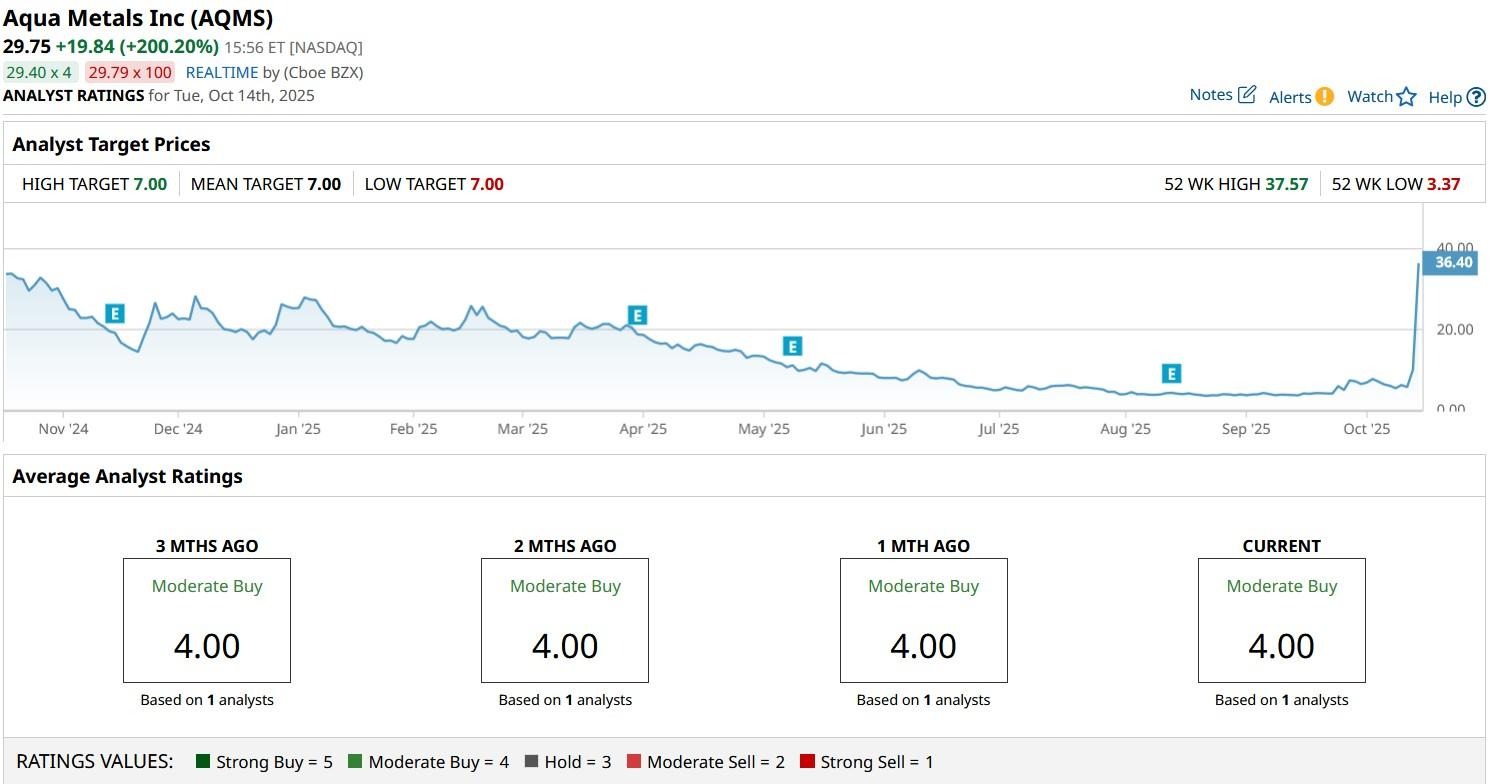

Aqua Metals (AQMS) shares nearly tripled on Tuesday as China’s recently announced export curbs renewed investor enthusiasm around domestic critical minerals companies.

Part of this rally is related to visibility from the company’s participation in The Battery Show North America 2025, where it showcased its proprietary AquaRefining technology as well.

Following today’s explosive move to the upside, Aqua Metals stock is trading at about 8x its price in late August.

The Bull Case for Aqua Metals Stock

Aqua Metals role in metal recycling, particularly its focus on battery materials, positions it in a market projected to grow at a compound annualized rate (CAGR) of a whopping 69.45% over the next 10 years.

The automotive sector is emerging as a major driver of demand for battery recycling that, coupled with regulatory pressure for responsible battery disposal, creates massive opportunities for AQMS stock.

Meanwhile, the integration of artificial intelligence (AI) and robotics in battery recycling processes is becoming an industry trend, potentially benefitting companies like Aqua Metals with advanced technological capabilities.

Still, the company faces more than a few challenges that warrant caution in buying its stock.

AQMS Shares’ Valuation Isn’t Sustainable

Investors should practice caution on AQMS as its recent rally may not reflect a sustainable valuation.

Aqua Metals’ surge looks largely influenced by speculative interest and broader market sentiment rather than company-specific developments, which suggests potential volatility ahead.

Plus, the sector more broadly faces meaningful headwinds including production bottlenecks, price volatility, and uncertain demand dynamics.

Given these concerns, investors may be better served waiting for a pullback before initiating a new position in AQMS shares. While federal support and strategic importance provide some downside protection, the stretched price levels at writing carry increased risk.

Aqua Metals Lack Broad Wall Street Coverage

Note that Aqua Metals shares do not receive broad coverage from Wall Street analysts – indicating limited institutional insights.

The only analyst who covers AQMS stock currently has a “Moderate Buy” rating on it with a price target of $7, suggesting potential downside of more than 70% from here

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Cloud%20Computing%20diagram%20Network%20Data%20Storage%20Technology%20Service%20by%20onephoto%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)