/Uber%20and%20Lyft%20by%20Thought%20catalog%20via%20Unsplash.jpg)

Lyft (LYFT) stock is soaring today, thanks to a groundbreaking partnership with Waymo to launch autonomous ride-hailing services in Nashville by 2026. This collaboration with the Alphabet (GOOG) (GOOGL) unit will leverage Lyft's Flexdrive subsidiary for comprehensive fleet management services, including vehicle maintenance and depot operations, while implementing dynamic marketplace integration to maximize fleet utilization across both platforms.

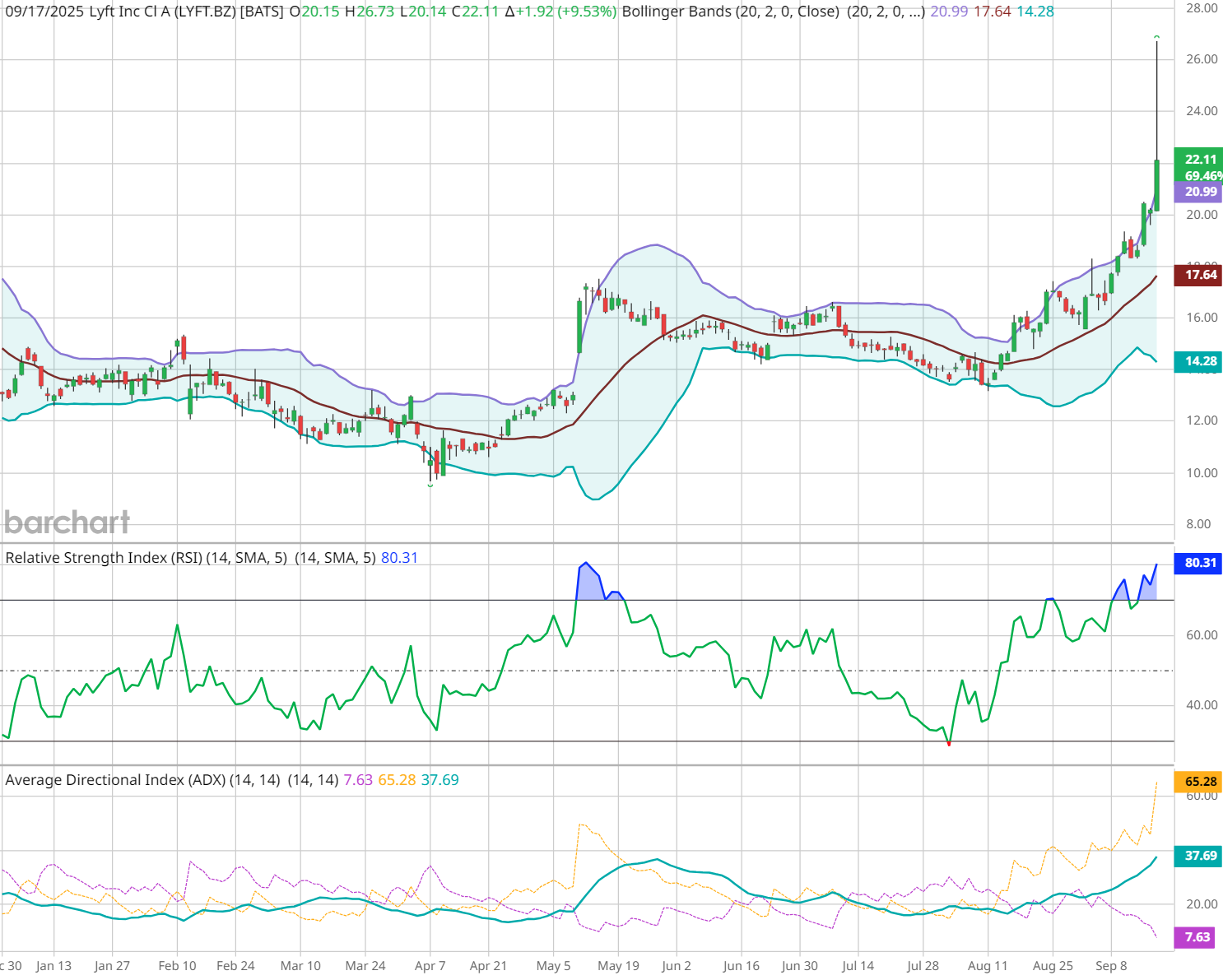

Traders are loving the news, with LYFT ripping to a gain of more than 11% out of the gate. The stock has broken out above its upper Bollinger Band, with the 14-day Relative Strength Index (RSI) revisiting its mid-May highs north of 80. With the shares launching into overbought territory on today’s news, traders should be cautious about chasing this rally.

Lyft’s Fundamental Story

Operationally, Lyft has demonstrated robust performance with nine consecutive quarters of double-digit growth in rides, achieving a record 235 million rides in Q2 2025 and maintaining 26 million active riders. The company's Q2 results showed impressive revenue growth of 10.6% year-over-year to $1.59 billion, while active riders increased by 10.3% annually, indicating sustained user expansion. Pending legislation in California, particularly SB 371, could potentially reduce Lyft's costs by approximately 30% of projected 2026 EBITDA, providing significant operational tailwinds.

Lyft’s financial health continues to strengthen, with analysts projecting non-GAAP earnings of $1.18 per share and revenue of $6.57 billion for the fiscal year, representing growth of 24.21% and 13.52% respectively. Management’s commitment to shareholder value is evident through its $200 million stock repurchase in Q2, with plans for approximately $500 million in buybacks over the next year. The company's improving profitability metrics are noteworthy, with free cash flow margins expanding by 23.7 percentage points over recent years.

Is LYFT Stock a Good Buy Right Now?

From a valuation perspective, Lyft appears attractively positioned, trading at 8 times free cash flow, significantly below competitor Uber's (UBER) 23x multiple. Going forward, the convergence of regulatory tailwinds, strategic partnerships, and solid financial performance suggests continued growth potential in the evolving mobility landscape.

However, analysts rate LYFT a tepid “Hold,” on average, and the stock has already outstripped its 12-month price target of $16.88. Investors may want to proceed with caution, particularly with the shares lingering near all-time highs, and wait for a short-term pullback before picking up LYFT.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever. On the date of publication, Elizabeth H. Volk did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)