Howdy market watchers!

Greetings from the Oklahoma City Zoo where we are sharing our love of craft beer made with local wheat and barley with fellow beer enthusiasts at the annual ZooBrew!

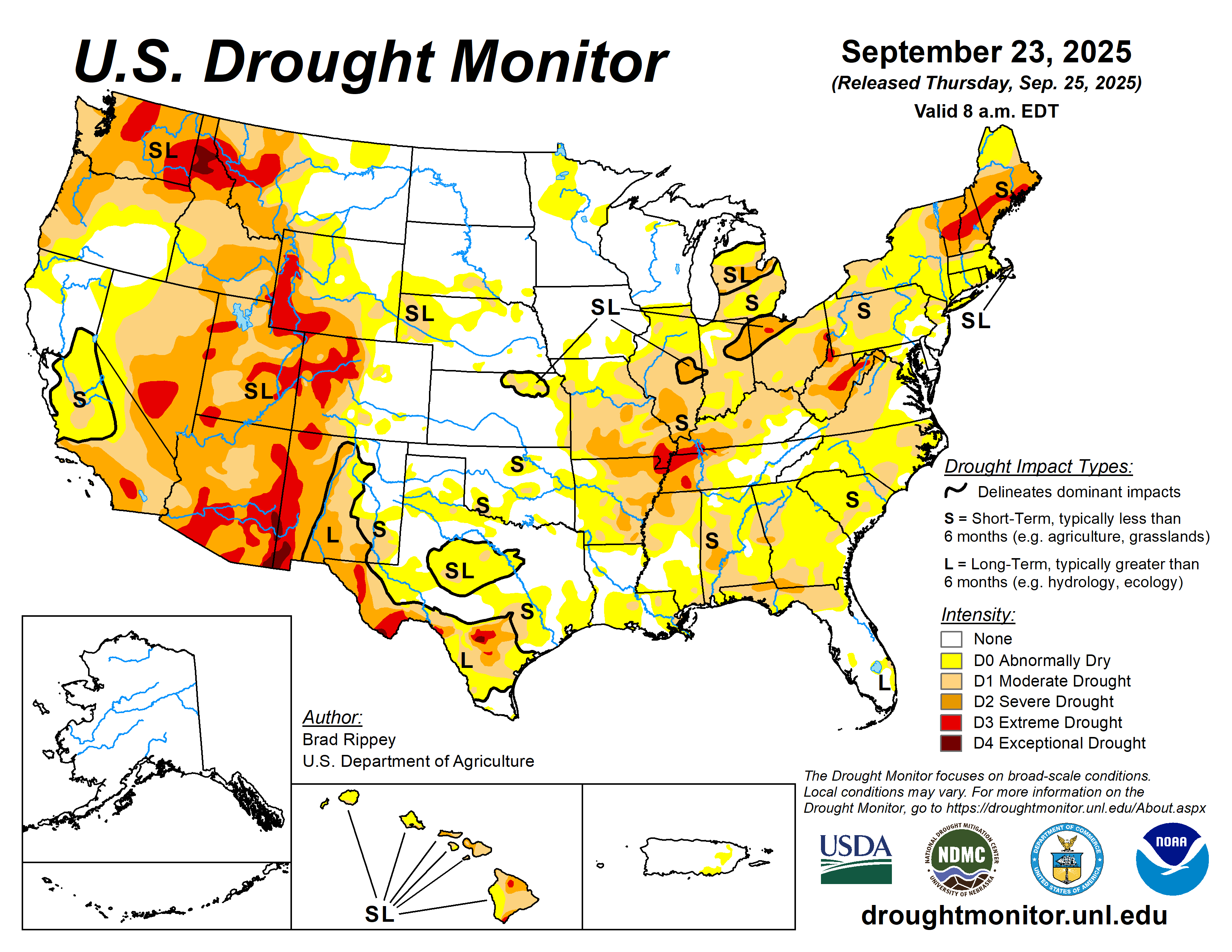

Temperatures have definitely warmed up as we near the end of September after a counter seasonal cooler than normal August until now. In fact, it is drying out as well after an unusually wet late summer and this pattern looks set to continue into at least the 2nd week of October.

