/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

Oracle (ORCL) shares soared as much as 40% on Wednesday after the legacy technology company reported blockbuster earnings for its fiscal Q1 and issued ambitious guidance for the long term.

Oracle now expects its annual AI-driven cloud revenue to hit $144 billion by the end of this decade. In comparison, its forecast for the current financial year stands at only about $18 billion.

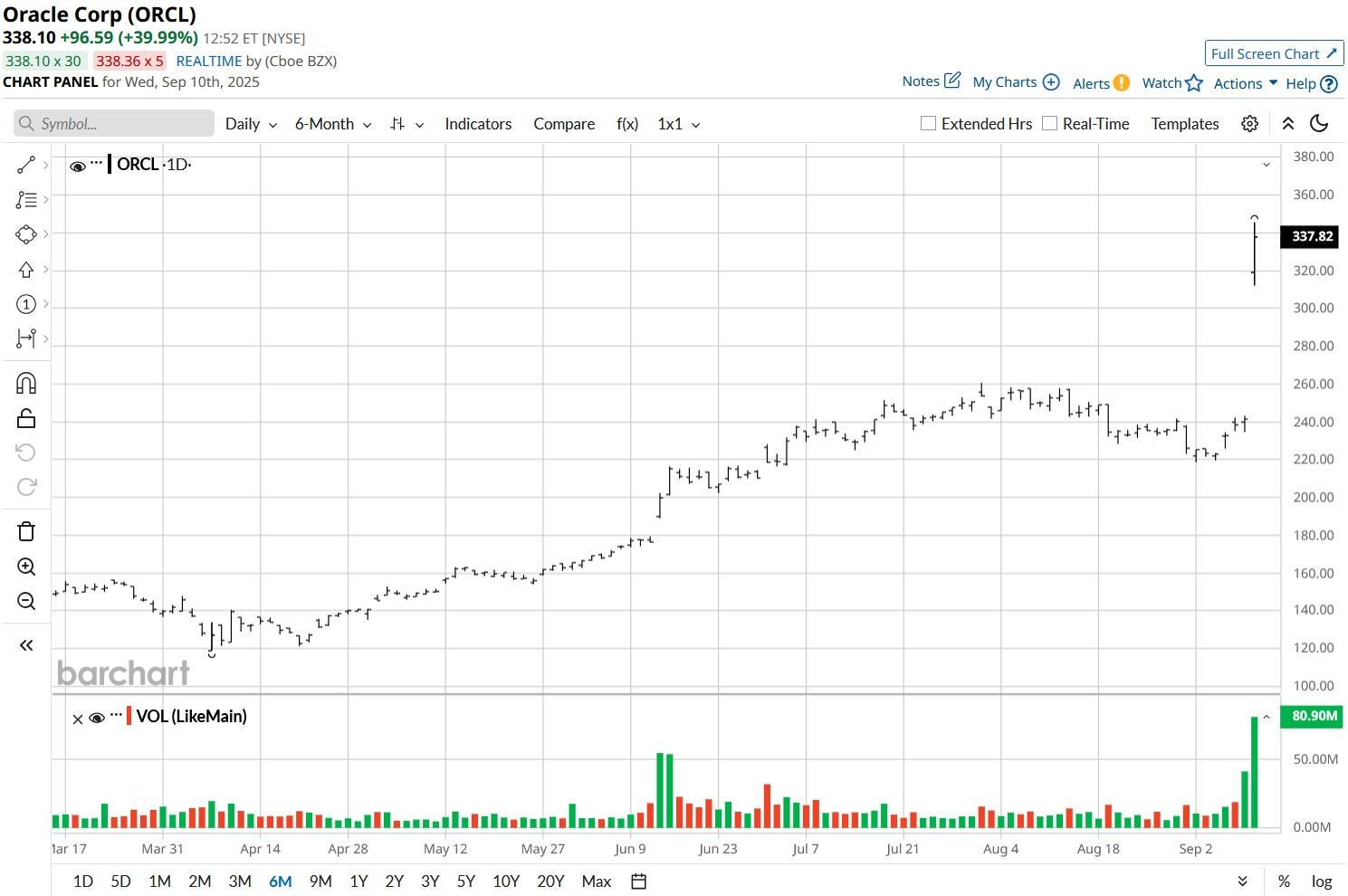

Including today’s surge, Oracle stock is up nearly 200% versus its year-to-date low set in early April.

