/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

With a market cap of $25.5 billion, Super Micro Computer, Inc. (SMCI) is a leading provider of high-performance, energy-efficient server and storage solutions built on modular and open-standard architectures. Supermicro delivers its products and services worldwide through direct sales, distributors, value-added resellers, system integrators, and OEMs.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Super Micro Computer fits this criterion perfectly. The company designs and manufactures a wide range of systems, including AI-optimized servers, blade and multi-node platforms, storage solutions, and edge computing systems, serving industries such as cloud computing, artificial intelligence, 5G, and enterprise data centers.

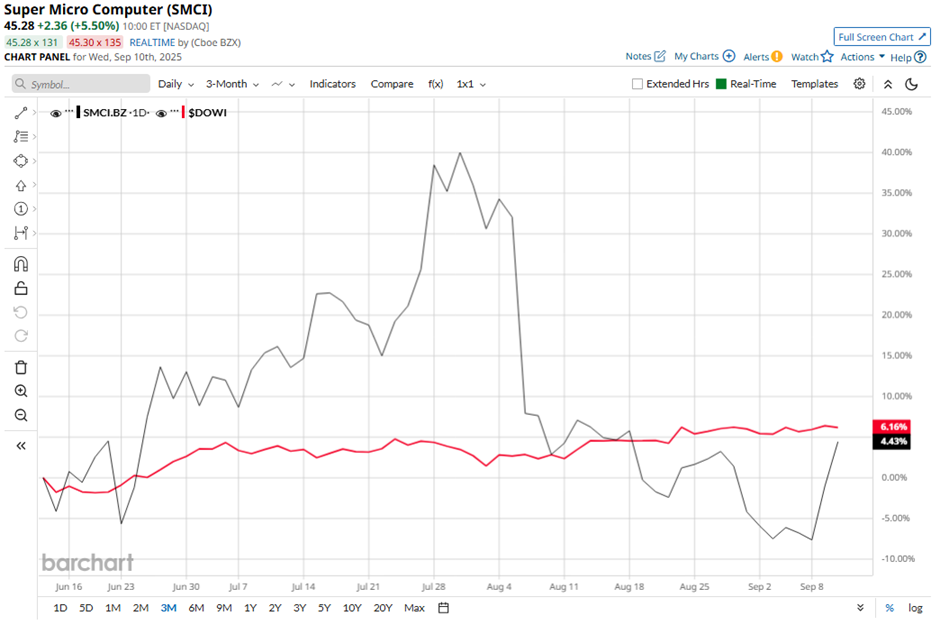

Shares of the San Jose, California-based company have decreased over 34% from its 52-week high of $66.44. Over the past three months, its shares have risen 3.9%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 6.4% gain during the same period.

Longer term, shares of the server technology company have returned nearly 8% over the past 52 weeks, lagging behind DOWI’s nearly 12% increase over the same time frame. However, SMCI stock is up 46.2% on a YTD basis, outperforming DOWI's 7.2% gain.

The stock has fallen below its 50-day moving average since early August.

Super Micro Computer’s shares tumbled 18.3% following its Q4 2025 results on Aug. 5. The company reported adjusted EPS at $0.41 and revenue at $5.76 billion, missed Wall Street expectations. The company also cut its long-term outlook, projecting at least $33 billion in fiscal 2026 revenue, down from its earlier forecast.

In addition, SMCI stock has performed weaker than its rival, Pure Storage, Inc. (PSTG). PSTG stock has climbed nearly 33% YTD and 74.9% over the past 52 weeks.

Due to the stock’s underperformance, analysts remain cautious about its prospects. SMCI stock has a consensus rating of “Hold” from 18 analysts in coverage, and the mean price target of $47.62 is a premium of 5.6% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)