/IQVIA%20Holdings%20Inc%20phone%20and%20site-%20by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $32.2 billion, IQVIA Holdings Inc. (IQV) is a leading global provider of advanced analytics, technology solutions, and clinical research services for the life sciences industry. Based in Durham, North Carolina, the company operates through four segments: Technology & Analytics Solutions, Research & Development Solutions, Contract Sales & Medical Solutions, and Contract Sales & Medical Solutions.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and IQVIA fits this criterion perfectly. IQVIA is positioned for steady growth supported by its diverse offerings and strong backlog, with digital health and AI trends providing long-term tailwinds.

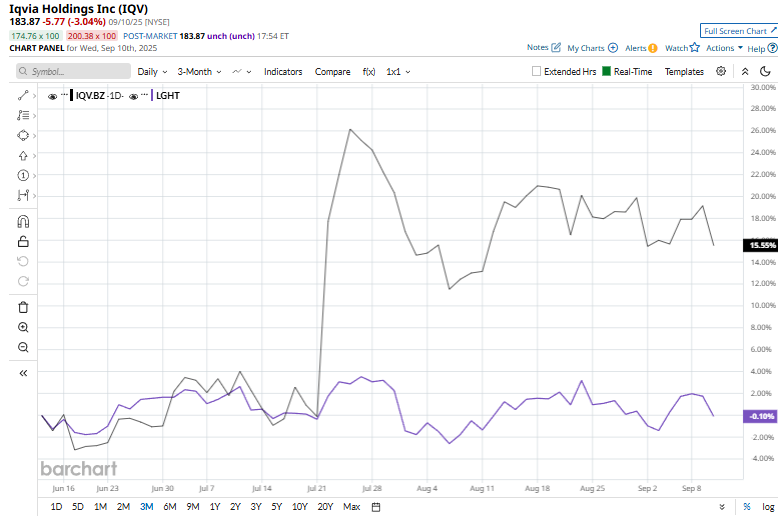

But, its not all sunshine and rainbows for the stock. Shares of IQVIA have dipped 25.9% from its 52-week high of $248.03. IQV stock has surged 15.1% over the past three months, outperforming the Langar Global Healthtech ETF’s (LGHT) 1.3% decrease.

On a YTD basis, IQVIA’s stock has crumbled 6.4%, lagging behind LGHT’s marginal rise. Additionally, over the past 52 weeks, shares of IQV have plunged nearly 21.8%, compared to LGHT’s 2.3% drop.

Indicating an uptrend, the stock has been trading above its 50-day moving average since early June and over its 200-day moving average since mid-July.

On July 22, IQVIA shares jumped 17.9% following the release of its Q2 results, with adjusted EPS of $2.81 topping Wall Street’s estimate of $2.76. Revenue came in at $4.02 billion, also ahead of expectations of $3.96 billion. Looking ahead, the company guided for full-year adjusted EPS between $11.75 and $12.05 and revenue in the range of $16.1 to $16.3 billion.

Moreover, top rival Agilent Technologies, Inc. (A) shares have fallen 7.6% on a YTD basis, lagging behind IQV. However, A shares have dropped 10.1% over the past 52 weeks, surpassing IQV’s drop over the same time frame.

IQV has a consensus rating of “Strong Buy” from the 22 analysts covering the stock, and its mean price target of $213.52 implies an upswing potential of 16.1% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)