With a market cap of $51.7 billion, Public Storage (PSA) is the largest owner and operator of self-storage facilities. Structured as a REIT, the company acquires, develops, owns, and operates storage properties that provide month-to-month leasing options for personal and business use.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Public Storage fits this criterion perfectly. As of June 30, 2025, Public Storage managed 3,432 facilities across 40 states, along with a 35% equity interest in Shurgard Self Storage Limited, which operates 321 facilities in Western Europe.

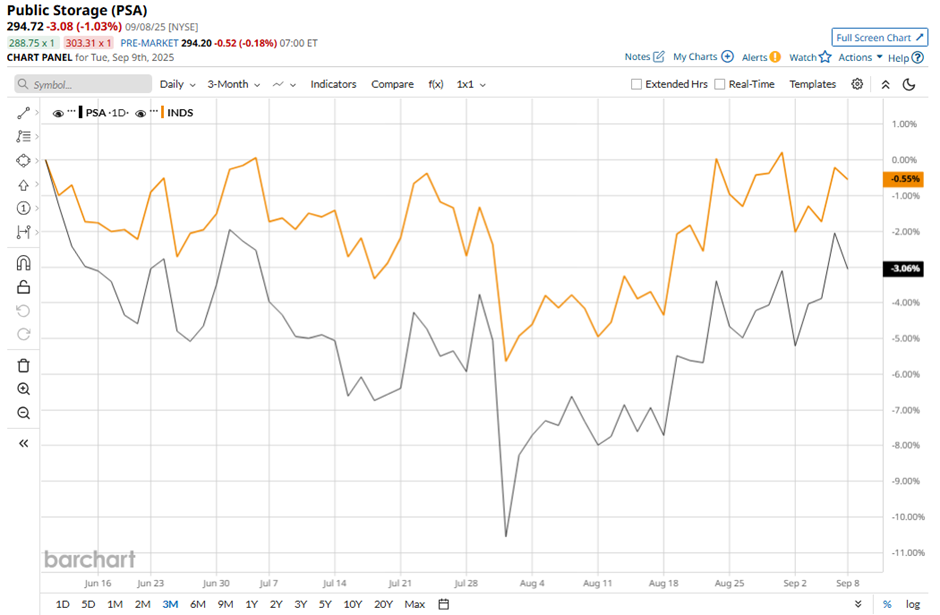

Despite this, shares of the Glendale, California-based company have dipped 20.5% from its 52-week high of $369.99. PSA stock has decreased 2.8% over the past three months, lagging behind the Pacer Benchmark Industrial Real Estate SCTR ETF’s (INDS) 1.1% rise during the same period.

Longer term, Public Storage’s shares have fallen 1.8% on a YTD basis, underperforming INDS' 5.8% gain. Moreover, the self-storage facility REIT stock has dropped 16.3% over the past 52 weeks, compared to INDS's nearly 12% decline over the same time frame.

The stock has been trading below its 200-day moving average since mid-December last year.

Despite Public Storage's better-than-expected Q2 2025 core FFO of $4.28 per share and revenues of $1.2 billion on Jul. 30, same-store occupancy declined 0.4% year over year to 92.6%, same-store NOI slipped 0.6%, and expenses rose 2.9%, signaling margin pressure. Additionally, management’s updated guidance implied muted same-store growth and highlighted higher costs, which overshadowed the earnings beat and drove the 5.8% share drop the next day.

In comparison, its rival, Extra Space Storage Inc. (EXR), has shown less pronounced decline than PSA stock. EXR stock has dipped 1.7% on a YTD basis and 15.9% over the past 52 weeks.

Despite the stock’s underperformance, analysts are moderately optimistic, with a consensus rating of "Moderate Buy" from 22 analysts. The mean price target of $323.31 is a premium of 9.7% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)