What to Expect From Oracle Stock Moving Forward

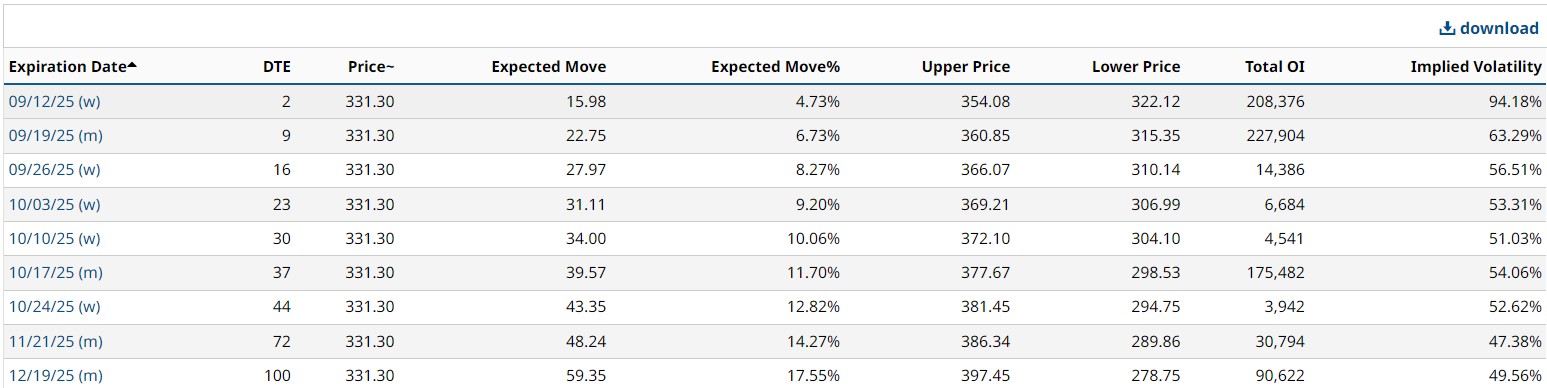

According to Barchart, options traders are pricing in a continued 4.73% move in ORCL's share price through the end of the week, which would place the stock around $354.08 on the upside and $322.12 on the downside.

Looking out to December, the forecast calls for a 17.55% move in ORCL shares. That would translate to a continued rally up to $397.45, based on current prices, or a pullback to $278.75.

Notably, options flow is leaning bearish today. Traders will want to track both options flow and put/call ratios as key indicators of options market sentiment in the near term.

While a short-term pullback or mean reversion could be in the cards after today's massive bull gap, the exciting pace at which the company’s artificial intelligence business is growing suggests that the bull case seems much more likely to play out over the medium and longer term.

Oracle’s Guidance Has Analysts in ‘Shock’

In a post-earnings research note, Deutsche Bank’s senior analyst Brad Zelnick said “we’re all kind of in shock, in a very good way,” following Oracle’s exceptionally bullish forecast.

Reiterating his “Buy” rating on Oracle shares, Zelnick said the company’s “truly awesome” quarter reinforces its position as a leader in AI infrastructure.

Citi analysts also raised their price target on the AI stock this morning to $410, indicating potential for another 20%-plus upside from here.

While Oracle stock is not particularly inexpensive to own at current levels, its forward price-earnings (P/E) ratio of nearly 45x is not unheard of for fast-growing artificial intelligence names.

