/Quantum%20Computing/A%20concept%20image%20showing%20a%20ray%20of%20light%20passing%20through%20cyberspace_%20Image%20by%20metamorworks%20via%20Shutterstock_.jpg)

IonQ (IONQ) shares rallied as much as 13% on Oct. 23 after the White House reportedly signaled interest in taking equity stakes in quantum computing firms.

President Donald Trump’s administration is willing to offer a minimum of $10 million in federal grants in exchange for equity in these companies, the Wall Street Journal reported on Thursday.

Following today’s gains, IONQ stock is trading at well over 3x its price in early March.

Significance of Federal Support for IonQ Stock

The prospect of federal support is bullish for IonQ shares as it signals quantum computing is now viewed as a national priority, on par with semiconductors and artificial intelligence (AI).

While the $10 million grant itself may be modest, the administration’s reported willingness to take equity stakes underscores its long-term commitment to the sector.

For IONQ that already boasts strong liquidity, commercial partnerships, and technical milestones, this isn’t about funding, it’s about validation.

The U.S. government’s interest could bring more institutional capital to the NYSE-listed firm and position it as a prominent name in the fast-growing quantum technologies market.

However, investors should note that the Trump admin has since said that they are not in fact negotiating stakes with any quantum tech firms.

Where Options Data Suggests IONQ Shares Are Headed Next

While IONQ stock has already climbed aggressively over the past seven months, options traders seem to believe it could push higher from here through the remainder of 2025.

According to Barchart, contracts expiring Jan. 16 suggest this quantum computing stock could rally further to above $80 within the next three months.

In the near term as well, the expected move through the end of October is 13.57%, with the upper bound currently pegged at $68.

IonQ’s impressive technical progress this year, including achieving record-breaking fidelity levels and a whopping 82% year-over-year increase in Q2 revenue, also support the case for further upside in its stock price.

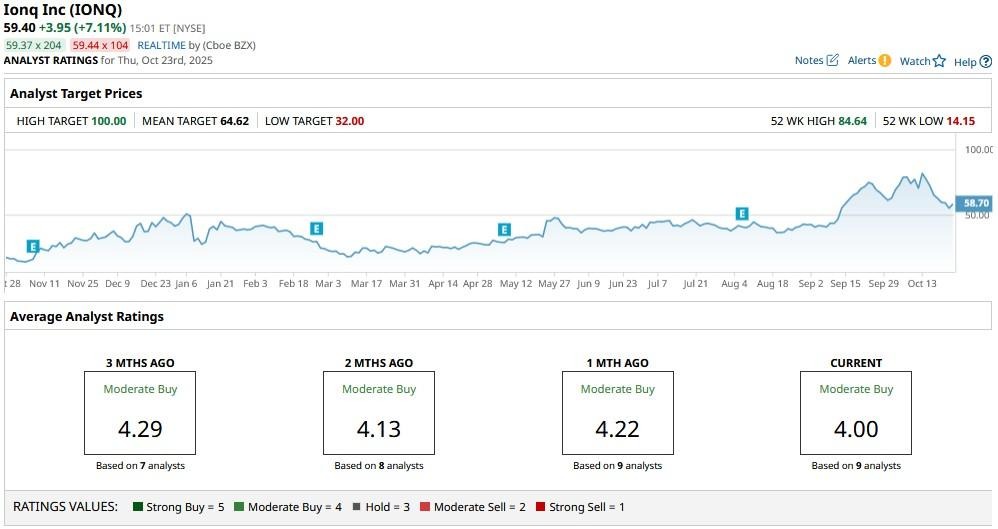

IonQ Remains a ‘Buy’ Among Wall Street Firms

Wall Street firms also currently see IONQ shares as an exciting long-term holding.

According to Barchart, the consensus rating on IonQ stock remains at “Moderate Buy” with price targets going as high as $100, indicating potential upside of another 52% from here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)