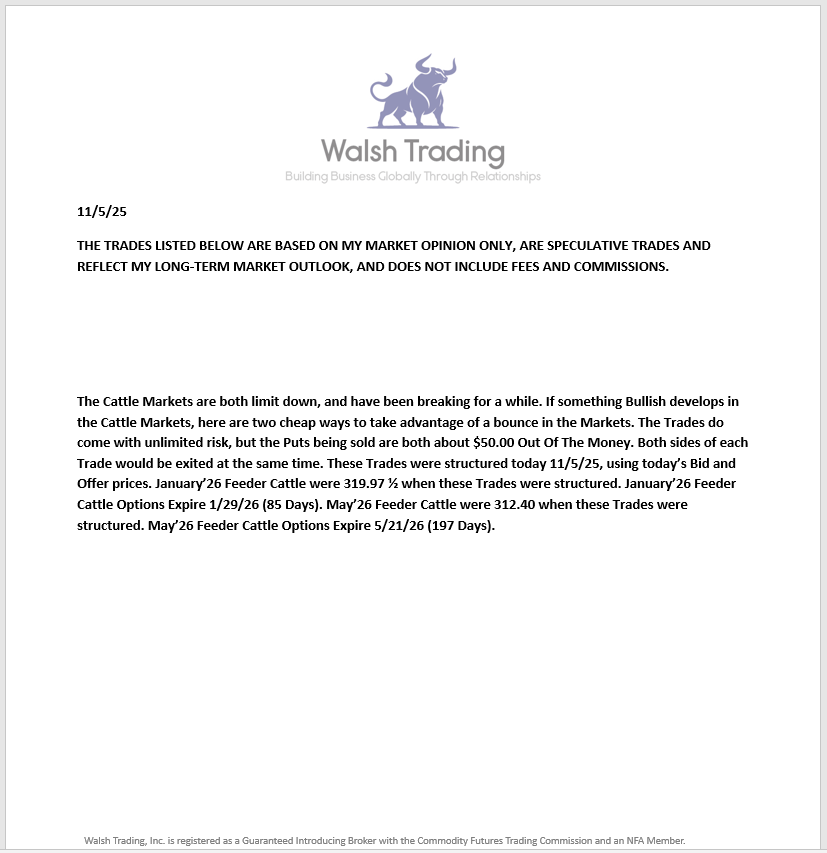

FEEDER CATTLE

.

.

THIS WEEKS WALSH GAMMA TRADER FROM YESTERDAY 11/10/25 BELOW.

.

.

