/Synopsys%2C%20Inc_%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Synopsys (SNPS) shares crashed more than 35% on Wednesday after the electronic design automation firm reported a disappointing Q3 and lowered its earnings guidance for the full year.

The company’s management now sees per-share earnings (EPS) falling between $12.76 and $12.80 this year, sharply below its previous guidance for $15.15 a share.

Following the post-earnings plunge, Synopsys stock is down roughly 40% versus its year-to-date high set in the final week of July.

Synopsys Stock Faces Three Major Headwinds

SNPS shares are facing three significant headwinds in the second half of 2025.

First, disrupted design starts in China – a direct consequence of tightened U.S. export controls – are delaying customer onboarding and dampening demand for its EDA tools and IP licensing

Second, friction with a major foundry partner – likely tied to integration or pricing dynamics – is creating uncertainty around collaborative chip development timelines.

Third, suboptimal resource allocation across its product roadmap has led to underinvestment in high-growth verticals like automotive and edge AI, raising questions about strategic focus.

Together, these factors introduce execution risk for Synopsys stock, especially as investors expect artificial intelligence (AI) driven acceleration.

Should You Load Up on SNPS Shares Today?

Synopsys management has responded proactively by announcing a 10% workforce reduction by the end of fiscal 2026 and implementing strategic resource realignment towards higher-growth opportunities.

However, several factors suggest caution before viewing the post-earnings dip in SNPS stock. The IP business challenges could take several quarters to resolve, and China-related uncertainties create additional risk.

Moreover, Synopsys shares remain expensive to own at a forward price-earnings (P/E) multiple of about 56x even after the selloff and the integration challenges with Ansys need time to settle.

All in all, the magnitude of the earnings miss and reduced guidance warrant careful consideration.

Wall Street May Revise Expectations for Synopsys

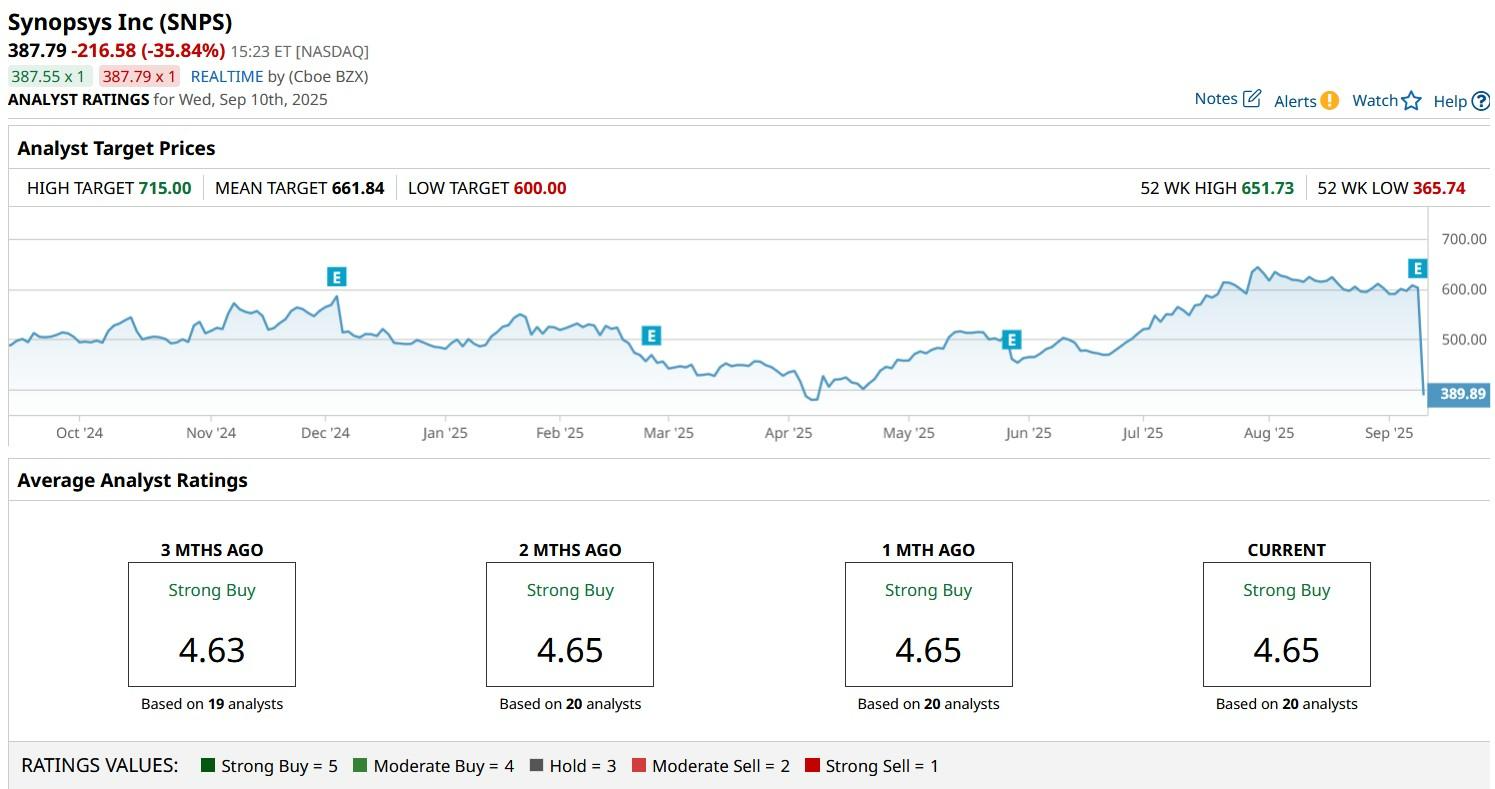

According to Barchart, the consensus rating on Synopsys stock currently sits at “Strong Buy” with a mean target of about $662.

However, investors should note that Wall Street analysts could downwardly revise their estimates for SNPS shares following the company’s disappointing earnings release today.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)