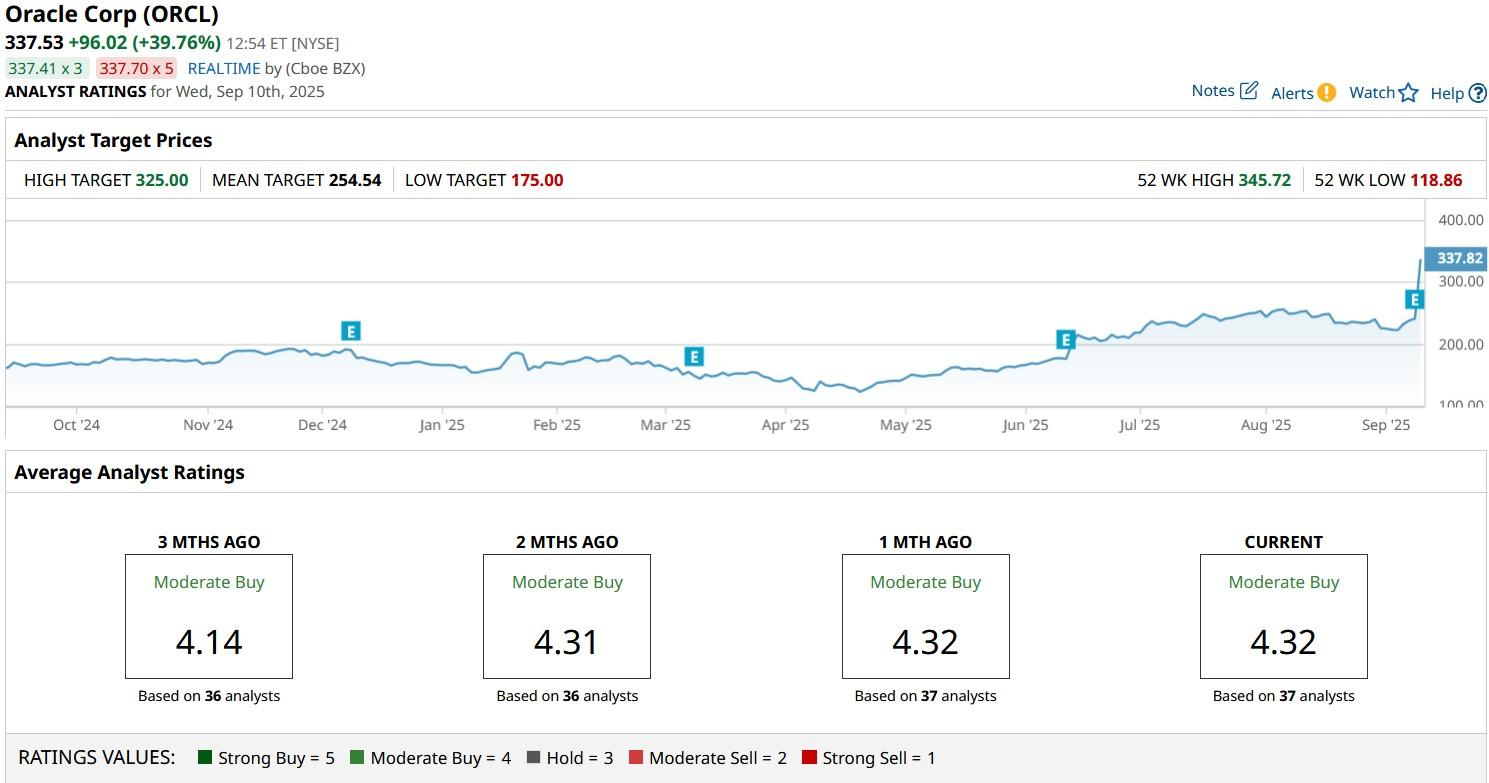

Wall Street Continues to Rate ORCL Shares at ‘Buy’

Wall Street more broadly is now in favor of owning Oracle stock for the longer term as evidenced in its consensus “Moderate Buy” rating on the Austin-headquartered firm at the time of writing.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)