/Modern%20city%20with%20wireless%20network%20connection%20and%20city%20scape%20concept%20by%20yaom%20via%20iStock.jpg)

EchoStar (SATS) shares rallied hard on Monday after the satellite communications provider signed an agreement to sell its AWS-4 and H-block spectrum licenses to SpaceX for about $17 billion.

The deal with billionaire Elon Musk’s company arrives only days after SATS announced a similar multibillion-dollar transaction with the Dallas-headquartered AT&T (T) as well.

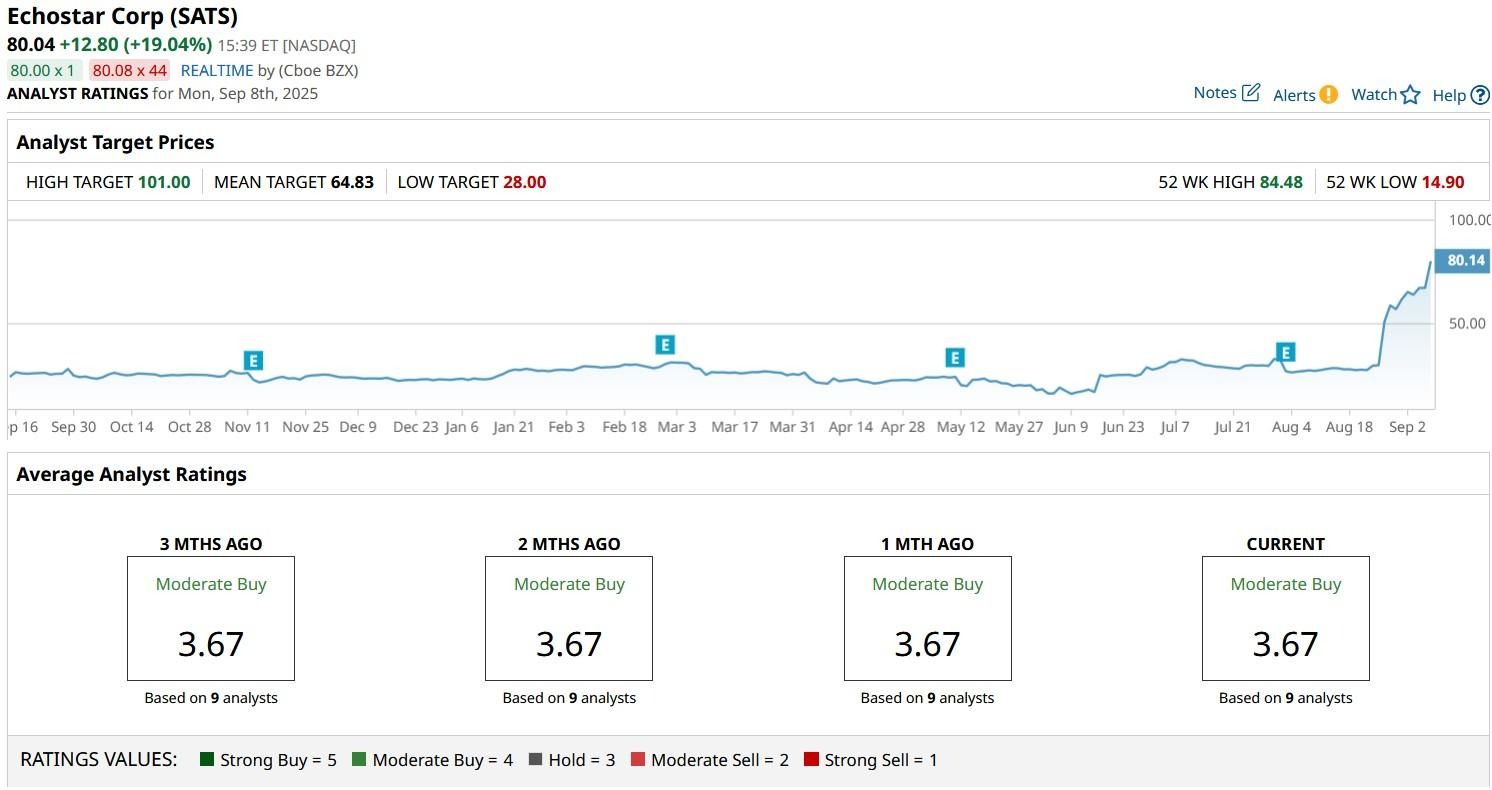

EchoStar stock has experienced an explosive rally in recent weeks. At the time of writing, SATS shares are up more than 200% versus their price in late August.

What the SpaceX Deal Means for EchoStar Stock

The SpaceX agreement is particularly notable for SATS stock as it resolves ongoing FCC inquiries regarding EchoStar’s spectrum utilization and 5G deployment obligations. These inquiries have previously threatened the company’s licenses.

The announced deal includes a strategic commercial partnership that will allow EchoStar’s Boost Mobile subscribers to access SpaceX’s next-generation Starlink Direct-to-Cell service, potentially revolutionizing wireless coverage in remote areas.

All in all, this arrangement ensures the Nasdaq-listed firm maintains beneficial access to the spectrum while monetizing these valuable assets, which may unlock further upside for EchoStar shares over time.

Is It Too Late to Invest in SATS Shares?

Despite the recent meteoric surge, SATS shares maintain a relatively modest price-book (P/B) ratio of 0.98x, suggesting they may not be significantly overvalued at current levels.

Moreover, the combined proceeds from both spectrum sales with substantially improve EchoStar’s financial stature by nearly eliminating its $30 billion debt burden, which required $480 million in interest payments last year.

That said, the firm’s legacy satellite TV and broadband business continues to wrestle with secular headwinds in an evolving telecommunications landscape.

Therefore, waiting for a pullback before initiating a position in EchoStar stock may be prudent for new investors.

EchoStar Has Rallied Past Wall Street Expectations

Note that Wall Street analysts are also against buying EchoStar shares at current levels.

According to Barchart, the consensus rating on SATS stock remains at “Moderate Buy,” but the mean target of roughly $65 indicates potential downside of a little under 20% from here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)