/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI) stock is extending gains on Tuesday after the artificial intelligence (AI) server company announced record-breaking STAC-M3 benchmark results.

SMCI achieved this milestone in collaboration with Intel (INTC) and Micron (MU), showcasing its Petascale X14 Series All-Flash Storage Servers powered by Intel Xeon 6 processors and Micron 9550 NVMe SSD.

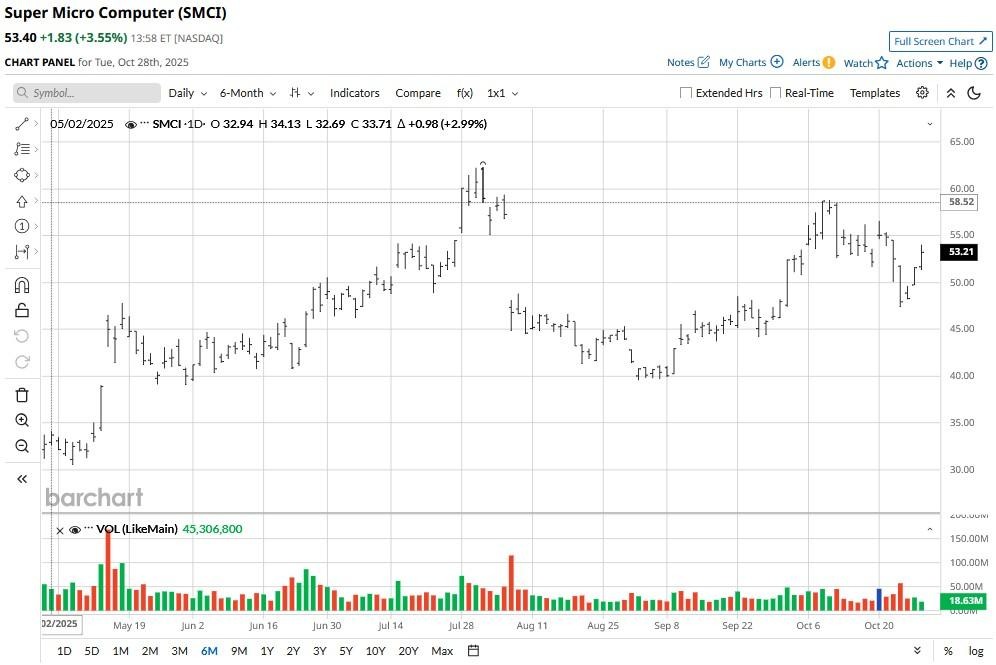

While volatile, Supermicro shares have emerged a lucrative investment in 2025. Following today’s gains, they’re up roughly 100% versus their year-to-date low set in the first week of February.

Why Is the STAC-M3 News Positive for SMCI Stock?

The record-breaking STAC-M3 results are bullish for SMCI shares as they reinforce the company’s leadership in high-performance artificial intelligence and financial analytics infrastructure.

Super Micro’s announcement validates the speed, scalability, and efficiency of its Petascale X14 Series server, critical for time-sensitive workloads like quantitative trading and AI mode training.

Partnering with Intel and Micron adds credibility and ecosystem strength while the compact 12U footprint and 1.6 petabyte capacity highlight engineering excellence as well.

These benchmarks strengthen Supermicro’s reputation as a go-to provider for financial firms and hyperscalers seeking ultra-low latency and high throughput, major drivers for future demand and margin expansion.

Why Supermicro Shares Still Aren’t Worth Owning

Despite the attention-grabbing STAC-M3 development, SMCI stock continues to face some near-term challenges.

Its recently revised guidance for the first quarter indicates a slowdown, with revenue now expected to come in at $5 billion, nearly $1 billion less than a year ago.

Meanwhile, analysts project a 52% year-over-year decline in the company’s earnings per share (EPS) in Q1 as well, reflecting continued pressure on margins amid operational inefficiencies.

Rising competition is among other major risks facing Supermicro stock heading into 2026. In fact, in the latest segment of Mad Money, famed investor Jim Cramer said “I want you to sell SMCI – and I want you to buy Dell stock.”

Wall Street Warns of Downside in Super Micro Computer

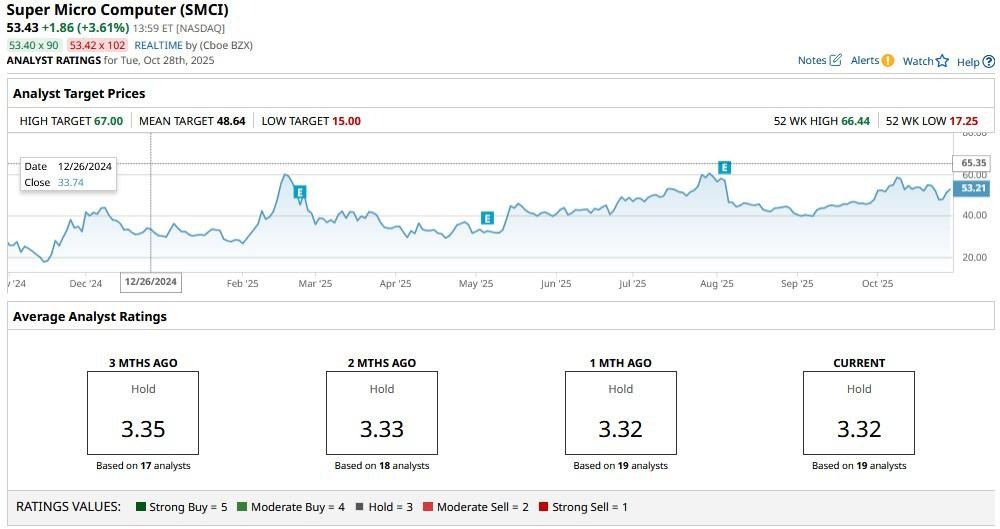

Wall Street also recommends caution in playing Super Micro stock at current levels.

The consensus rating on SMCI shares currently sits at “Hold” only with the mean target of about $48 indicating potential downside of nearly 10% from here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)