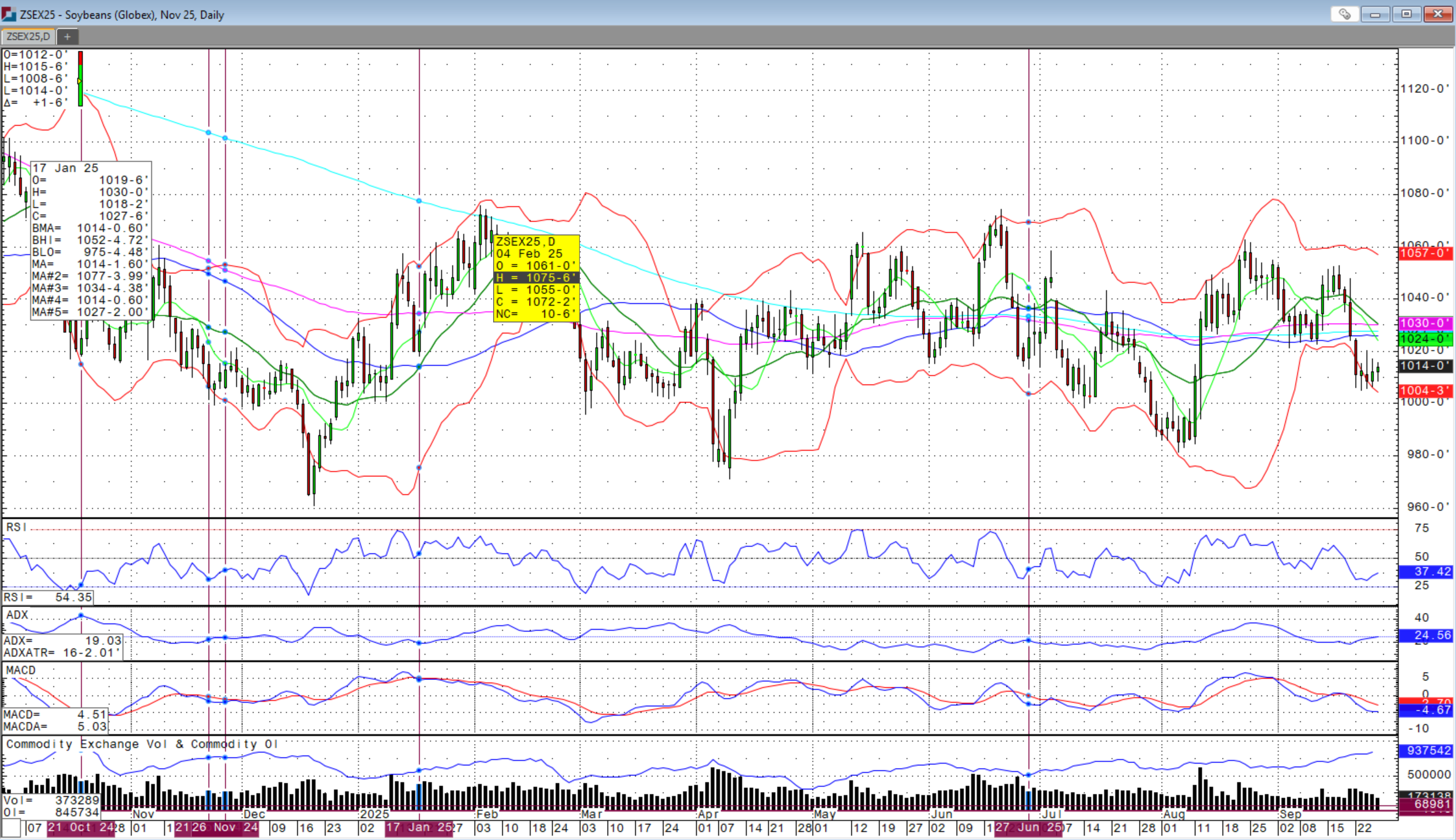

This will be timely for corn harvest getting started in the Midwest while soybeans will now begin to dry down quickly and start shedding leaves. Such conditions are not ideal for late soybeans filling and we’ve heard more about at least one or maybe two of three seeds in the pods being small. I’m expecting quite a lot of variability seed size in later soybean varieties.

While it seems that the US corn and soybean crops will be getting smaller from USDA’s recent estimates, there are questions on global demand for both, especially soybeans. Events this week delt another blow to the continued absence of China from US soybean purchases that are currently zero while representing nearly 20 percent of last year’s total US soybean demand and 54 percent of US soybean exports.

