10/23/25

.

.

If you don't like the customer service or lack of personal attention you are receiving from your broker, you have options, and you don't have to stay there. Account transfers are easy and so is opening a new account. Sign Up Now

.

.

If you would like to receive more information on the commodity markets, please use this link to join my email list Sign Up Now

.

.

I will be in Amarillo Texas December 1st-5th, let me know if you would like to meet there.

.

.

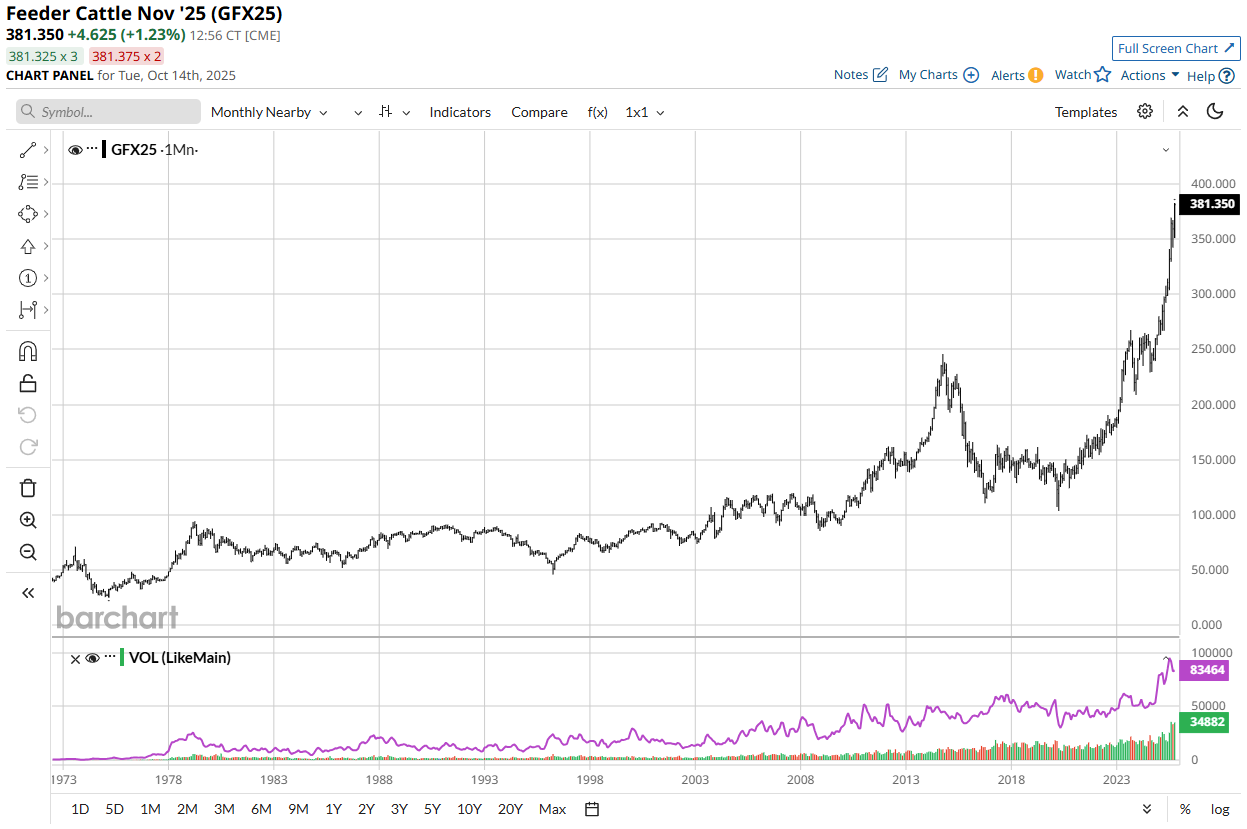

The Livestock Markets were mixed today, with the Feeders continuing lower. The December'25 Fats were able to stay positive, but the back months were lower today. December'25 Live Cattle were 1.35 higher today and settled at 241.17 ½. Today's high was 243.25 and the 1-month and contract high is 248.30. Today's low was 240.32 ½ and the 1-month low is 231.75. Since 9/23 December'25 Live Cattle are 2.25 higher or almost 1%. The January'26 Feeders dropped again today. The January'26 Feeder Cattle were 3.60 lower today and settled at 357.42 ½. Today's high was 363.80 and the 1-month and contract high is 380.20. Today's low was 356.87 ½ and the 1-month low is 343.12 ½. Since 9/23 January'26 Feeder Cattle are 2.47 ½ higher or almost 1%. The Hogs are in real trouble. December'25 Lean Hogs were 62 ½ cents lower today and settled 81.77 ½. Today's high was 83.00 and the 1-month high and contract high is 91.52 ½. Today's low was 81.72 ½ and that is the new 1-month low as well. Since 9/23 December'25 Lean Hogs are 8.95 lower or almost 10%. The Cattle Markets were higher early today, but the negative sentiment in the Cattle Markets, with the Government getting involved in the price of beef, was too much for the futures price, as fear of the unknown weighed heavily on the Cattle Markets. The Front months in the Fats were able to post a gain, but the back months were all lower. The Feeders were a couple dollars higher this morning, but prices eroded throughout the day and pushed the January'26 Feeders down almost 3-Dollars, while the deferred months sank even more. The 