Howdy market watchers!

Where to begin?

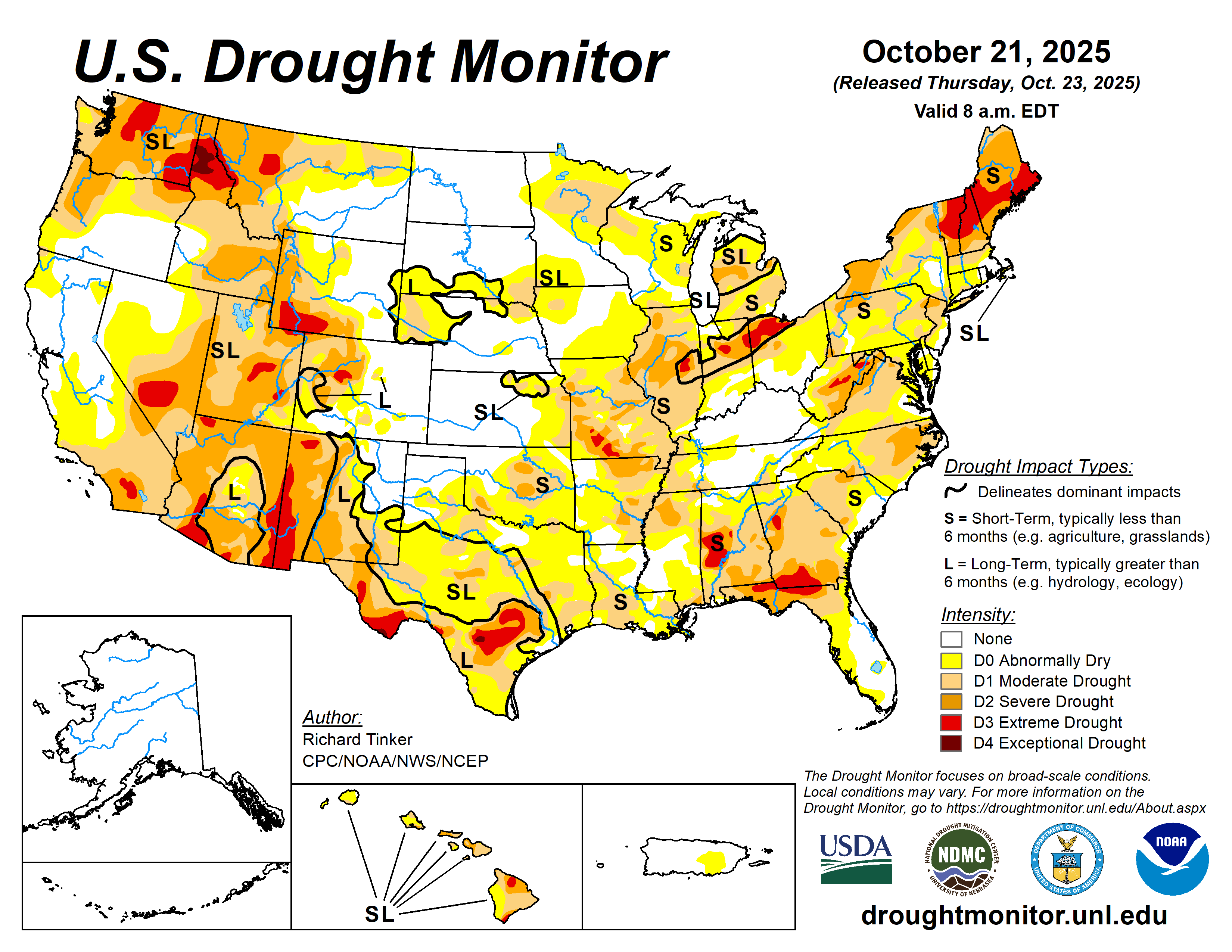

Firstly, we are thankful for the rain! After an unusually wet summer that delayed harvest, field work and another harvest, it is amazing how quickly flash droughts can return. Every state in the nation is now in some level of drought, sharply contrasted to just a couple of months ago when many areas were completely drought free. The southern plains received soaking rains to start the weekend, just as winter wheat is getting planted and so great timing for early season conditions.

With frustratingly low prices that finally managed to close above $5.00 this week on Chicago and Kansas City futures, it will be interesting to see how many acres are in fact planted back to wheat. Of course, the cure for low prices are low prices with producers lacking the incentive to plant leading to lower production, tighter balance sheets and therefore, higher prices. However, wheat is produced in so many countries in both hemispheres with conditions this year exceeding the average for most of them.

