/CompareForexBroker%20Chart.png)

This is sponsored content. Barchart is not endorsing the websites or products set forth below.

According to the 2025 BIS Triennial Survey, daily global forex turnover reached USD 9.6 trillion in April 2025. This volume of turnover is a record result and a 28% lift since 2022. No other financial market matches this scale; these markets include equities and bonds combined.

Where Trading Happens

Three quarters of Forex trades are concentrated in four hubs - The United Kingdom, the United States, Singapore, and Hong Kong SAR. Of these, London accounts for about 38% of these trades.

“Daily turnover at USD 9.6 trillion confirms forex as the most traded market on earth. The depth across London, New York, and Asia is clear in the latest numbers.” said Justin Grossbard, citing the 2025 Triennial Central Bank Survey by BIS.

Currency Leaders

The US dollar remains on one side of almost nine in ten trades. The euro ranks second, followed by the Japanese yen and British pound. The Chinese yuan is rising, making up about 8.5% of all Forex turnover, with the USD/CNY now the fourth most trade pair.

“The BIS figures show the yuan is steadily gaining share, while the US dollar still leads. The market mix is shifting at the edges, but the US dollar continues to anchor pricing and liquidity,” said Justin Grossbard, citing the 2025 Triennial Central Bank Survey by BIS.

Why Trading Keeps Growing

Several forces can be attributed to the increase in Forex volumes, these include:

- Trade and Investment Flows - Multinationals, asset managers, and public institutions settle cross-border transactions and hedge currency risk.

- Hedging in Volatile Conditions - Higher rates, trade disputes, and geopolitics increase demand for risk management.

- Retail Participation - Retail flow reaches USD 242 billion per day, or 2.5% of turnover. Small in share, consistent in presence.

- Technology - Faster platforms, better connectivity, and wider access support both institutions and individuals.

What Gets Traded

Forex can be traded several ways, these include:

- Swaps, 42% (of all Forex trades) - Short-term currency exchanges used mainly by banks, then reversed.

- Spot, 31% - Immediate exchange of currencies.

- Forwards, 19% - Agreements to exchange at a future date, widely used for hedging.

- Options, 7% - Contracts granting a right to exchange at a preset rate, used for structured risk control. Retail traders focus on spot and short-dated forwards via CFDs. Swaps and options remain dominated by institutions.

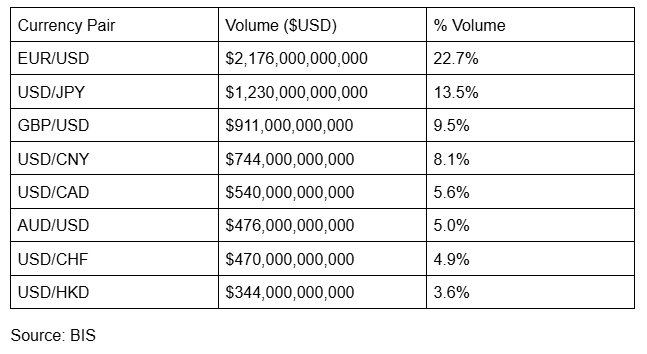

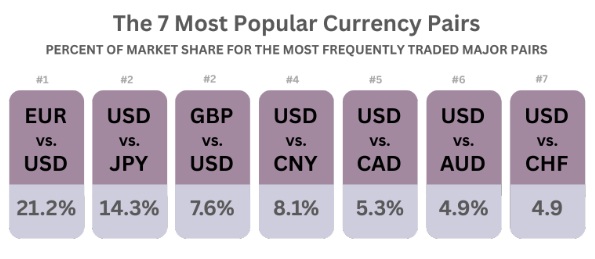

The Top Currency Pairs

All the top 8 most traded pairs include the US dollar with the EUR/USD holding first place. The USD/CNY is now in 4th spot, a rise from past performance while USD/CHF has eased.

Top 8 pairs in 2025 based on daily turnover:

The Role of Forex Brokers

Brokers link retail clients to institutional liquidity and provide trading platforms. Key elements provided by good Forex brokers include:

- Market access and order routing

- Tight pricing through deep liquidity

- Fast execution speed and platform stability

- Risk controls such as margin monitoring and stop orders

Brokers offering CFD trading involve leveraged instruments which can raise both exposure and risk. Education, demo accounts, and customer support help users understand products before funding an account.

In 2025, CompareForexBrokers awarded Pepperstone the title of Best Forex Broker. This was based on spreads, regulation, and platform range.

Why Forex Matters

Currencies influence equities, bonds, and commodities, all products that affect many businesses in some way. A stronger US dollar often pressures importers, commodity exporters, and USD borrowers while a weaker dollar often supports global risk sentiment. For this reason, Forex sits at the core of global finance, touching portfolios, corporate earnings, and policy transmission every day.

This article contains sponsored content. Barchart has not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information, please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)