50-Day moving average in the Feeders is rapidly approaching, and a trade through that level could signal a major shift in the market. The 50-Day moving average in the January'26 Feeder Cattle is 353.72 ½, just 3.70 away from today's closing price. In the December'25 Live Cattle the 50-Day moving average is 237.70, just 3.47 ½ away from today's settlement price. I am still looking for a 10% pullback from the contract highs in the Cattle Markets. The Contract High in the December'25 Fats is 248.30 and a 10% break from there is 223.47. In the January'26 Feeders the Contract High is 380.20 and a 10% break from there puts the price at 342.18. If the Cattle Markets reach the 10% break level, everything will have to be reassessed, but I have a few ideas. The Hogs look like they are going to continue breaking, and I still like the 80.00 level, but 5-dollars below that looks possible as well. I recommend putting on a short position now, and I can show you many different ways to do that in the Option Markets. Give me a call if you have any questions. Soybean Oil Option Trade below. Have a great night. Hedge them if you buy them.

.

GOVERNMENT PLAN FOR CATTLE INDUSTRY LINK BELOW

FINAL 10.20.2025 - USDA Beef Industry Plan White Paper

.

NOW IS THE TIME TO OPEN AN ACCOUNT BEFORE ANOTHER MONTH PASSES BY - (Only 2 ½ Months Left This Year) If you hit the link and provide your information, you will have a wealth of Market information at your fingertips. Sign Up Now

.

.

The need for a successful business to have a trading account is immeasurable. Look at the market movement in all markets over the last three months. Opening an account sometime in the future will not help you if you need access now. To be successful, and able to manage risk, you need to be proactive now and secure your access to markets in real time. You can be both Prepared and Patient at the same time. ***WATCH FOR TRADE DEAL NEWS***

.

.

Through Walsh Trading I have built the best 5-man team in the business. Give me a call and let me show you how the Pure Hedge Division can help your bottom line.

.

.