As tensions continue to escalate in the Black Sea with the proposed meeting Hungary between Presidents’ Trump and Putin being cancelled when the latter refused this week to agree to stop where the lines are currently drawn. Russia has intensified the rhetoric in reaction to more comments from Trump who now says that Tomahawk missiles will not be sent to the Ukraine. We are beginning to see some war premium return to the wheat market just as there is a lack of any USDA information due to the continued shutdown of the US government.

There were also rumors this week that China was shopping for US wheat ahead of the scheduled Trump and Xi meeting next week in South Korea around the APEC Summit. Monsoon-like rains have plagued nearly one-third of China’s corn harvest and impacted winter wheat planting, which was likely the source of the rumors. With US and Chinese trade officials meeting in Malaysia starting Friday leading up to the Presidential meeting, it is uncertain what progress will be made as tensions have recently escalated to new levels with both sides sharing restrictions to gain leverage.

Despite Trump’s stepped-up rhetoric towards China as well as the upcoming tariff hike, several recent moves make me believe that Trump wants to make a deal with increasing pressure at home, especially from the agriculture sector that helped elect him. The lack of China as a soybean customer for US soybeans is only the beginning. The recent fumbling of the Argentine bailout that resulted in China being able to swoop in and buy cheaper soybean cargos in a short, no-tax window, was bad optics. This was compounded by the delay in US farmer support that has been talked about for months and just when we thought it was going to happen, the excuse of the US government shutdown delayed it again.

Just this week did the FSA offices reopen to restart necessary programs for farmers. I don’t believe however that includes the large support package paid for by tariff revenue. To add insult to injury, President Trump tweeted this week that cattlemen should be thankful to him for higher cattle prices, explaining that he was the only reason for such prices due to his tariffs. That hurt and adds to recent announcements that beef prices need to come down to help consumers.

There is a lot to unpack here, but suffice it to say that our President is misinformed. Firstly, consumers continue to buy beef and this is a choice. The cheaper alternatives of poultry and pork have surprisingly not kept the pace with increasing beef prices, but are amply available should consumers want to spend less on protein. The truth is that the meat packers and further processors would like to access cheaper, lean beef from abroad to lower cost on ground beef and formed products. It has nothing to do with the consumer, frankly.

President Trump announced Thursday that Argentine beef import quotas to the US would quadruple to 80,000 metric tons. The problem with this theory is that even if all that is imported, it is a drop in the bucket of US demand and will make little, if any difference in retail beef prices. Meanwhile, tariffs on Brazilian beef remain at 50 percent and remain in effect. The Mexican border also remains closed given persistent New World Screw Worm cases that the US eradicated decades ago and is trying to avoid reintroducing.

The Mexican Ag Minister announced that he would travel to the US next week to discuss reopening the border. I believe that announcement had a larger impact on cattle futures than the Argentine news. However, I do not believe that the border will reopen in the near term given that screw worm cases in Mexico persist and continue to be reported closer to the US border. Freezing temperatures will help with the eradication in the US, but the issue remains in Mexico. The outcome of this meeting next week will be most consequential to the cattle futures versus other announcements. Lowering tariffs on Brazilian beef would also be significant when that takes place.

The plan announced by Secretary Rollins this week to bolster US beef production had many encouraging aspects, but it does nothing to change the shortage of beef in the US in the short-term.