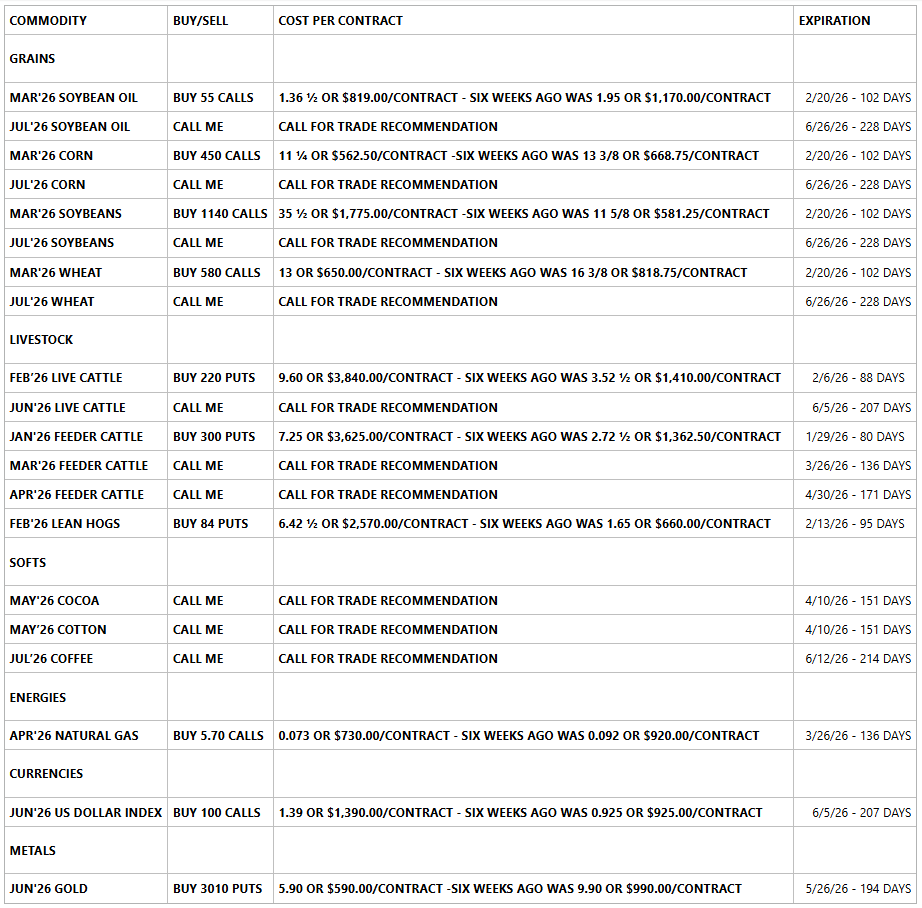

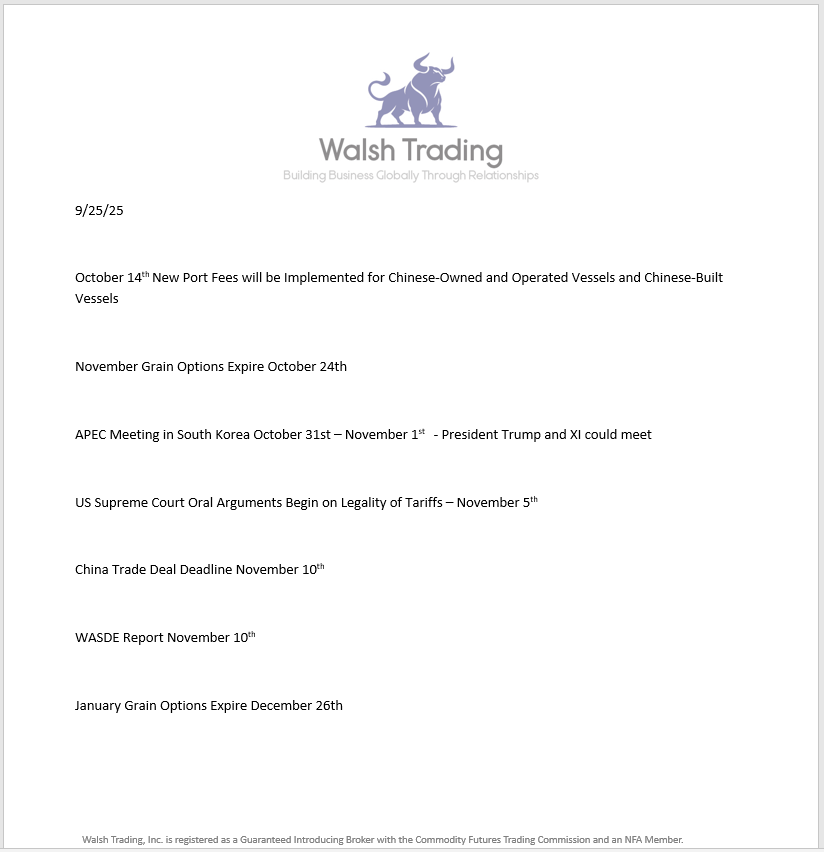

IMPORTANT UPCOMING DATES BELOW

.

.

.

The need for a successful business to have a trading account is immeasurable. Look at the market movement in all markets over the last three months. Opening an account sometime in the future will not help you if you need access now. To be successful, and able to manage risk, you need to be proactive now and secure your access to markets in real time. You can be both Prepared and Patient at the same time. WATCH FOR TRADE DEAL NEWS

.

.

If you don't like the customer service or personal attention you are receiving from your broker, you have options, and you don't have to stay there. I can have your new account open in 1-2 days. Call me anytime 312-957-8079 BALLEN@WALSHTRADING.COM Sign Up Now

.

.

50-Year Cattle Chart Below. Whenever it Breaks it Will Be a Spectacular Collapse.

.

.

.

.

April'26 Natural Gas 5-Year Chart Below.

.

.

.

.

March'26 Soybean Oil 5-Year Chart Below.

.

.

.

.

USE THE QR CODE BELOW TO SIGNUP FOR TRADE ALERTS

.

.

If you would like to open an account, please call or send me an email BALLEN@WALSHTRADING.COM

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Thank you to all of my Canadian Customers. If you live in Alberta or Ontario, you are able to open an account in the USA. Hopefully we can work with the Province of Saskatchewan, and all Canadian Provinces soon. Your ability to open an account in the US is blocked by your Provincial Governments, not by the United States.

.

.

Thank you to all of my old and new Customers. I appreciate your business. To those of you that are close to opening an account, please call me if you have any questions, and I look forward to working with you soon. To anyone thinking about opening a Hedge or Trading account, give me a call and we can talk about it.

.

.

Most Recent Walsh Gamma Trader Link - Walsh Gamma Trader

.

.

GOD BLESS AMERICA

.

.

.

.

.

.

.

.

Give me a call if you have any questions.

.

.

Bill Allen

Vice President

Pure Hedge Division

Direct: 312-957-8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540 Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)