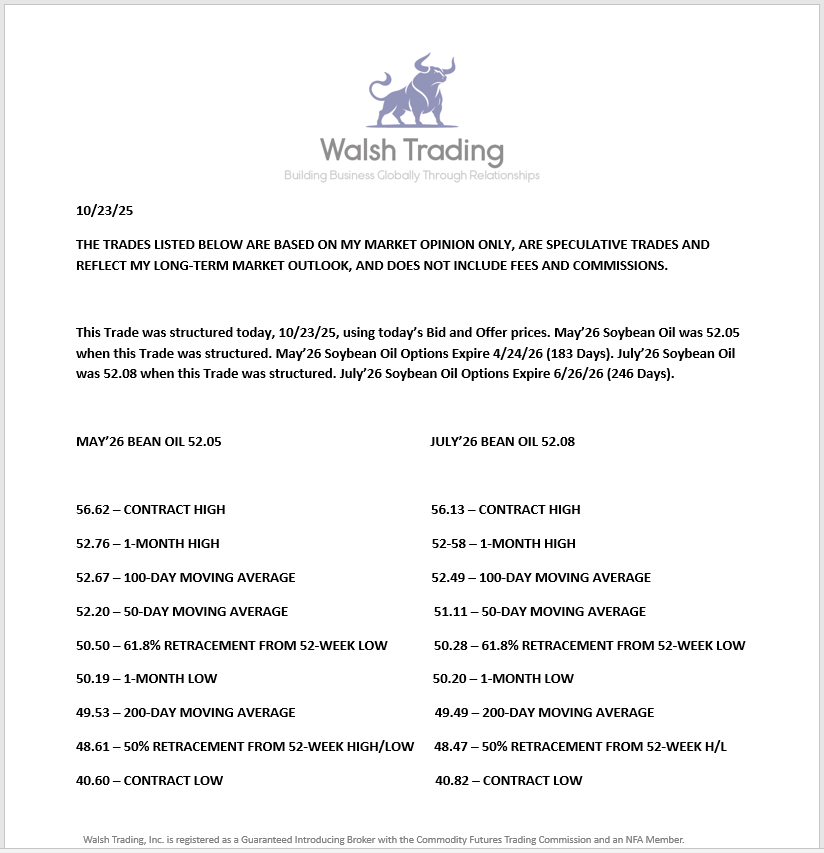

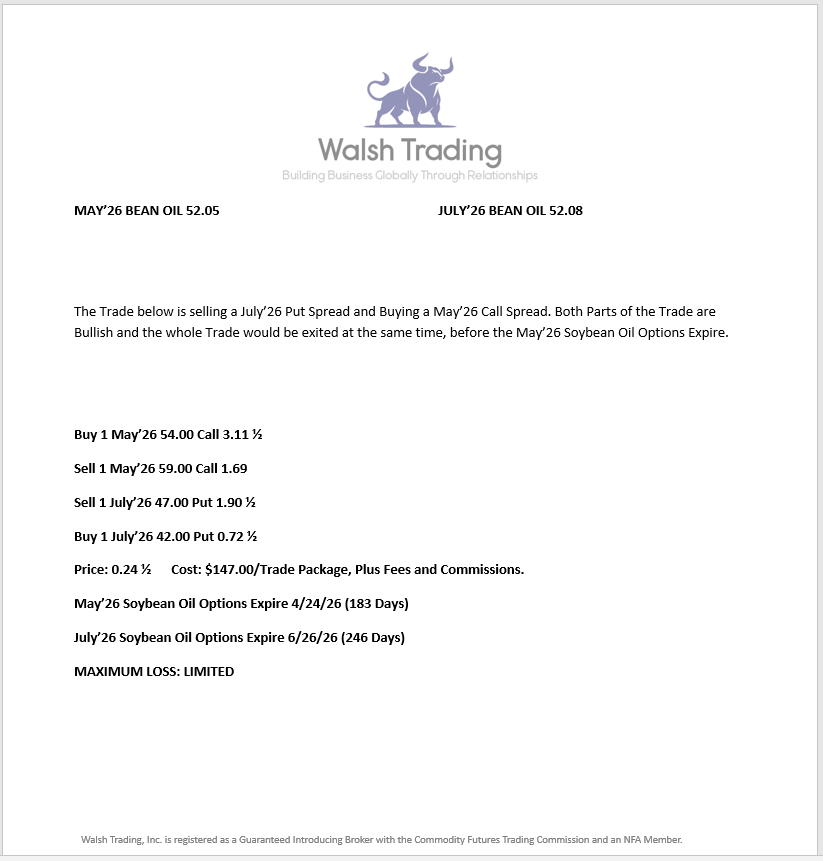

The Grain Markets were all much higher and lead by the Beans today. January'26 Soybeans were 12 cents higher today and settled at 1062. Today's high was 1062 ¼ and that is the new 1-month high as well. Today's low was 1049 ¾ and the 1-month low is 10.12 ½. Since 9/23 January'26 Soybeans are 30 ¼ cents higher or almost 3%. December'25 Corn looked good and set a new monthly high today. December'25 Corn was 5 cents higher today and settled at 428. Today's high was 428 ½ and that is the new 1-month high as well. Today's low was 421 and the 1-month low is 409 ¼. Since 9/23 December'25 Corn is 1 ¾ cents higher or about ½ %. The Wheat looked great as well. December'25 Wheat was 9 ¼ cents higher today and settled at 513. Today's high was 513 ½ and the 1-month high is 527 ¾. Today's low was 502 ½ and the 1-month and contract low is 492 ¼. Since 9/23 December'25 Wheat is 7 ½ cents lower or more than 1%. President Trump will be meeting with XI one week from today. The anticipation of a Trade Deal with China has put some premium back into the Grain Markets. The Grains all looked good today with the December'25 Corn making a new 1-month high and closing just ½ a cent off the high. The December'25 Wheat also closed just ½ a cent below the high of the day. The January'26 Soybeans made a new 1-month high, settled 10 cents higher, and just a ¼ of a cent below today's high. The Soybeans and the Soybean Oil could trade substantially higher if a trade deal is made with China and India. The Bean Oil has its own upside potential as well and could be the best contract to be long for the next six months. I feel the demand for Soybean Oil will remain strong. There is a Soybean Oil Trade below and it is Selling a July'26 Bean Oil Put Spread and Buying a May'26 Call Spread. Take a look and let me know if you have any questions. The contract high in January'26 Soybeans is 1087, just 25 cents away from today close. Have a great night.

.

.

May'26/July'26 Soybean Oil Trade structured today, 10/23/25 Below

.

.

IMPORTANT UPCOMING DATES BELOW

.

GOVERNMENT PLAN FOR CATTLE INDUSTRY: LINK BELOW