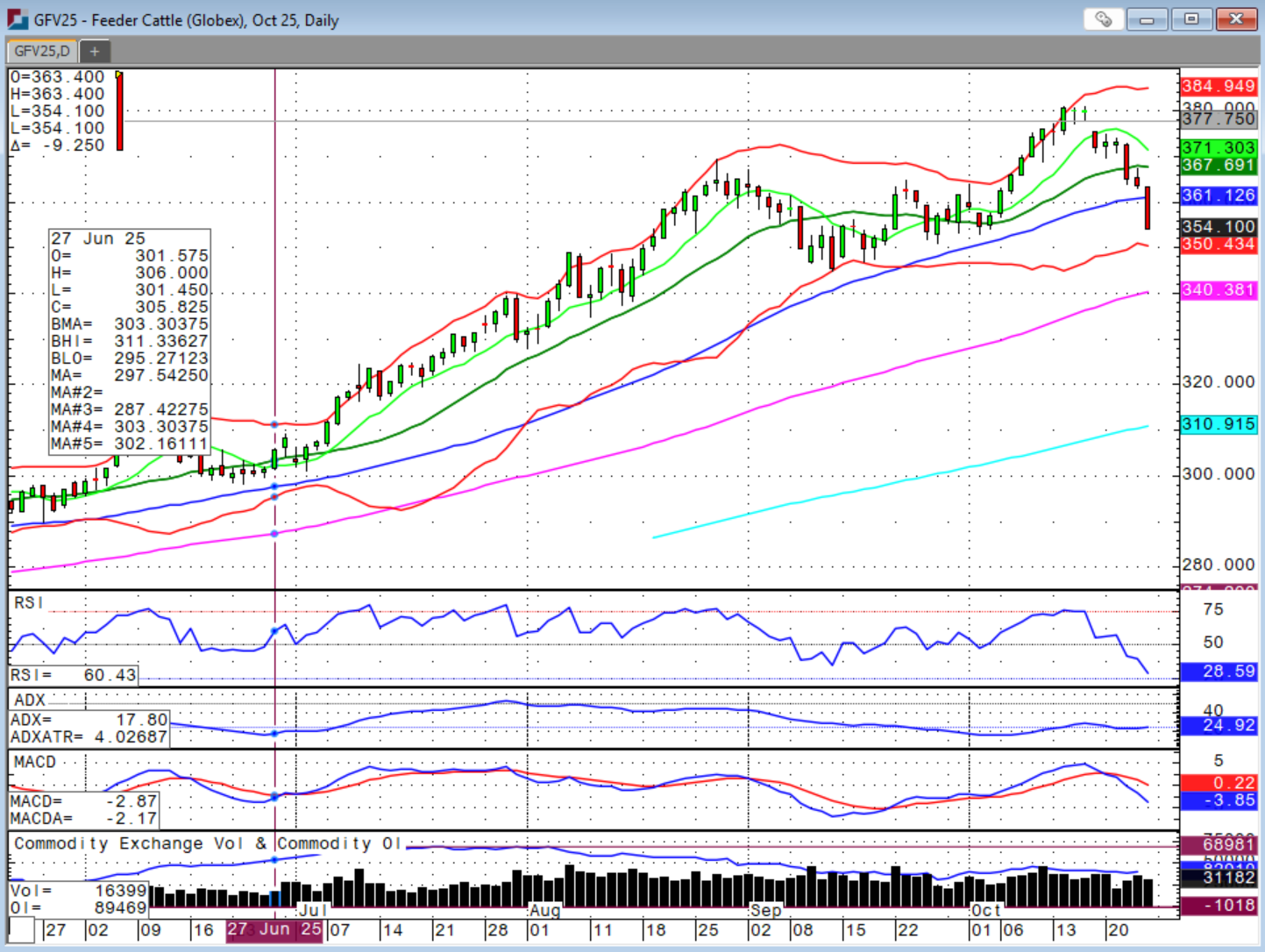

Cattle futures gapped lower on the chart with the lower opening on October 17th and then again on Friday morning. Monday’s action will be important with feeder and live cattle futures closing limit down on Friday and below the 50-day moving average. Expanded limits of $13.75 per cwt on feeders and $10.75 on fed cattle will be in place Monday. There was no LRP on Friday due to the limit down trade, which was also supposed to be a Cattle-on-Feed report release, which was suspended due to the government shutdown.

We have all been asking what it would be that would break this cattle market and the very last idea on everyone’s mind would be that it was the President we all voted for. I hope the Trump Administration can take a few steps back to reflect on how these casual mentions has significantly impacted the cattle market at a time when producers are exposed and then not able to protect prices with limit down moves on futures and the resulting unavailability of LRP.

Grain prices have started to turn higher with many hopes placed on this next week’s meeting between the US and China. Soybeans, corn and wheat contracts are at key resistance levels that if pushed through could become support with higher prices ahead. However, if there is any slippage in these negotiations, we could also see these contracts sell off hard with harvest pressure and farmer selling as uncertainty and cash flow needs are a top priority. There remains a chart gap on December futures that would fill at $4.32 ¾ that I could see happening this week with a push up to the $4.37, 200-day moving average. If KC wheat can get above $5.05, I could see $5.30 potentially in the cards for December futures. China buying of any or all of these US commodities would be of significant help in the absence of USDA reports.

If soybeans can push through this $10.44 level on November, I could see $10.60-10.75.

These are extremely uncertain times in the market with volatility elevated. When managing risk in such an environment, you will not sell the high nor buy the low. Don’t beat yourself up for making a decision and then being wrong as things can change quickly and protecting a profit, large or small, is still protecting a profit. US CPI reported Friday despite the government shutdown showed annual inflation in September increasing 3.1 percent, but lower then expected. The Federal Reserve FOMC meets this next week with the interest rate decision being announced on Wednesday at 1 PM CDT.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)