On the verge of defaulting again, Argentina this week announced the elimination of export taxes on agricultural products to generate foreign currency. The dropping of these tariffs lowered the soybean price by around $3.00 per bushel and around $0.50 per bushel for corn. The goal was to raise $7 billion, which they reached in just 3-days with major purchases of soybeans by China and soybean oil by India. This brief window offered these needed commodities to countries as an alternative to Brazil, but cheaper, and permitting them to continue to avoid buying from the US as hopeful leverage in the ongoing tariff war with President Trump.

Coinciding with Argentina’s achieving their goal, the Trump Administration announced backing the country’s bonds to avoid default and as a preferred alternative to the IMF. This move has outraged some US farmer groups with the domestic agricultural industry at-home desperately needing soybean sales. The window for US farmers to secure exports with China and others is right now or risk importers being able to bridge to the next Brazilian crop, our archenemy in the global commodity market. Currently, US soybeans are cheaper than Brazil by around 10 percent. This should and is driving demand for US soybeans from other importers, but it takes time to be as meaningful volume-wise as China.

The brief opportunity to buy Argentine soybeans cheaper than Brazil was a gift and China took advantage at the expense of US farmers. Ultimately, there will likely be a deal between the US and China that will result in purchase announcements of US soybeans by China. Time is of the essence as US farmers begin soybean harvest with extremely negative basis levels especially in areas of the country that typically export to China. Presidents’ Trump and Xi are said to meet next month at the APEC Summit.

The Trump Administration is hearing the ag community’s demands for action instead of continued promises of future support. On Friday, the USDA confirmed that the Emergency Commodity Assistance Payment (ECAP) payment factor would be increased from 85 percent to 99 percent, meaning that farmers will receive an additional 14 percent of their ECAP payments as soon as next week. During a press conference this week with Turkey’s President at the White House, President Trump also said that funds from US import tariffs would soon be used, in part, to send funding to US farmers.

USDA's next major report comes Tuesday on grain stocks that will be another potential trigger for futures contracts.

Amid low commodity prices while input prices remain historically high, more questions are being asked about the structure of the input segment of the supply chain that is dominated by conglomerates that have monopolized much of the seed, chemical and fertilizer product segments through acquisition over the decades. I suspect we will see more on this in the coming months and years. This question is much like the issue of consolidation of meat packers in the livestock complex. While scale is critical especially when it comes to commodity products, the lack of competition in grain handling and meat processing is becoming an issue. It is time that more entrepreneurs enter these segments and focus on higher margin, specialty products that help to bring margin back to the farm.

Over in the livestock complex, news Sunday of another screwworm case in Mexico, this time only 70 miles from the US border, brought about much nervousness in the futures markets. Feeder and Live cattle futures surged Monday above the 20-day moving average resistance that I wrote about last week. The market then weakened below those levels as the week progressed, but managed to bounce back and close just above that level in Friday’s trade. I think we could see some more strength to begin the week, but if we do not make a high above this last Monday’s high, beware of further selloff.

We’ve now put in a lower high and so we will have to see if the high on August 27th was the high or if we are going to try again. Regardless, expect volatile, two-sided trade as this market whipsaws among headlines and movements in the equity market and managed money fund flow. And don't forget about that chart gap from April 11th all the way down at $282.100 on October feeders, which seems an eternity away. September feeder futures and options expired Thursday at $365.400, which was a premium to the CME Feeder Index.

There has been chatter that the US government may step in to provide support to trigger heifer retention. While that is needed to calm prices, the market really needs to be the entity which leads to such actions in the physical markets. It is hard to see US tax dollars doing much in this space while tariffs are on our import trade partners, especially the 50 percent currently in place on Brazil.

Cash trade was relatively strong in fed cattle this week and surging hog futures could add additional overflow support to cattle futures. The key will be if we can take out Monday’s high and then that August 27th high. Failure to do so could begin to spell trouble on the technical side of charts especially if we take out the September 12th lows. These values, even if we go higher, are excellent margins to protect no matter when you bought or where you are in the supply chain and so begin to lock in prices. Once we start a long liquidation by the managed funds, things will move quickly without compassion.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)