/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

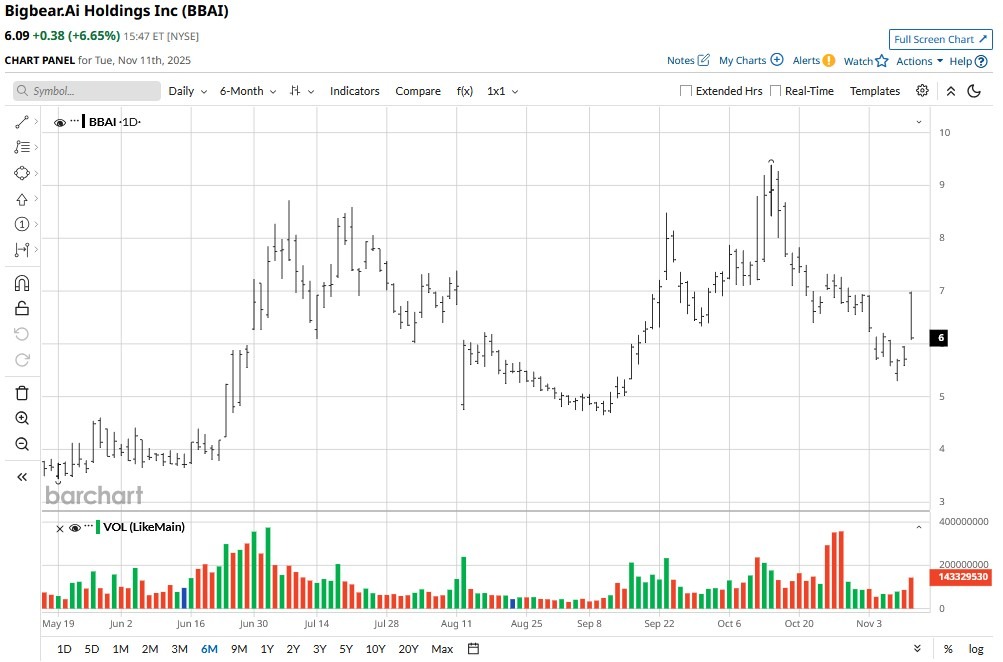

BigBear.ai (BBAI) stock soared over 20% on Nov. 11 after the artificial intelligence (AI) company announced a $250 million acquisition of Ask Sage and posted market-beating financials for its Q3.

According to the earnings release, the NYSE-listed firm generated over $33 million in revenue and narrowed its loss to $0.03 per share, indicating improved operational efficiency.

BBAI shares, however, pared back much of their intraday gains by market close, ending Tuesday up roughly 6.8%.

What Ask Sage Deal Means for BBAI Stock

The Ask Sage deal is positive for BBAI stock as it could substantially alter the company’s competitive position in the defense artificial intelligence market.

The generative AI platform is designed for secure distribution in defense and highly regulated sectors and brings compelling strategic value, serving over 100,000 users across 16,000 government teams and hundreds of commercial companies.

The acquisition is projected to generate about $25 million in annual recurring revenue for 2025, representing six-fold growth from prior year and adding material scale to BigBear.ai’s operations.

It directly addresses BBAI’s need for recurring revenue streams while positioning it to compete more effectively for larger, multi-year government contracts in the defense and national security sectors.

Why BBAI Shares Still Aren’t Attractive to Own

Despite strong headline numbers and a strategic acquisition, several financial metrics in BigBear.ai third-quarter release warrant investor caution.

For example, the company’s gross margin compressed 350 basis points to 22.4%, indicating inadequate cost discipline. This pushed adjusted EBITDA back into the negative territory ($9.4 million) in Q3

Moreover, the ongoing government shutdown has temporarily paused parts of several contracts, particularly for the intelligence community, creating additional revenue and operational headwinds for BBAI shares.

With a market cap nearing $2.5 billion against relatively modest revenue, the BigBear.ai valuation also appears speculative, which may be another red flag for seasoned investors.

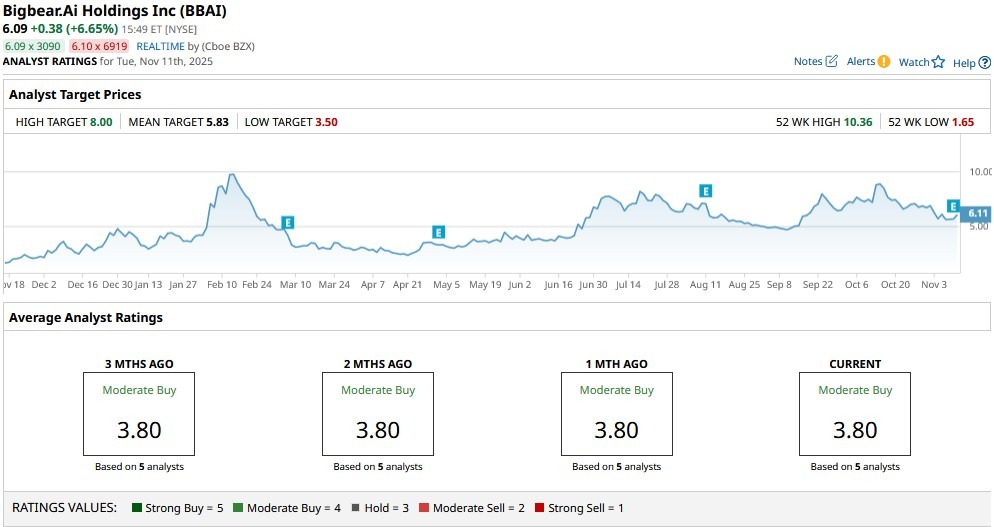

How Wall Street Recommends Playing BigBear.ai

Wall Street’s current estimates also suggest the post-earnings-and-acquisition rally has indeed gone a bit too far.

While the consensus rating on BBAI stock remains at “Moderate Buy,” the mean target of $5.83 indicates potential downside of more than 7% from here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)