.

FINAL 10.20.2025 - USDA Beef Industry Plan White Paper

.

.

The need for a successful business to have a trading account is immeasurable. Look at the market movement in all markets over the last three months. Opening an account sometime in the future will not help you if you need access now. To be successful, and able to manage risk, you need to be proactive now and secure your access to markets in real time. You can be both Prepared and Patient at the same time. WATCH FOR TRADE DEAL NEWS

.

.

If you don't like the customer service or personal attention you are receiving from your broker, you have options, and you don't have to stay there. I can have your new account open in 1-2 days. Call me anytime 312-957-8079 BALLEN@WALSHTRADING.COM Sign Up Now

.

.

50-Year Cattle Chart Below. Whenever it Breaks it Will Be a Spectacular Collapse.

.

.

.

.

December'25 Natural Gas 5-Year Chart Below.

.

.

.

.

December'25 Soybean Oil 5-Year Chart Below.

.

.

.

.

USE THE QR CODE BELOW TO SIGNUP FOR TRADE ALERTS

.

.

If you would like to open an account, please call or send me an email BALLEN@WALSHTRADING.COM

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Thank you to all of my Canadian Customers. If you live in Alberta or Ontario, you are able to open an account in the USA. Hopefully we can work with the Province of Saskatchewan, and all Canandian Provinces soon. Your ability to open an account in the US is blocked by your Provincial Governments, not by the United States.

.

.

Thank you to all of my old and new Customers. I appreciate your business. To those of you that are close to opening an account, please call me if you have any questions, and I look forward to working with you soon. To anyone thinking about opening a Hedge or Trading account, give me a call and we can talk about it.

.

.

Most Recent Walsh Gamma Trader Link - Walsh Gamma Trader

.

.

GOD BLESS AMERICA

.

.

.

.

.

.

.

.

Give me a call if you have any questions.

.

.

Bill Allen

Vice President

Pure Hedge Division

Direct: 312-957-8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540 Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)